Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

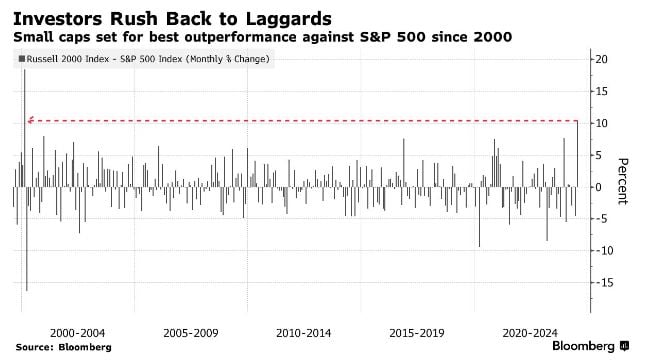

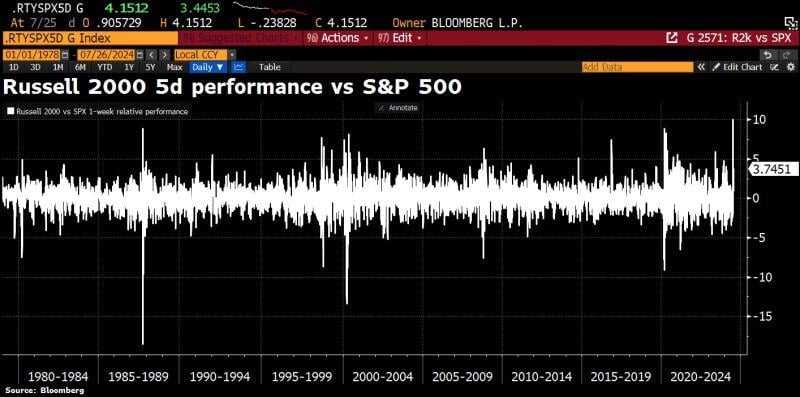

Small Cap Stocks $IWM are on track to outperform the S&P 500 $SPX in July by the biggest margin in 24 years

Source: Barchart, Bloomberg

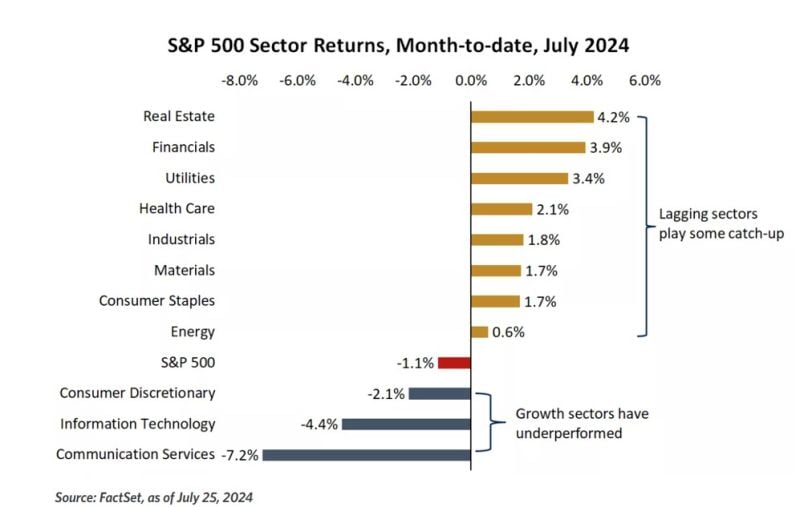

This week equity markets continued the rotation that began earlier this month, with small-cap stocks and value and cyclical sectors all outperforming mega-cap technology and growth sectors.

Source: Edward Jones

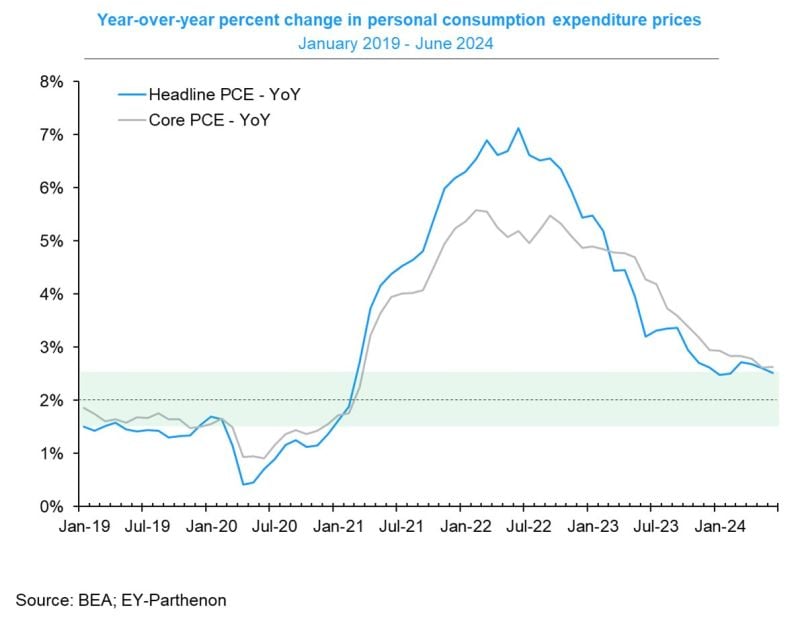

Easing US inflation in June👏

✅Headline PCE prices: 0.1% m/m ✅Core PCE prices: +0.2% m/m 🎯Moving toward Fed's 2% target: ⤵️Headline inflation -0.1pt to 2.5% yoy, IN-LINE with expectations. This is the lowest level since February '21 and down from 7.2% two years ago... ↔️Core inflation is flat at 2.6% yoy, at the lowest level since March '21. This is slightly above expectations (2.5%), which is not such a big surprise as PCE data from yesterday's GDP report revealed a similar picture. Source: Gregory Daco, BEA, EY-Parthenon

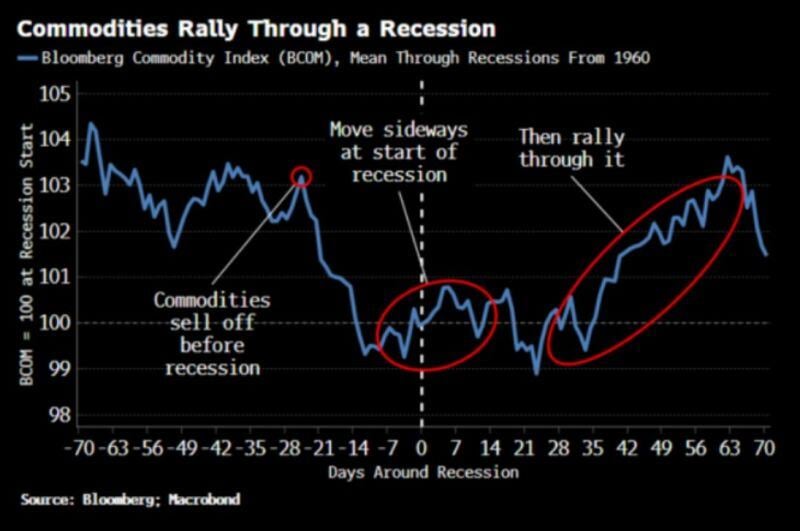

'It is a misconception that commodities fall in a recession - on average they rally through one.'

Source: Bloomberg

FUN FACTS >>> Usain Bolt The "Chicken McNuggets" diet In 2008, Usain Bolt won gold in 100m (9.69 secs) and 200m (19.30 secs) at the Beijing Olympics while only eating McDonald’s.

He didn’t want to take risks on food, so Bolt had 100 Chicken McNuggets a day during his 10-day stay in the country (1000 nuggets total). "I should have gotten a gold medal for all that chowing down," Bolt wrote in his biography Faster than Lightning. Source: Trung Phan on X

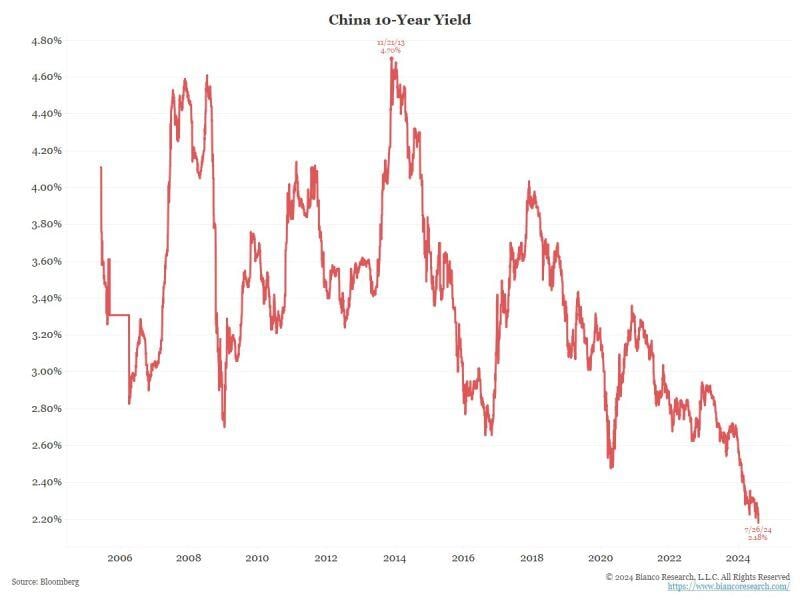

CHINA 10-YEAR YIELD FALLS TO A FRESH RECORD LOW

So, what is the Chinese bond market signaling about the Chinese economy? Source: Bianco research

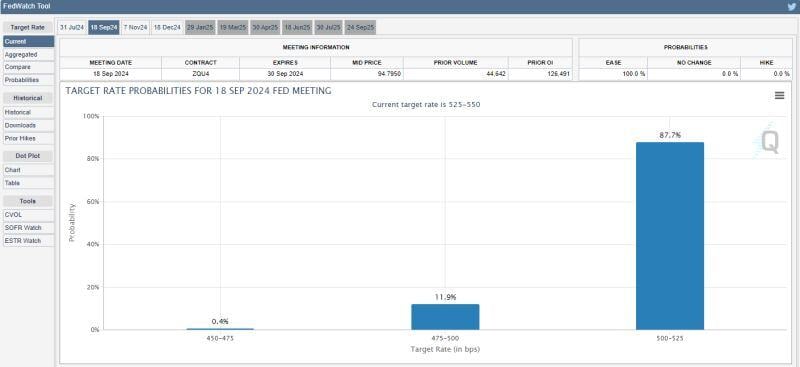

JUST IN 🚨: There is now a 100% chance of a 25 bps interest rate cut by September, according to CME FedWatch

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks