Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

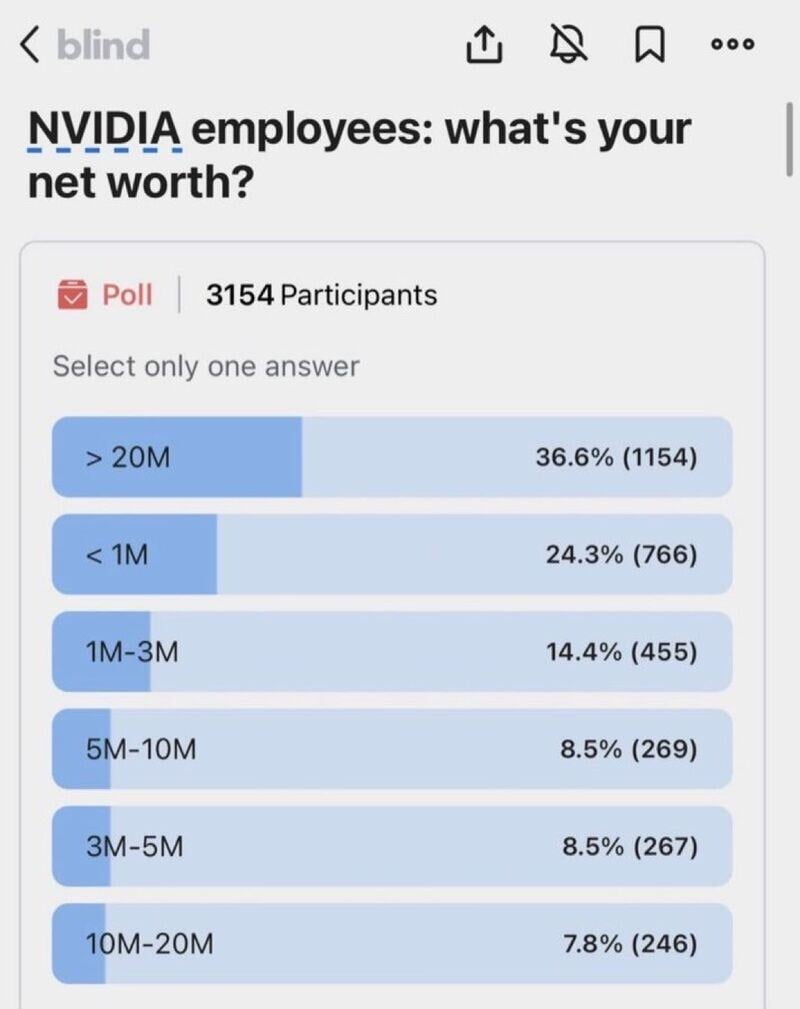

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

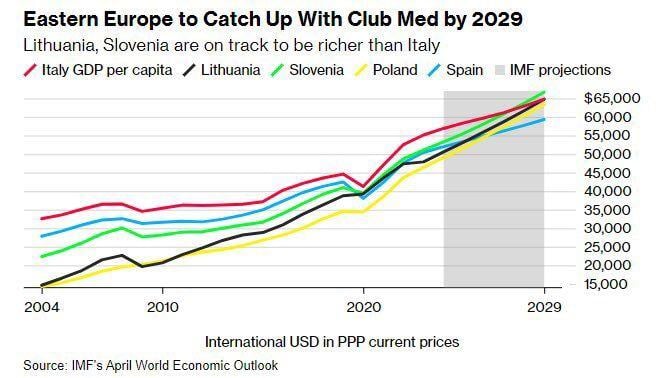

What is happening in Poland is nothing short of economic wonder.

Standard of living in Poland overtaking Spain and Italy within just one generation is amazing. Source: Michel A.Arouet, IMF

Speculators have ramped up their bets against long-dated US bonds due to the rising prospects of Trump 2.0.

Source: Bloomberg, HolgerZ

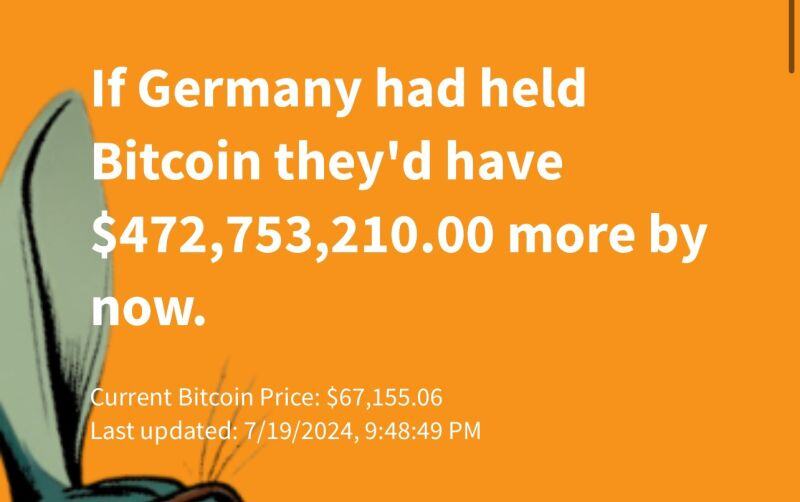

There is a website tracking the German Bitcoin losses in real time:

https://lnkd.in/eU_icc8x Source: Carl B Menger on X

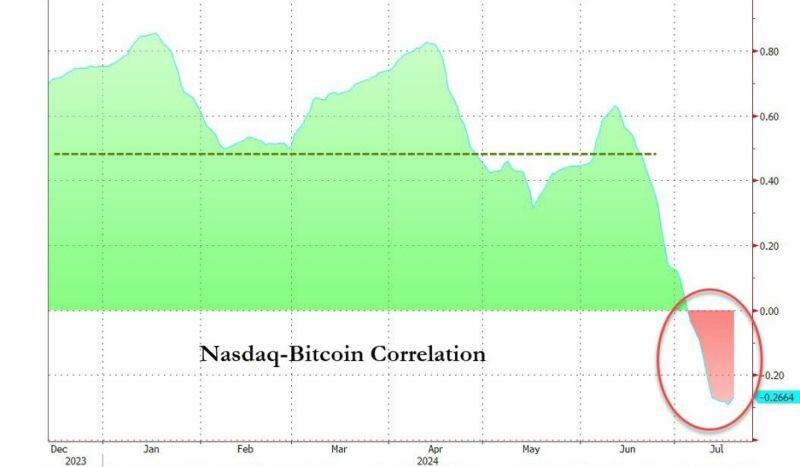

Bitcoin has decoupled from its strong correlation with tech overall in the last two weeks...

Source: Bloomberg, zerohedge

This is not a Trump trade but rather a "soft landing trade" => Stocks have rallied on the prospects of a soft landing for the economy

Source: Edward Jones

Stocks have rallied on the prospects of a soft landing for the economy">

Stocks have rallied on the prospects of a soft landing for the economy">

Stocks have rallied on the prospects of a soft landing for the economy">

Stocks have rallied on the prospects of a soft landing for the economy">

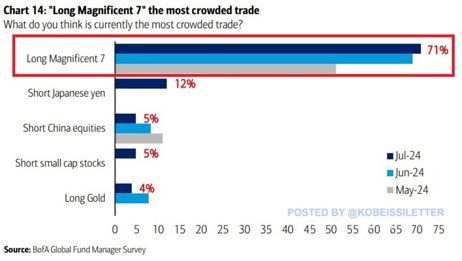

Long Magnificent 7" has been the most crowded trade among investors for 16 months straight, even after the recent drop.

This is according to 71% of 242 global fund managers polled by Bank of America. This percentage is up from 69% and 52% in June and May Source: BofA, The Kobeissi Letter

The Japanese Yen is up against the US dollar to its strongest level since mid-June.

The USD-JPY currency pair is down over 3% since Thursday after hitting a 38-year high following another round of intervention by Japan’s Ministry of Finance. Japanese authorities reportedly spent $22 billion on Thursday and Friday to prop up the yen, according to Bloomberg. This comes after Japan spent a record $62 billion to support the currency between April 26th and May 29th. Over the last 12 months, the Yen has declined by ~12% and has been the worst-performing currency of G10. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks