Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

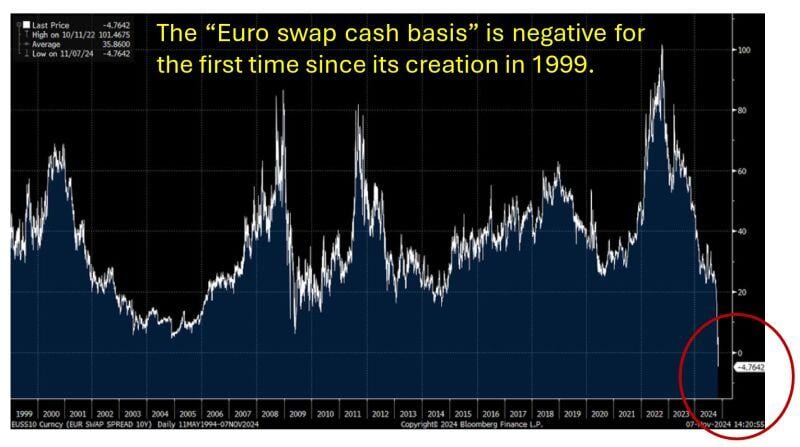

🚨 The “Euro swap cash basis” is negative for the first time since its creation in 1999.🚨

👉 It reflects the difference in cost between borrowing money in euros and the cost of swapping it to another currency, like U.S. dollars. 👉When it’s negative, it means borrowing in euros and swapping it to dollars is unusually expensive or difficult. 👉The fact that it’s negative for the first time since 1999 suggests that dollar demand is at an all time high🥤 Source: BowTiedMara @BowTiedMara

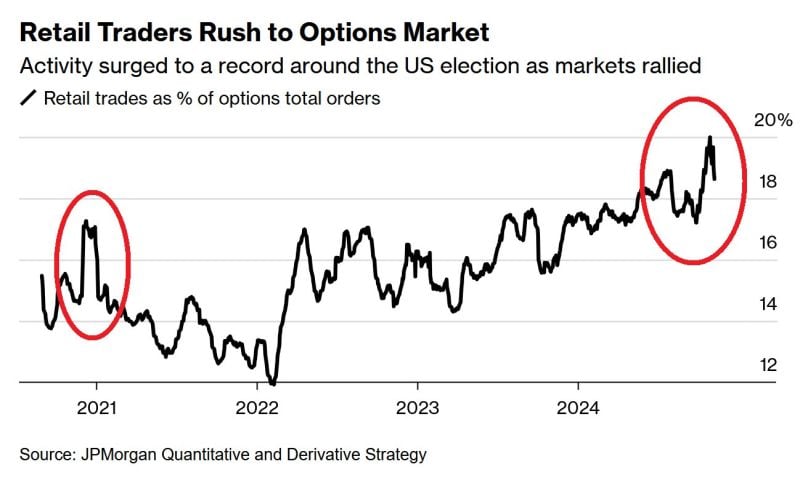

🚨MARKET SPECULATION LEVEL HAS RARELY BEEN GREATER🚨

Retail traders' activity share in the options market SPIKED to 20% last week, the highest level ever recorded. Retail is piling into options at a much faster pace than during the 2020 retail trading bonanza. Source: Global Markets Investor, JP Morgan Quant

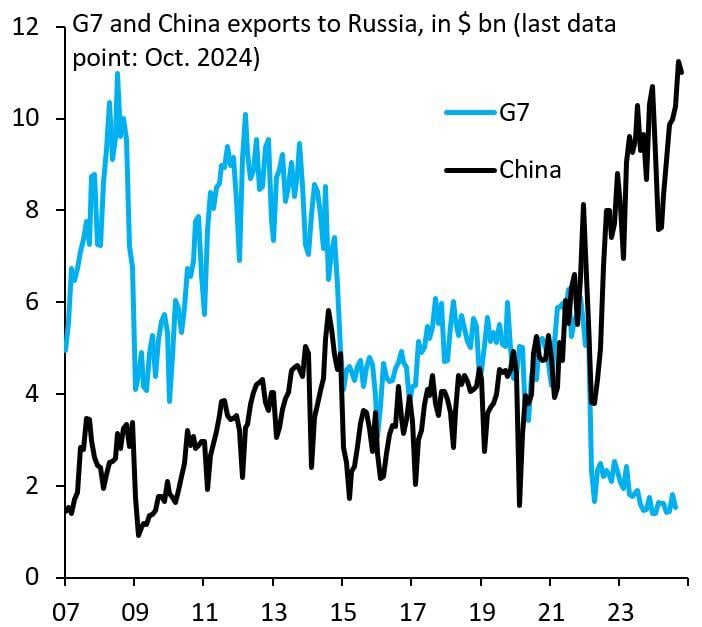

The US election doesn't change geopolitical truths facing the EU:

(i) China and Russia are allies - China is Putin's biggest enabler; (ii) the EU depends on the US for military protection, the US does NOT in any way depend on the EU. Strategic autonomy is a dangerous illusion... Source: Robin Brooks

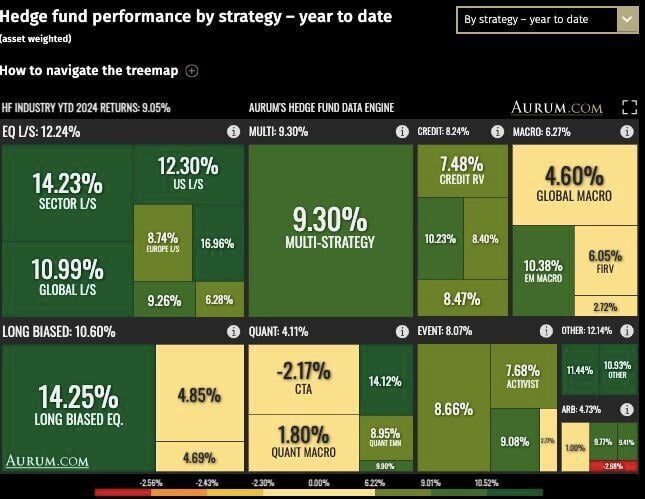

Hedge fund indices YTD performance by strategy as of 31/10/2024.

The top 5 hedgefund strategies according to Aurum database as of October 2024 were: 1) Equity long/short - AsiaPac (L/S) stands at 16.9% YTD. 2) Long biased equity stands at 14.2% YTD. 3) Equity long/short - Sector (L/S) stands at 14.2% YTD. 4) Quant - Multi stands at 14.1% YTD. 5) Equity long/short - US (L/S) stands at 12.3% YTD.

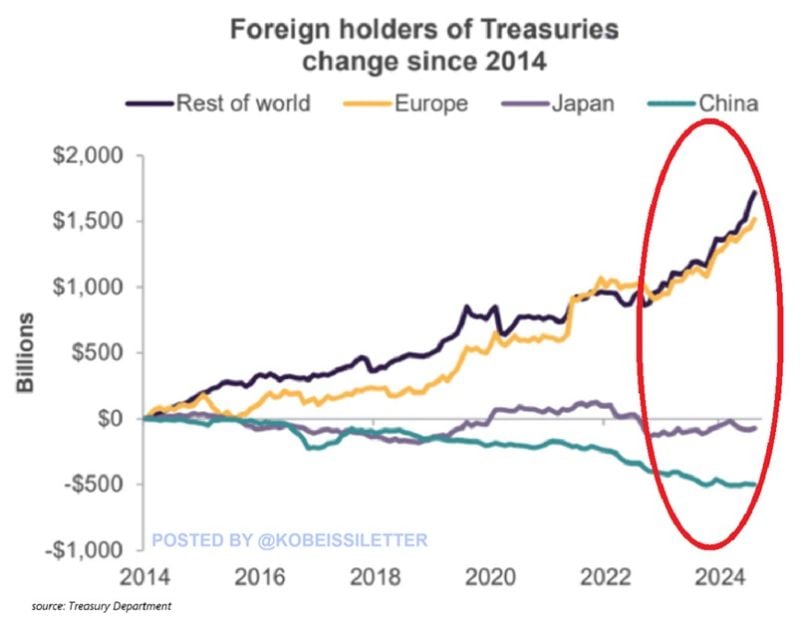

Foreign holdings of US Treasuries have jumped by $2.6 TRILLION over the last decade.

Europe’s Treasury holdings have risen by $1.5 trillion with the rest of the world acquiring $1.7 trillion of bonds. On the other hand, China and Japan's holdings have shrunk by ~$500 and ~$100 billion, respectively. Overall, total foreign holdings as a share of outstanding federal debt have dropped from 35% to 24%, near the lowest level in 18 years. This is the consequence of rapidly rising public debt with the supply of Treasuries rising ~$15 trillion over the last decade. Foreign demand for Treasuries cannot keep up with skyrocketing US debt. Source: The Kobeissi Letter

TRUMP LIKELY TO LET POWELL TO SERVE OUT TERM UNTIL MAY 2026

Source: CNN

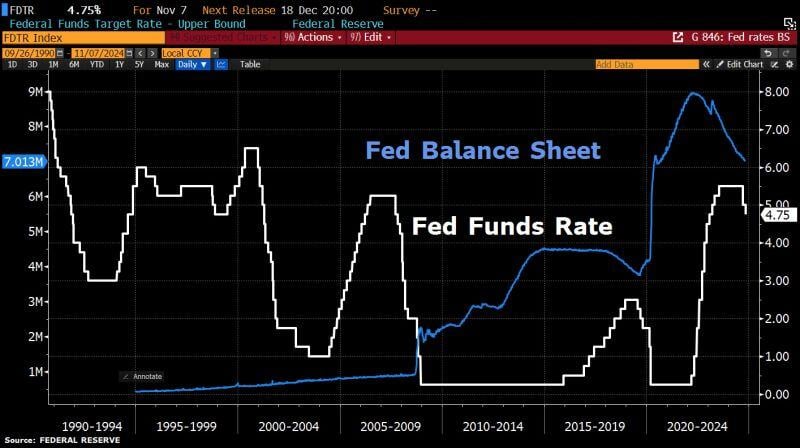

Fed cuts rates by 25bps in unanimous decision as expected. So what did the Fed do?

👉 FED LOWERS BENCHMARK RATE 25 BPS TO 4.5%-4.75% RANGE 👉 FED SAYS RISKS TO GOALS REMAIN 'ROUGHLY IN BALANCE’ 👉 FED: LABOR MARKET CONDITIONS HAVE 'GENERALLY EASED' No dissent on this rate-cut decision. 🚨 Key changes: - Most notably, removing language that Fed has "gained greater confidence that inflation is moving sustainable toward 2 percent". - Adding that labor market conditions have "generally eased" since earlier in the year, replacing "job gains have slowed". Source: Bloomberg, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks