Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

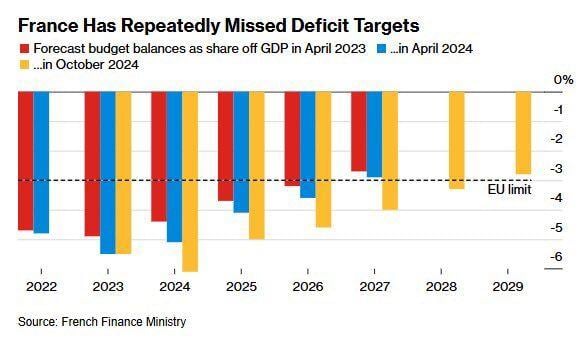

Spoiler: France will continue to miss deficit targets.

It already has the highest tax burden in Europe, and there are no real structural reforms on the horizon. Source: Michel A.Arouet

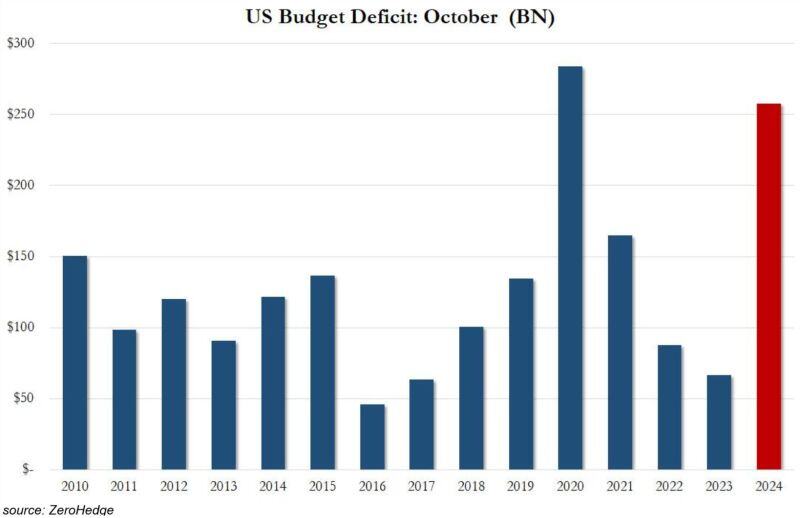

⚠️US GOVERNMENT BORROWING EXPLODED IN OCTOBER⚠️

US budget deficit hit a STAGGERING $257.5 BILLION in October. This is up nearly 400% year-over-year versus $66.6 BILLION last year. This was also the 2nd highest deficit in the entire United States history. Mind-blowing numbers. Source: Global Markets Investor, zerohedge

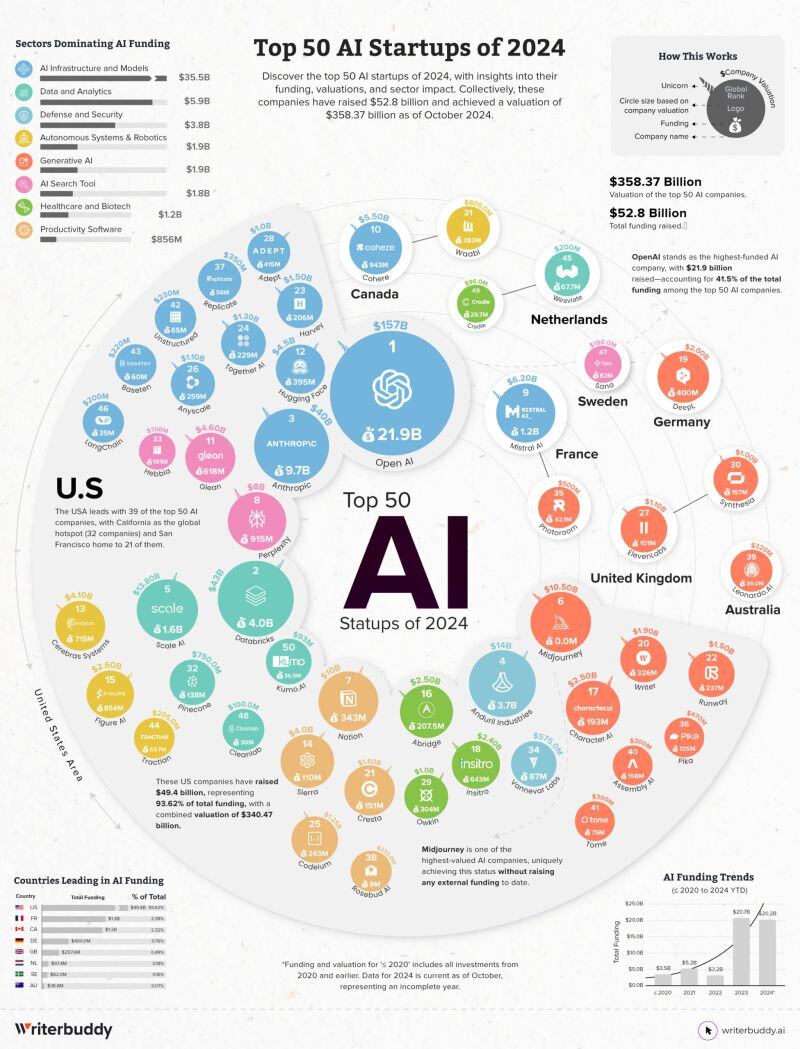

The Top 50 AI startups 2024 by WriterBuddy & Sujan Sarkar

Here’s the link to the full study: https://lnkd.in/ewsGnfSV Key Findings - Total Funding: The top 50 AI companies raised $52.8B as of 2024, with a 600% surge in 2023 to $20.7B compared to 2020. - Total Valuation: The collective valuation stands at $358.37B, indicating strong market confidence. - Top Funded Sector: AI Infrastructure & Models led with $35.5B (67% of total), followed by Data & Analytics ($5.9B) and Defense & Security ($3.8B). - Geographic Insights: U.S.-based companies raised $49.4B (94% of total), followed by France with $1.3B. California attracted $47.9B, making it the leading AI hub. - Google Alumni Influence: Ex-Google employees led 14 companies, raising $14.7B (28% of total), with a combined valuation of $71.61B. - Most Funded Startups: OpenAI ($21.9B), Anthropic ($9.7B), and Databricks ($4B). - Top Unicorns: OpenAI ($157B), Databricks ($43B), and Anthropic ($40B). Among the top 50 companies, 29 are unicorns. - Notable CEOs: Sam Altman (OpenAI), Ali Ghodsi (Databricks), and Dario Amodei (Anthropic).

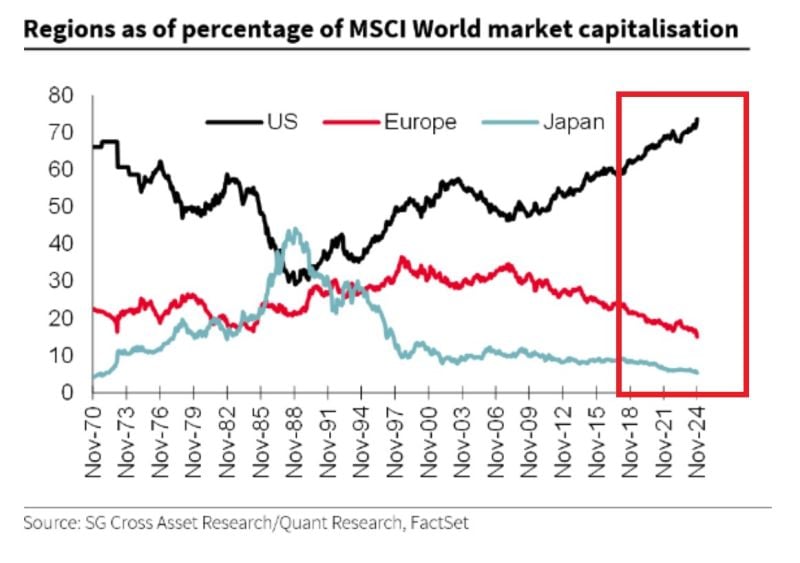

The US accounts for 74% of the MSCI world market capitalization, also a new all-time high.

Source: SG

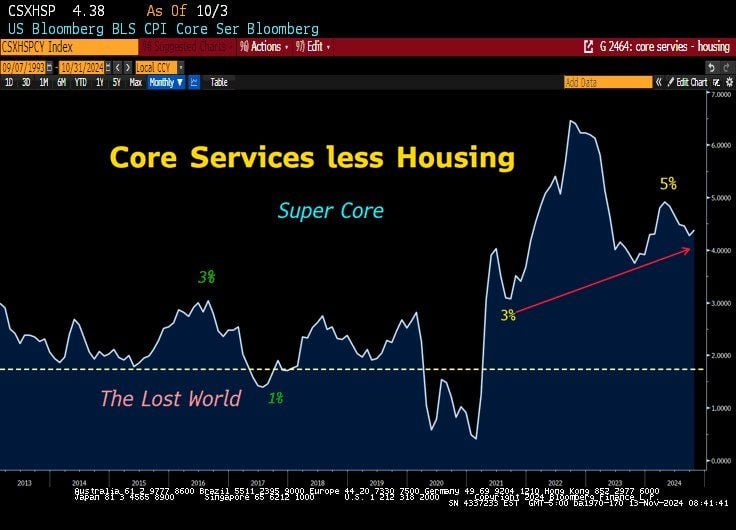

It seems that the FED's neutral rate is higher.

Are they going to throw the towel on the 2% target? Source: Bloomberg, Lawrence McDonald

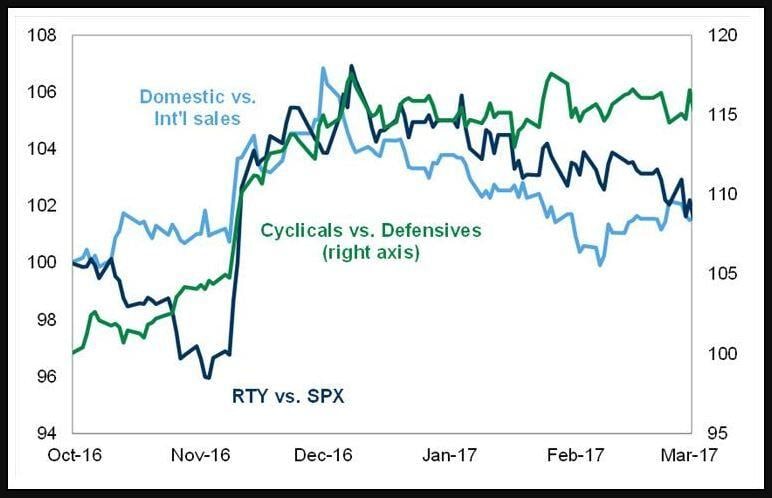

Will the "Trump trade" start top fade in December?

Goldman Sachs' trader John Flood highlighted the 2016 analogs: the 3 trades depicted below (Domestic vs. International sales, Cyclicals vs. Defensives, Small-caps vs. Large-caps) skyrocketed in November 2016 but ALL started to fade in December 2016, going nowhere in Q1 2017. Could we see something similar in December and Q1 2025 ? Source: www.zerohedge.com, Goldman Sachs

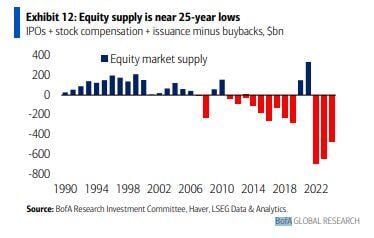

BofA (Woodward):

"the net supply of US equities has shrunk -$473bn. The steady growth of buybacks, a key source of demand, has overwhelmed sources of new supply such as share issuance, IPOs, and stock-based compensation." So basically we have: 1) US stocks: shrinking supply, (ever-) increasing demand 2) US Treasuries: rising supply, decreasing demand Source: Neil Sethi

Investing with intelligence

Our latest research, commentary and market outlooks