Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The 13 largest luxury companies by market cap.

Four fun facts: → $LVMH's market cap is more than double the size of the bottom ten companies combined. → $RMS is by far the largest single-brand company on the list, at 3.3x the size of $RACE. → Despite owning 10+ brands including iconic maisons such as Gucci, Saint Laurent, Brioni, and Bottega Veneta, $KER's revenue is "only" ~€20B, compared to Hermès' >€13B. → Tiffany & Co. was acquired by LVMH during the pandemic at a $16B valuation, which would place them at #8 on this list. Source: Quartr

US Poll: Majority believe Biden's cognitive health doesn't qualify him for presidency

A new CBS News/You Gov poll reveals that 72% of Americans doubt Biden's "mental and cognitive health" meets the standards required for the presidency. Of those surveyed, 46% of Democratic voters believe Biden should consider withdrawing from the race due to health concerns. The poll also asked respondents about former President Donald Trump's fitness for office, with 50% expressing confidence in his mental and cognitive abilities, while 49% disagreed. Source: https://www.albawaba.com/

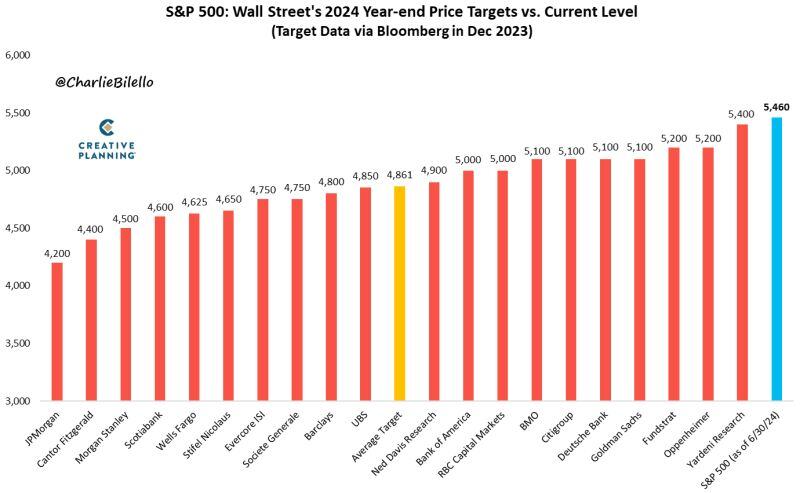

At 5,460, the S&P 500 ended the first half above every 2024 year-end price target from Wall Street strategists

We're 12% higher than average target price of 4,861. $SPX Source: Charlie Bilello

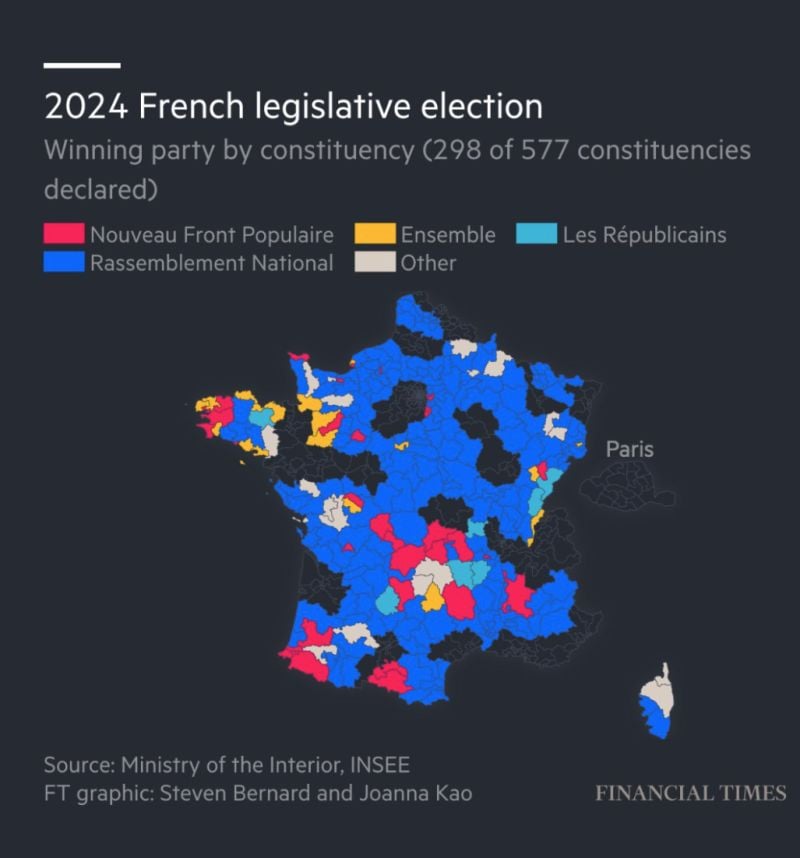

The Le Pen vote

Parliament elections 1st Round- over time: 1988: 9% 1993: 12% 1997: 15% 2002: 11% 2007: 4% 2012: 13% 2017: 13% 2022: 18% 2024: 34% National populism is only getting stronger. Source: Matt Goodwin

A maps of 2024 French legislative election 1st round

next round is 7th of July Source: FT

Euro starts slightly higher to the week following French election in which Marine Le Pen’s far-right party is poised to dominate the first round.

Source: Bloomberg, HolgerZ

FRENCH LOWER HOUSE SNAP ELECTIONS

FIRST TAKE 1) French far-right has strong lead in France's 1st voting round. The National Rally (RN) was projected to get between 33% and 34.2% of the vote. The left-wing New Popular Front coalition was set to get between 28.5% and 29.6% and Macron’s centrist alliance between 21.5% and 22.4%. 2) The exit polls were in line with opinion polls ahead of the election, but provided little clarity on whether the RN will be able to form a government to "cohabit" with the pro-EU Macron after next Sunday's run-off. As projections show between 240 to 270 seats won at the second round, the RN could thus get a relative majority in Parliament. Le Pen party needs 289 seats for a majority in the second round French ballot. Bottom-line >>> The National Rally is likely to win the elections. Question is would it be a RELATIVE or ABSOLUTE majority. There are 3 possible outcomes: 1/ Absolute majority (Bardella as Prime Minister) Expect modest OAT-Bund spread widening and another (modest) downside leg for French equities (especially “national victims”) 2/ Minority majority / Hung parliament Expect a modest OAT-Bund spread widening and French equities stabilize 3/ Caretaker or Technical government Expect a modest OAT-Bund spread tightening and French equities rebound (especially “national victims”). The euro is currently STRENGTHENING as Asia trading just started. This means that markets are now expecting a HUNG PARLIAMENT with no Prime Minister coming from Rassemblement National. Even of the party from Mrs Le Pen win the election, they will refuse to appoint Bardella as PM. This opens the door to a Prime Minster coming from the center or a technical one. This means political paralysis but markets can probably live with this...

Investing with intelligence

Our latest research, commentary and market outlooks