Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

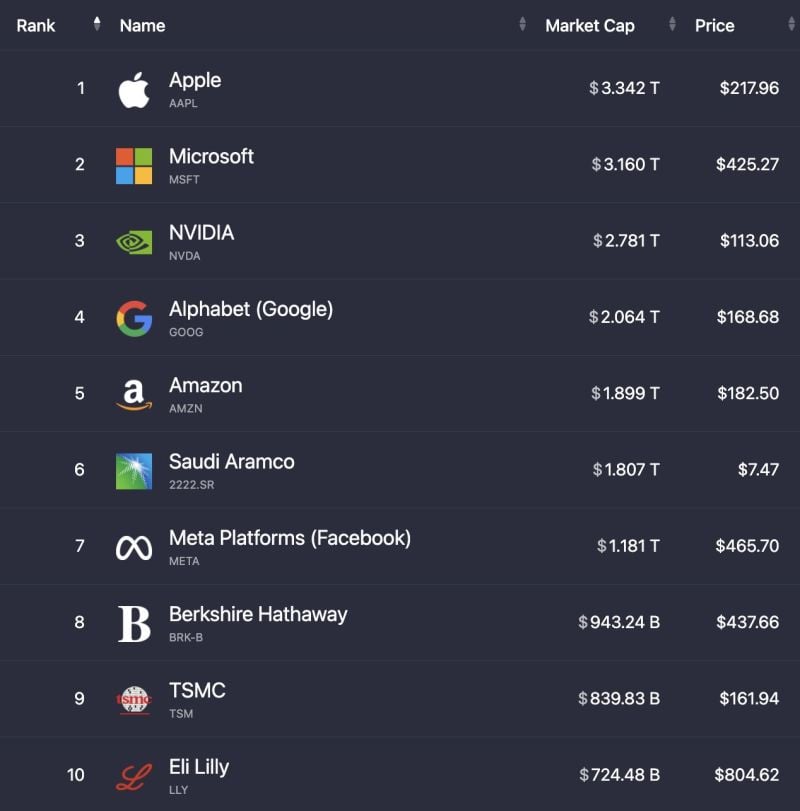

The top 10 largest stocks in the world are now worth a combined $18.74 Trillion down from $19.31T last week

Source: Evan

In the US, if your income and net wealth has not increased by 25% since 2020 you are poorer now than four years ago...

Source: Michel A.Arouet

As highlighted by Michel A.Arouet on X: the German business model was based on:

1. Cheap energy from Russia 2. Cheap subcontractors in Eastern Europe 3. Steadily growing exports to China All three are gone by now, and not much has been done to change the trend. Source: Bloomberg, Michel A.Arouet

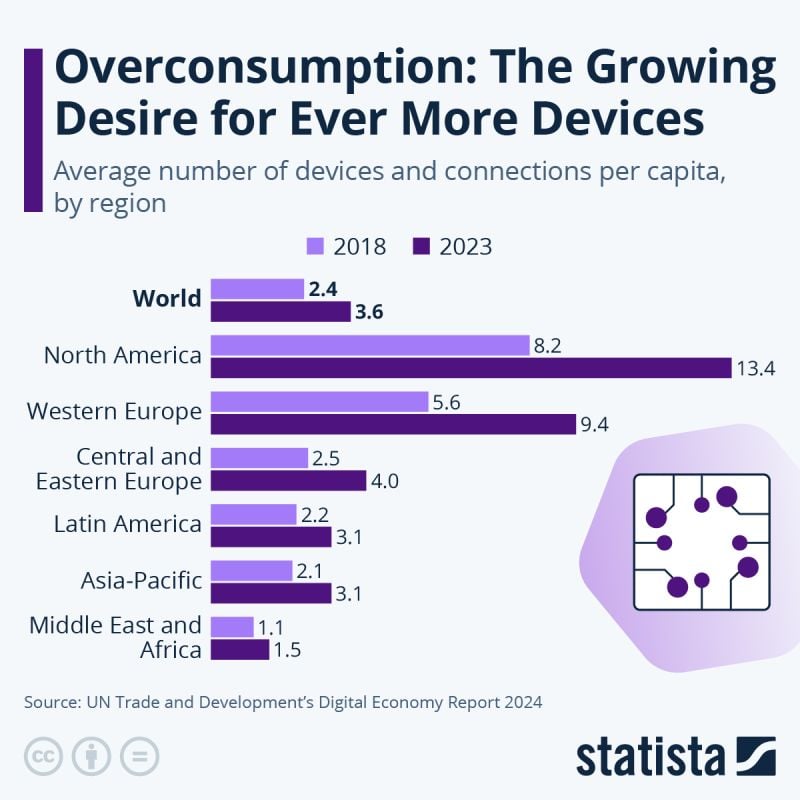

Data from the Digital Economy Report 2024 published by the UN Trade and Development.

it shows that the rising demand for more devices isn’t simply a case of more people buying electronic devices worldwide, but also that the average number of devices per consumer is increasing. Source: Statista

Under the surface, the US equity market looks stronger than before...

This might be counterintuitive to many investors who got hurt this week on their large-cap growth positions, the market looks actually healthier than it was a few weeks ago...As highlighted by the great J-C Parets, there are plenty of new all-time highs everywhere: DJ Industrial average, S&P 500 equal-weight, Mid-cap 400, etc. A mentioned by J-C Parets, we just saw the most amount of stocks on the NYSE above their 200 day moving average that we've seen this entire bull market. We also saw the most amount of stocks on the NYSE and the Nasdaq hitting new 52-week highs that we've seen this whole bull market. You can go sector by sector and you'll see. Source: J-C Parets

Interesting point by HolgerZ on X. Unlike on Wall Street – big stocks in germany are still doing well, while small stocks are struggling.

This can be seen in the ratio of the Benchmark Index Dax to the Mid-Cap-Index MDax, which hit its highest level since 2011. This could be because the economy isn't doing great, and small companies are more affected by this. The Purchasing Managers' Index for Germany dropped below make-or-break 50 this week, highlighting Germany's economic challenges. Source: HolgerZ, Bloomberg

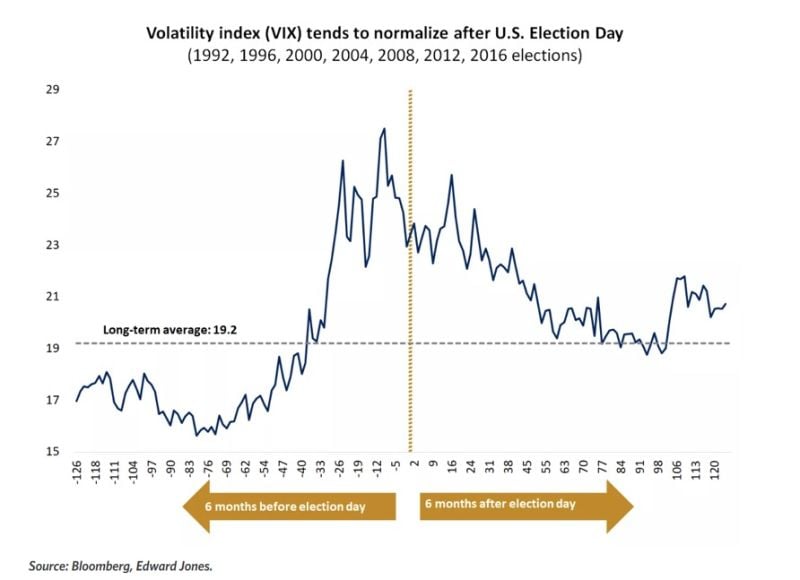

Expect a pickup in volatility as we head towards elections.

History shows us that market volatility tends to increase ahead of election day, and then subside afterwards, regardless of who is in power. This could be in part because some uncertainty is lifted after the election is over, and markets can again focus on opportunities ahead. Source: Edward Jones

The big names were the biggest losers this week

Even if other segments of the market are moving higher, it is tough for the main index to make progress of the big names continue to lose ground. Since July 10th, the market cap of the Magnificent 7 stocks has dropped a mind-numbering $2 trillion... Source: Trend Spider

Investing with intelligence

Our latest research, commentary and market outlooks