Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The YOLO crowd is back.

Retail investors were clearly in the driver's seat today, with Bitcoin-sensitive names finishing +19.7% and Goldman Sachs Meme Basket (GSXUMEME Index) closing +7%! Source: Bloomberg, HolgerZ

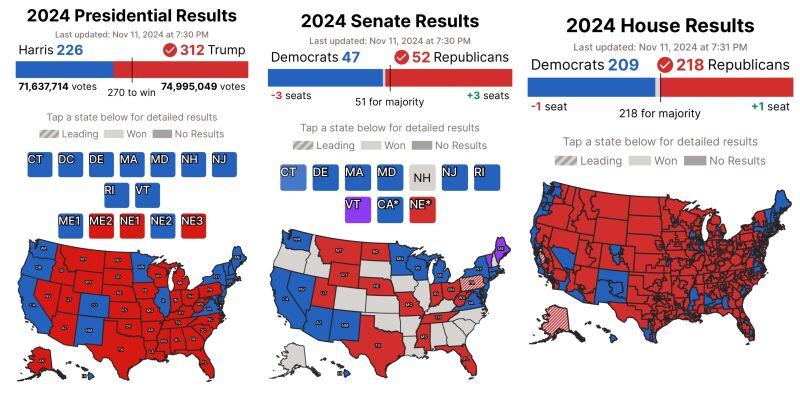

Republicans officially retain control of the U.S. House, giving the GOP a Trifecta; Control of both chambers of Congress and the Presidency.

The Republicans have won control of the U.S. House of Representatives after the party took 218 seats in national elections, according to a Decision Desk HQ projection on NewsNation. Source: @america

Ethereum $ETH now has a larger market cap than Bank of America

Ethereum: $380B Bank of America: $345B Source: Watcher.Guru

Actually, bonds performed really well last week

$TLT $AGG Source: Mike Zaccardi, CFA, CMT, MBA

$SPY The S&P 500 had its best-performing week of 2024. Here are the top-performing stocks from last week: 👇🏻

Source: The Future Investors @ftr_investors

Investing with intelligence

Our latest research, commentary and market outlooks