Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The king reports earnings exactly ONE WEEK from today. $NVDA

Source: TrendSpider

JUST IN: Senator Lummis on the U.S. being front-run by the whole world:

"The BITCOIN Act could be on POTUS’ desk ready to go within days. NOW is the time." Source: Bitcoin Magazine

🔉 President-elect Donald Trump’s choice of Senator Marco Rubio as his secretary of State

He is arguably the world’s most important diplomat, and could change the dial when it comes to the U.S.′ relationship with both its enemies, and its allies. 🚨 Rubio, considered a foreign policy hawk, has been highly critical of China and Iran, which are considered the hashtag#us′ top economic and geopolitical adversaries. 🦅 Trump’s choice for secretary of state, Marco Rubio, was a key sponsor of 2021 Uighur Forced Labour Prevention Act, which bans the import of all goods from Xinjiang unless companies offer verifiable proof that production did not involve such a violation. 🛢️ Marco Rubio, may intensify oil sanctions on Iran & Venezuela! Analysts note potential pushback from China could soften efforts. ❓ The Florida senator has also been ambivalent about ongoing support for Ukraine, echoing Trump’s stance that the war with Russia must come to an end. 👉 Rubio’s appointment as secretary of state and Trump’s focus on Latin America signals a potential shift in U.S. foreign policy priorities. While ‘America First’ often means pulling back globally, Latin America might indeed be an exception due to historic ties and regional security concerns. Source: CNBC

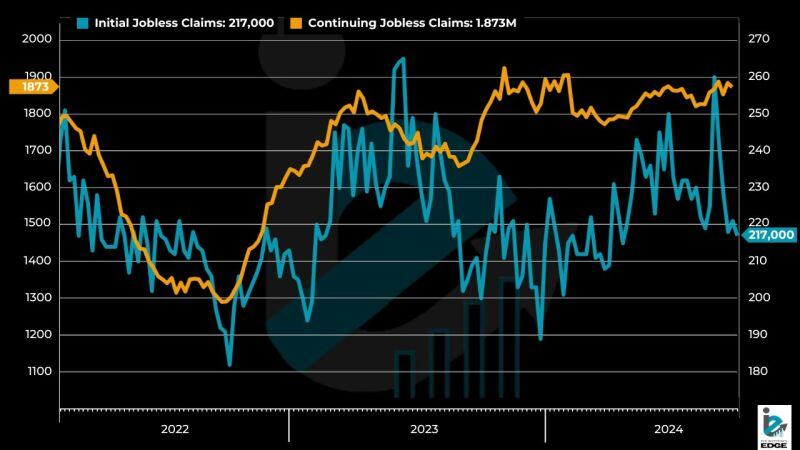

Both initial jobless claims and continuing claims were lower than expected last week.

🔊 Initial Jobless Claims came in at 217K versus the consensus forecast of 223K. 🔊 The 4-week average came in at 221K versus the consensus forecast of 226K. Source: CMG Venture Group

BREAKING 🚨 PPI data came out…

YoY Growth: • PPI (Oct), 2.4% Vs. 2.3% Est. (prev. 1.8%) • Core PPI, 3.1% Vs. 3.0% Est. (prev. 2.8%) MoM Growth: • PPI (Oct), 0.2% Vs. 0.2% Est. (prev. 0.0%) • Core PPI, 0.3% Vs. 0.2% Est. (prev. 0.2%) Source: Stocktwits

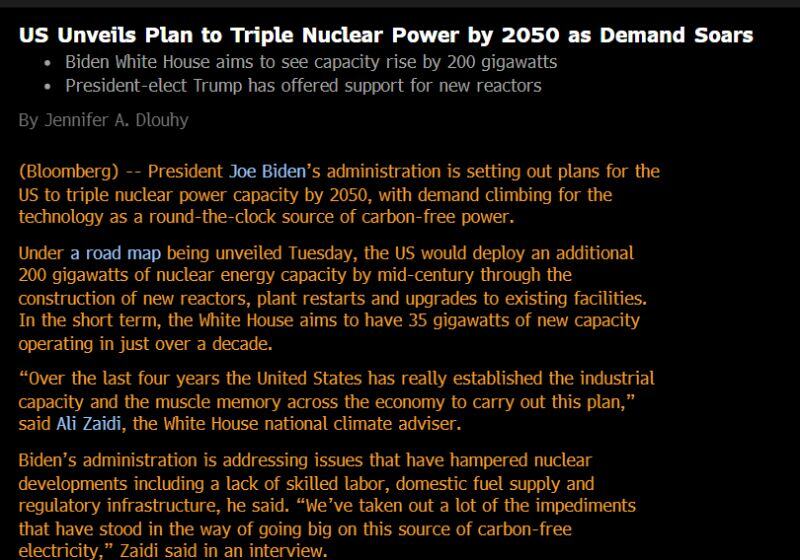

JUST IN: White House plans to triple Nuclear Power by 2050 to meet technology demands.

Source: Bloomberg

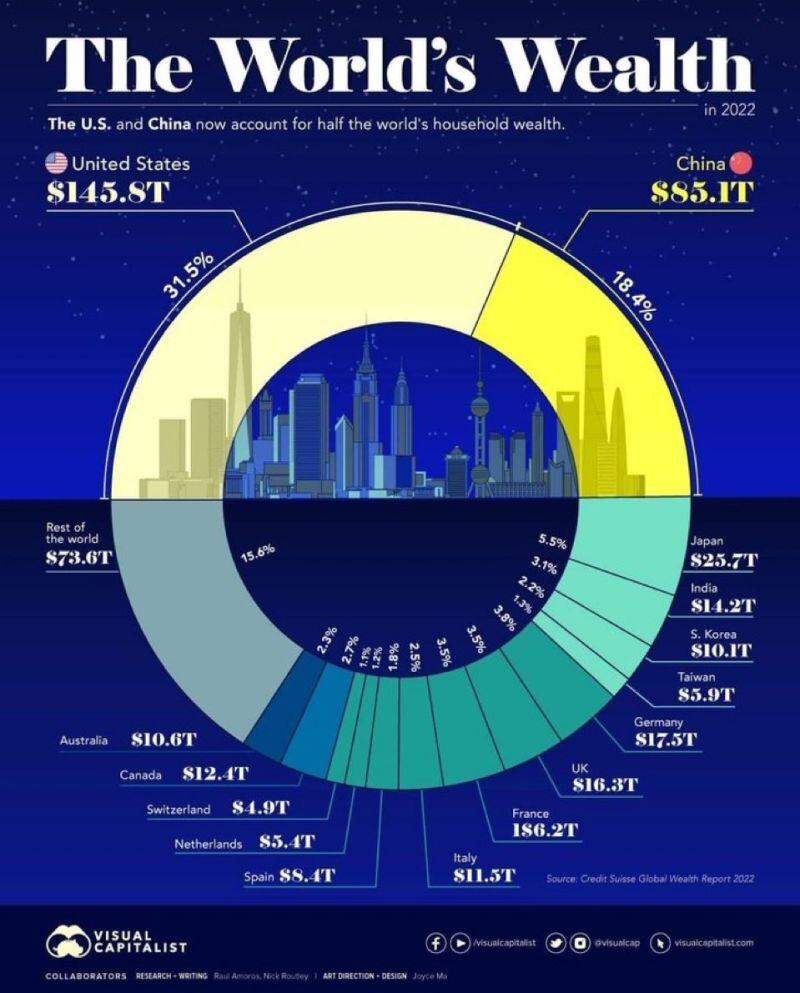

U.S. and China account for half the worlds’ household wealth

Source: Visual Capitalist

Investing with intelligence

Our latest research, commentary and market outlooks