Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

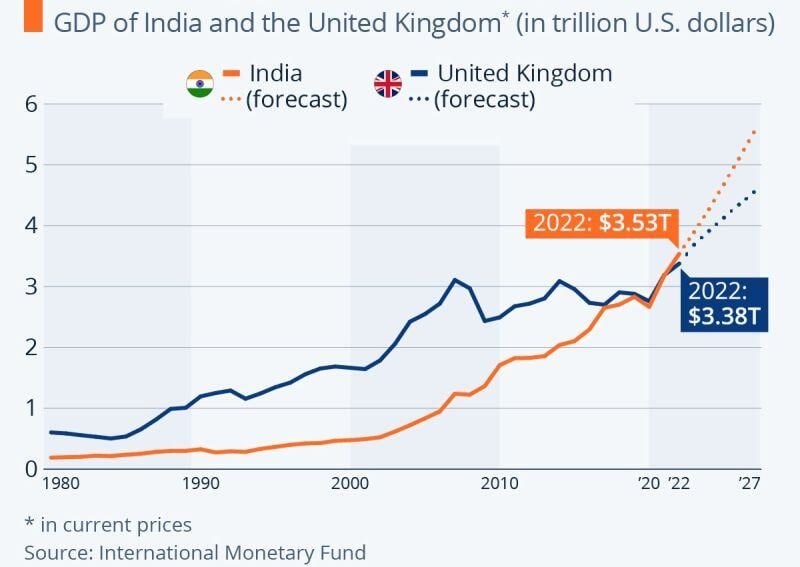

India‘s economy is overtaking UK, the former colonial power.

And this is most likely just a start. Source: The Economist, Michel A.Arouet

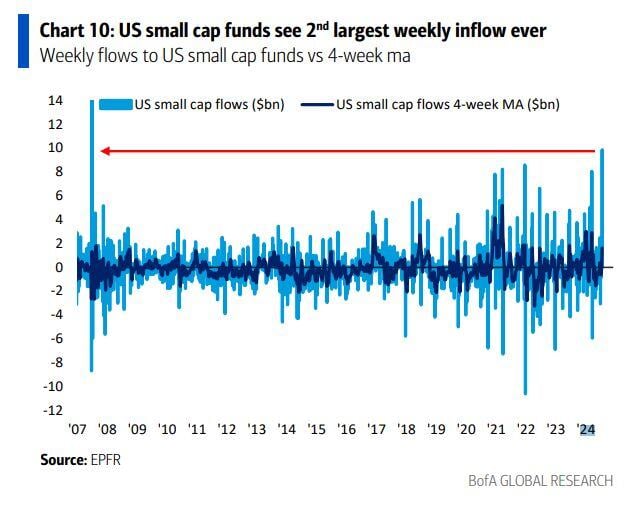

US small cap funds see 2nd largest weekly inflow ever

Source: EPFR, BofA, Mike Z.

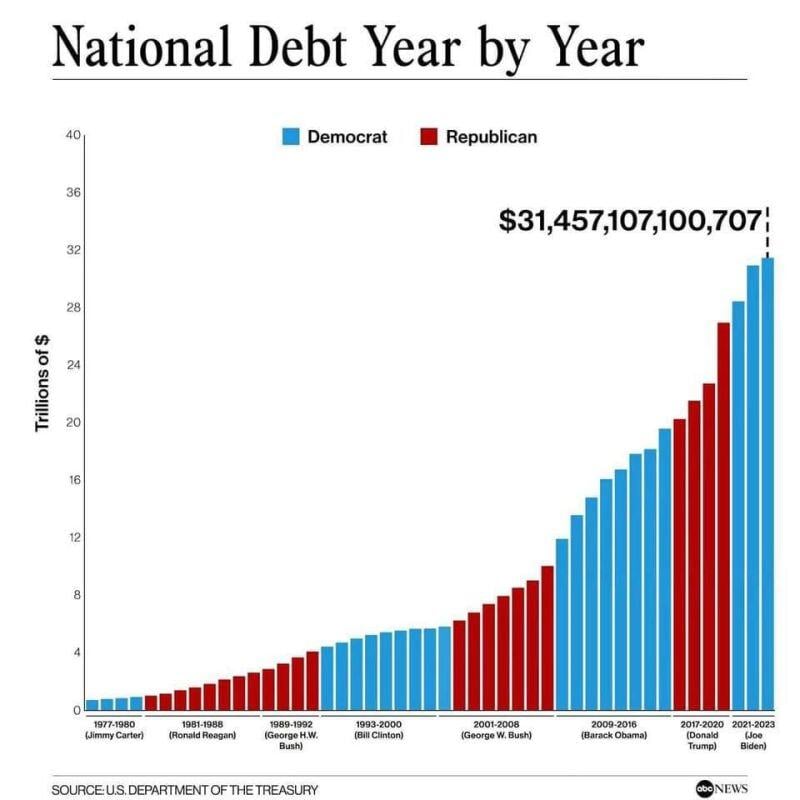

US National debt. A bit of maths...

The current level is almost $35 trillion. And the government has baked in minimum $2 trillion deficits going forward. There are $5 trillion in government revenues per year. 100% of government revenue is consumed by Social Security, Medicare, Medicaid and interest on the debt. Interest on the debt is WAY over $1 trillion per year, more than 20% of government revenue. It takes another $2 trillion minimum per year to fund defense and all of the other departments of the government that they are unwilling to cut. There are also extra items like Ukraine and whatever the wars going on that get additional off budget funding. It should thus keep rising. Source: Wall Street Silver, ABC News

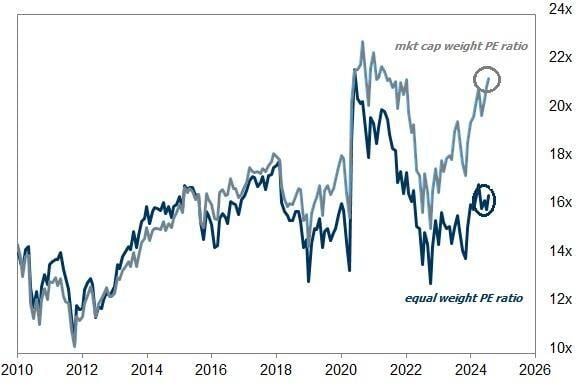

Equal weight S&P 500 (ETF $RSP) is considerably cheaper than the market cap weighted ETF, just as we may see earnings growth broaden out to a wider swath of companies.

Does that spell opportunity? Source: Markets & Mayhem, GS

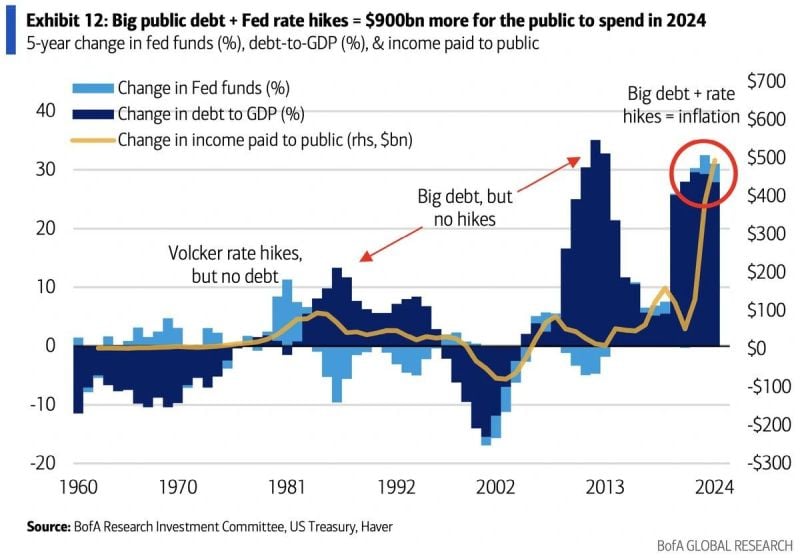

Interesting point of view by BofA:

"Fewer investors have focused on the inflationary effects of higher income. No other Fed hiking cycle in history occurred while government debt was so large ... interest payments flow to holders of Treasury securities and some portion will be spent." Source: BofA, Octavian Adrian Tanase

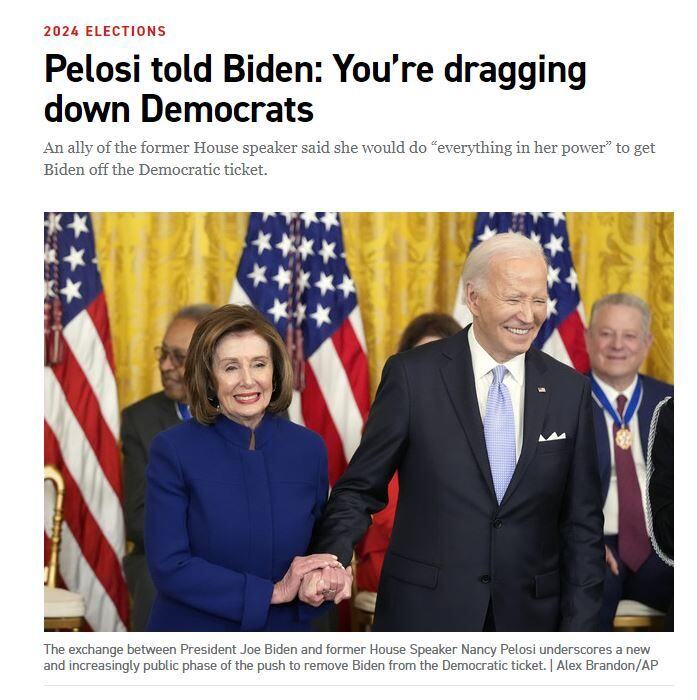

BREAKING: Nancy Pelosi has told US House Democrats that President Biden can be "persuaded fairly soon" to exit the 2024 presidential race.

New reports from Fox Business state that President Biden may drop out as soon as tomorrow. Source: Politico, The Kobeissi Letter

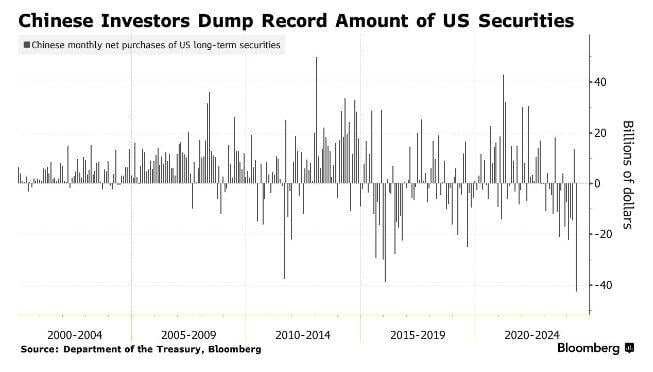

JUST IN 🚨: China dumped an ALL-TIME HIGH $42.6 billion worth of U.S. Securities in May

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks