Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

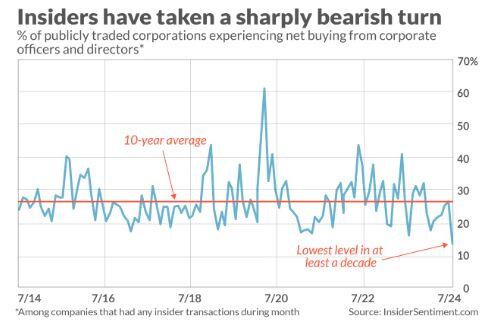

Corporate Insiders are dumping shares at the fastest pace in AT LEAST a decade 🚨🚨🚨

Source: Barchart

India quickly catches up to China as the world’s largest emerging market.

Indian stocks comprise nearly 20% of the MSCI Emerging Markets index, while China has dropped to a quarter from 40% in 2020. The narrowing gap has become one of the biggest issues for investors in emerging markets this year as they debate whether to put capital into an already red-hot Indian market, or into Chinese stocks that are relatively cheap, but are being hit by an econ slowdown. https://lnkd.in/ddkSqFy5 Source: FT, Charlie Bilello

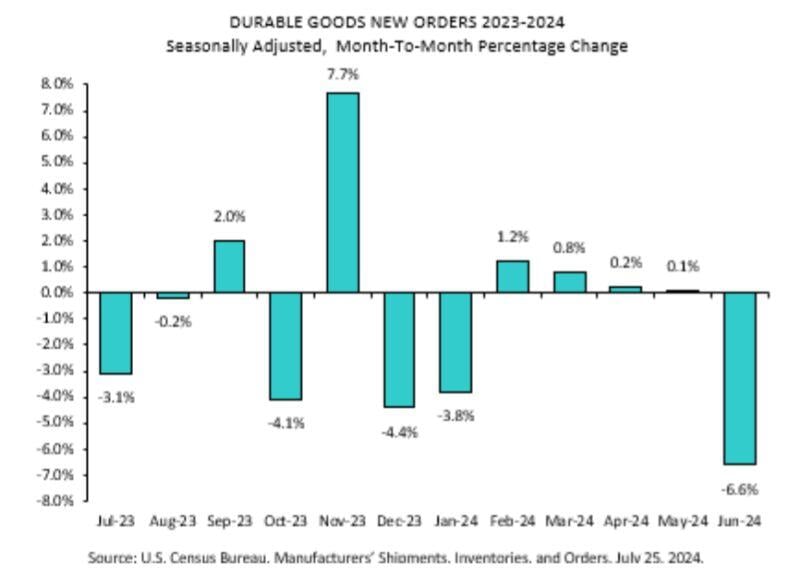

That was an enormous miss in durable goods, coming in at -6.6% vs a forecast of +0.3%.

We need to transport things in a growing economy, right? "Transportation equipment, down two of the last three months, drove the decrease, $19.6 billion or 20.5 percent to $75.8 billion. Source: Markets & Mayhem

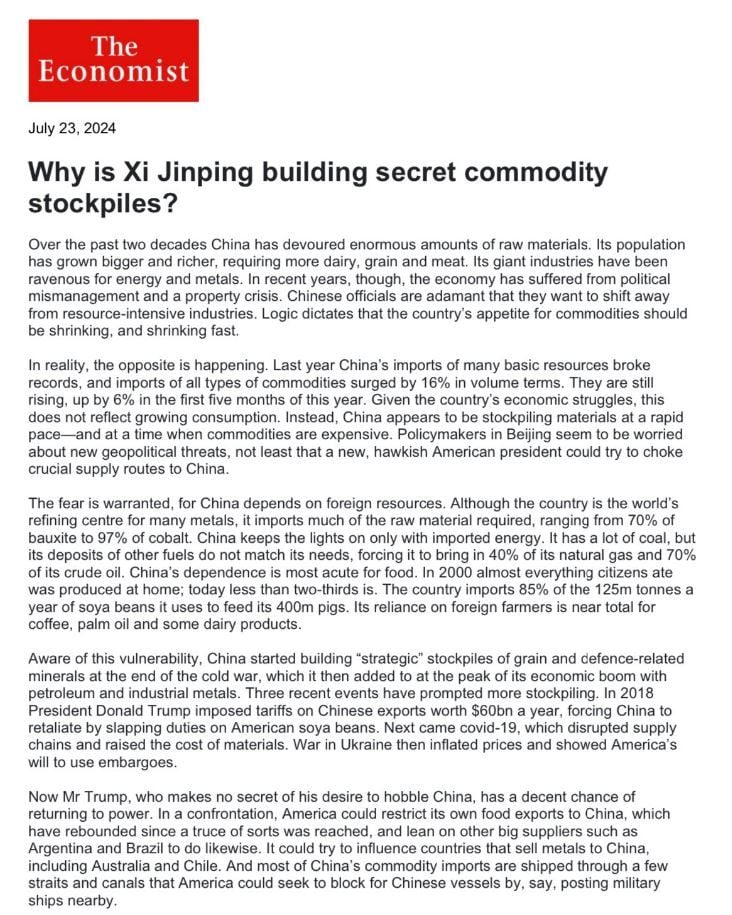

China commodity stockpiles

Source: Robert Friedland on X, The Economist

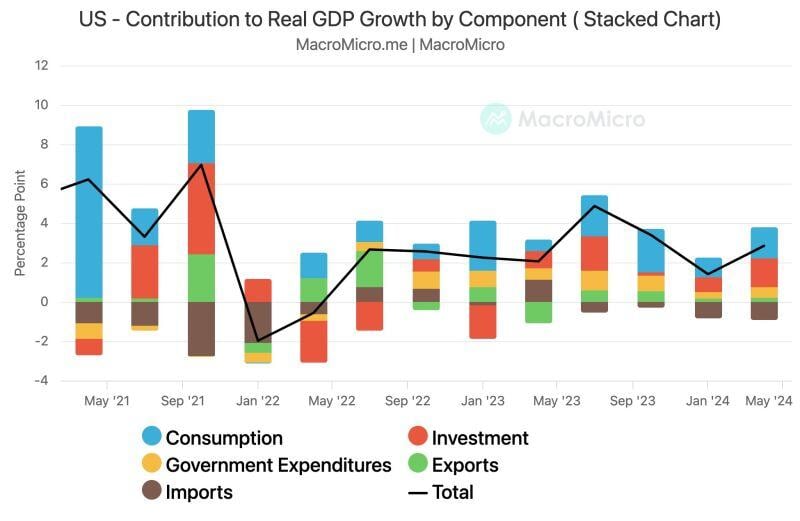

🚨 Breaking! US GDP growth surpasses expectations, hitting 2.8% (est. 2.0%, prev. 1.4%).

GDP Annualized QoQ Contribution: Consumption 1.57 pp (prev. 0.98 pp) Government Spending 0.53 pp (prev. 0.31 pp) Investment 1.46 pp (prev. 0.77 pp) Exports 0.22 pp (prev. 0.17 pp) Imports -0.93 pp (prev. -0.82 pp) Source: MacroMicro

NEW: Fold becomes the first Bitcoin only financial services company to go public on the NASDAQ 👏

They already have 1,000 BTC on their balance sheet 🚀 Source: Bitcoin magazine

Investing with intelligence

Our latest research, commentary and market outlooks