Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

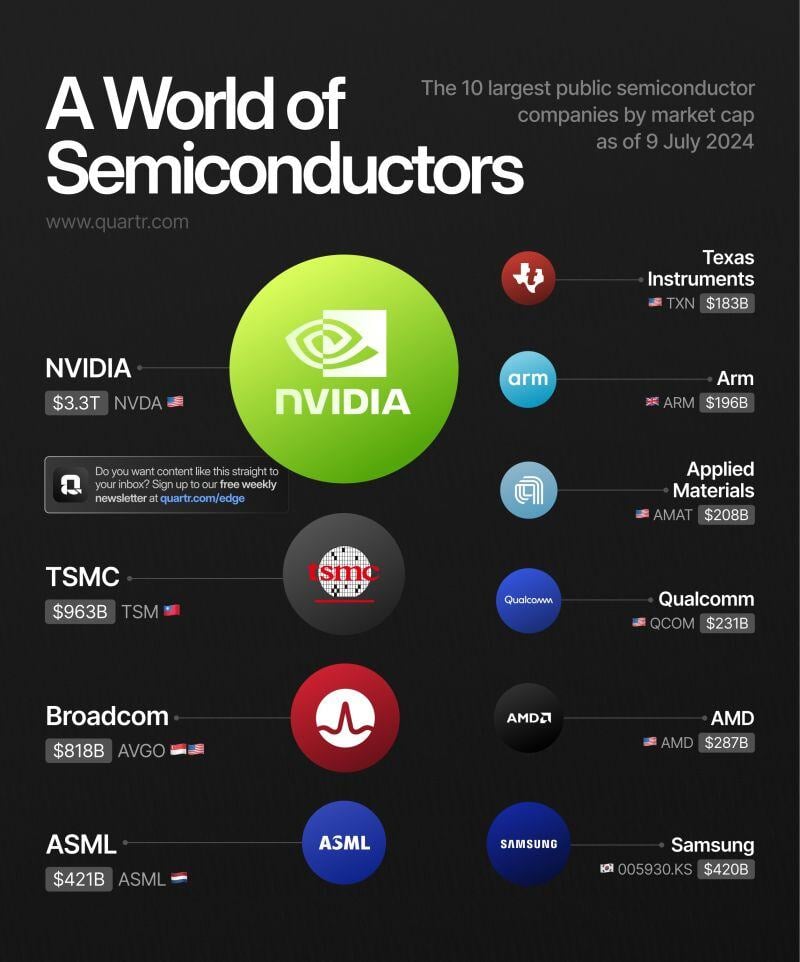

A visual overview of the world's 10 largest public semi conductor companies' market caps:

$NVDA $TSM $AVGO $ASML $TXN $ARM $AMAT $QCOM $AMD Source: Quartr

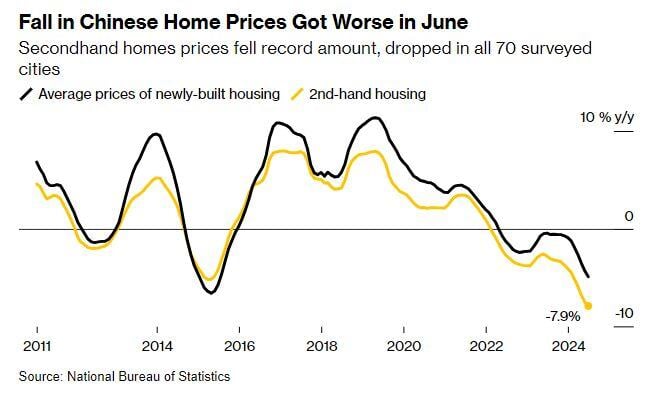

🚨 Chinese Existing Home Prices declined by 7.9% year-over-year last month, the largest decline in history!

Source: Bloomberg

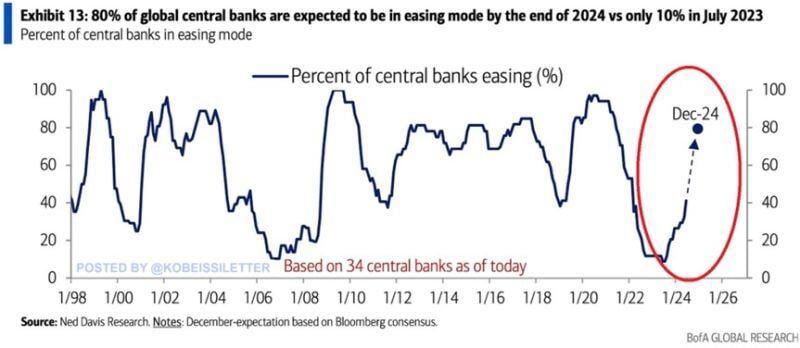

Monetary policy monetization => 27 of 34 global central banks, or 80% are expected to ease their monetary policy by the end of 2024, the highest since 2021.

By comparison, in July 2023 just 10% of central banks were expected to cut rates. Currently, 42% of central banks have been easing monetary policy. Canada and the European Central Bank were the latest to cut interest rates in June. Meanwhile, the market is pricing the first Fed rate cut in September and a total of 2 cuts this year. Source: The Kobeissi Letter, BofA

Trump Media shares $DJT surge 50% in premarket trading after assassination attempt

.

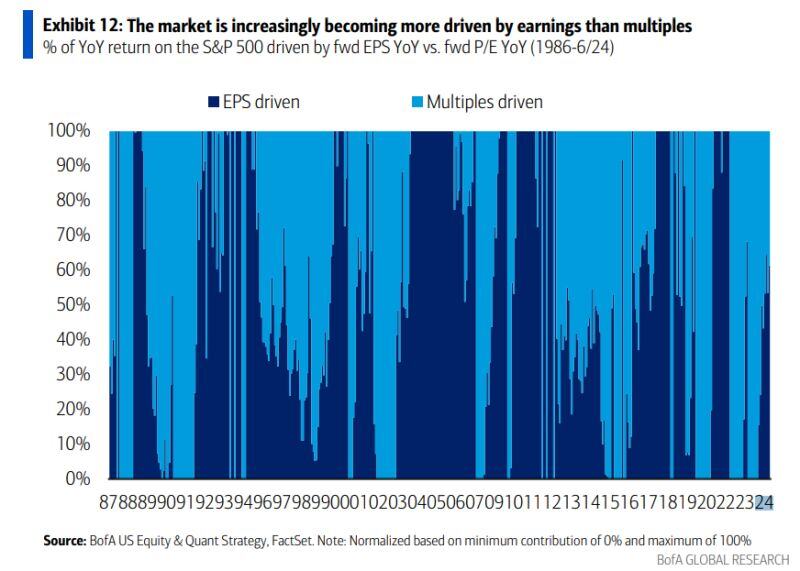

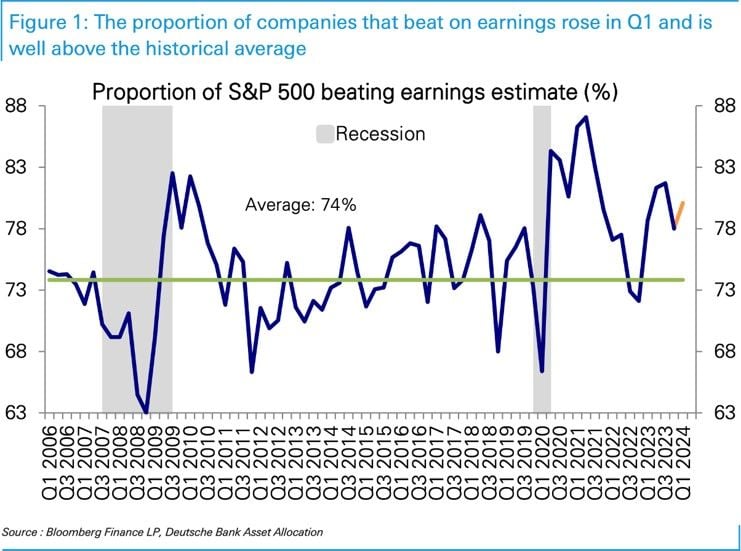

As we get into the heat of EPS season...

DB notes that more companies have been beating and by a larger amount in recent quarters. If this continues, it is tough to bet against this market... Source: Deutsche Bank, RBC

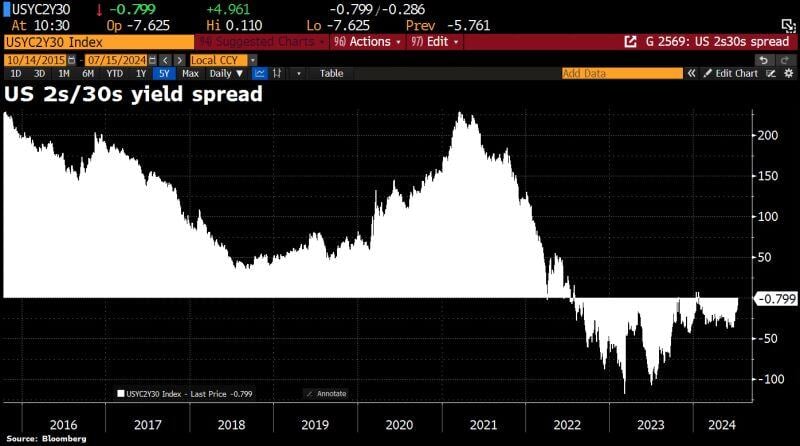

US 2s/30s yield spread briefly turns positive for 1st time since January

Source: HolgerZ, Bloomberg

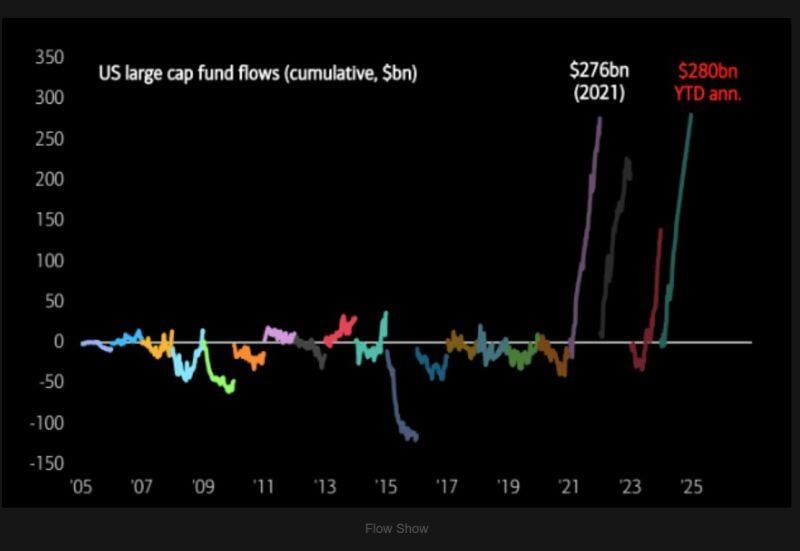

Inflows to US large cap funds on pace for 2nd largest on record.

Source: Flow Show, TME

Investing with intelligence

Our latest research, commentary and market outlooks