Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

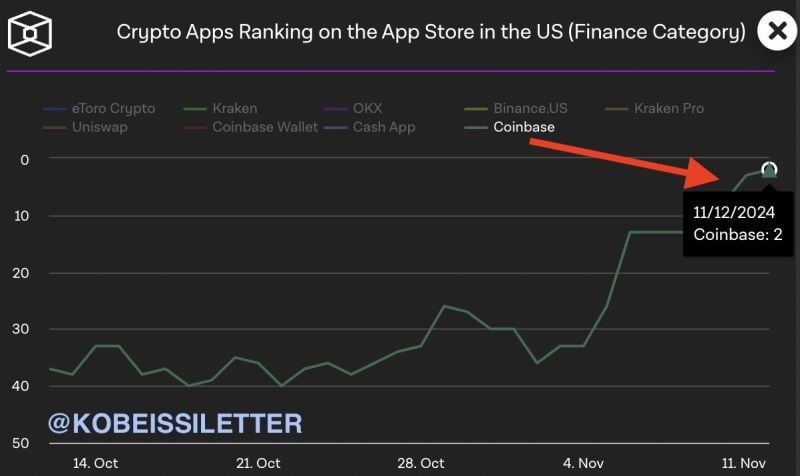

🚨 In case you're wondering how real the FOMO is in crypto:

Coinbase, $COIN, just became the 2nd most downloaded finance app in the app store. Just last week, it was the 33rd most downloaded finance app. All as Bitcoin just hit $90,000 for the first time in history. Tomorrow, will Coinbase become #1 ??? Source: The Kobeissi Letter

BREAKING: Ai company Genius Group adopts Bitcoin as its primary treasury asset and will buy $120m $BTC

Genius Group will also start accepting Bitcoin payments. "We see Bitcoin as being the primary store of value that will power these exponential technologies" Source: Bitcoin Archive

JUST IN:

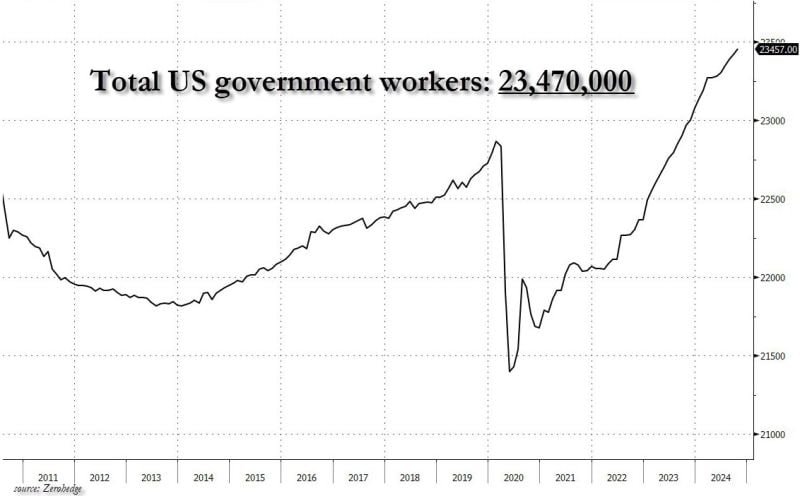

President-elect Trump appoints Elon Musk and Vivek Ramaswamy to lead Department of Government Efficiency (DOGE). #elonmusk #doge

There are a record 23,470,000 government workers

(80% of that is 18,776,000...) #elonmusk #doge Source: www.zerohedge.com

Uranium ETF $URA forms a Golden Cross for the first time since June 2023.

The last one sent shares soaring more than 50% over the next 7 months! Source: Barchart

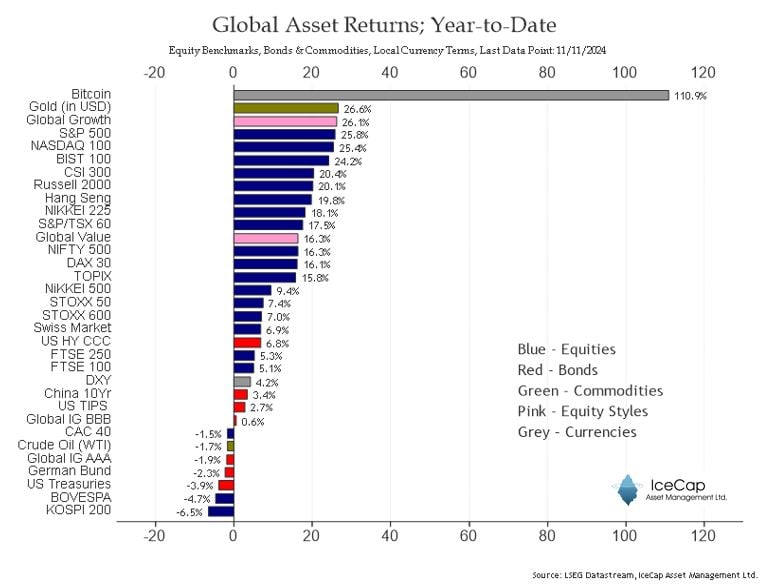

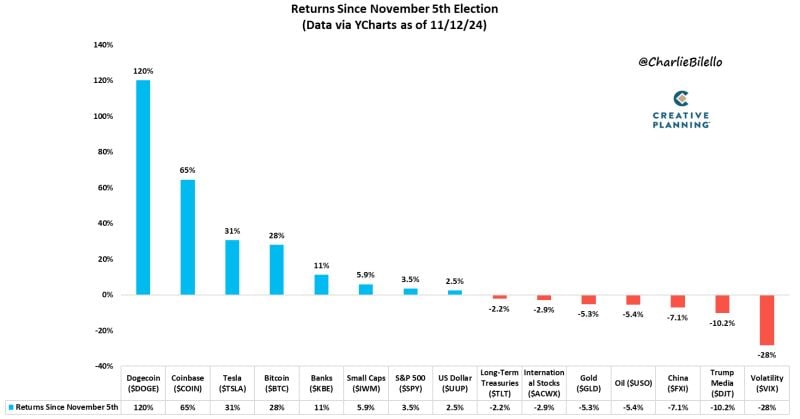

Returns since election...

Dogecoin: +120% Coinbase: +65% Tesla: +31% Bitcoin: +28% Banks: +11% Small Caps: +5.9% S&P 500: +3.5% US Dollar: +2.5% --- Long-Term Treasuries: -2.2% International Stocks: -2.9% Gold: -5.3% Oil: -5.4% China: -7.1% Trump Media: -10% Volatility: -28%

Investing with intelligence

Our latest research, commentary and market outlooks