Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

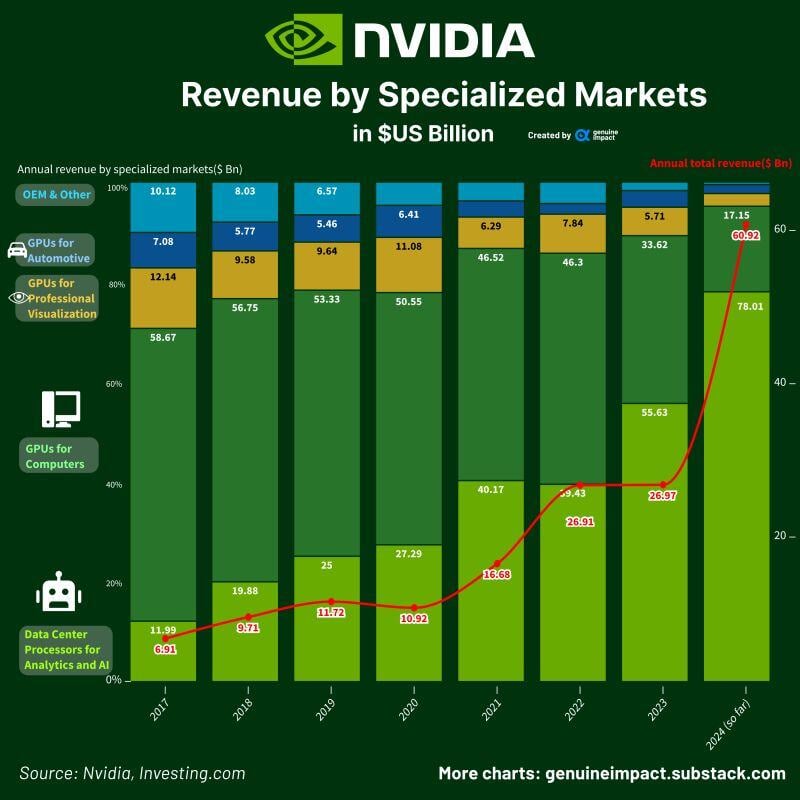

NVIDIA’s data center revenues have grown from 12% in 2017 to 78% in 2024 of total revenues.

Source: Genuine Impact

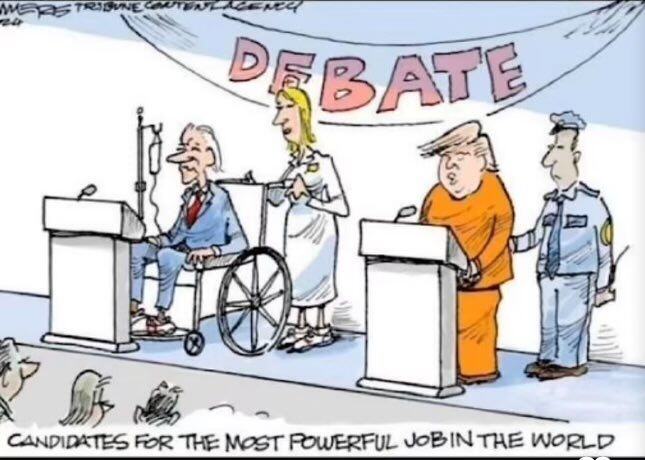

Candidates for the most powerful job on the world...

summarized in one cartoon... Maybe the US deserve better... 😅 Source: Markets & Mayhem 🤖

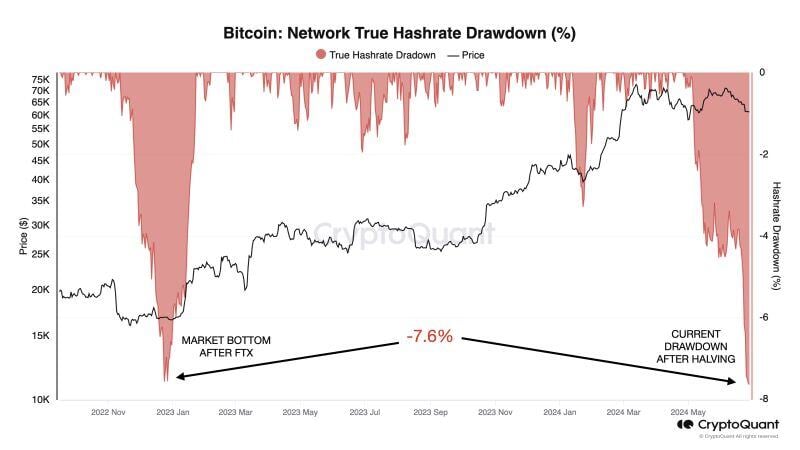

Bitcoin miner capitulation has reached levels comparable to December 2022: 7.6% drawdown.

December 2022 marked the cycle bottom after the FTX collapse. Source: Julio Moreno, Cryptoquant

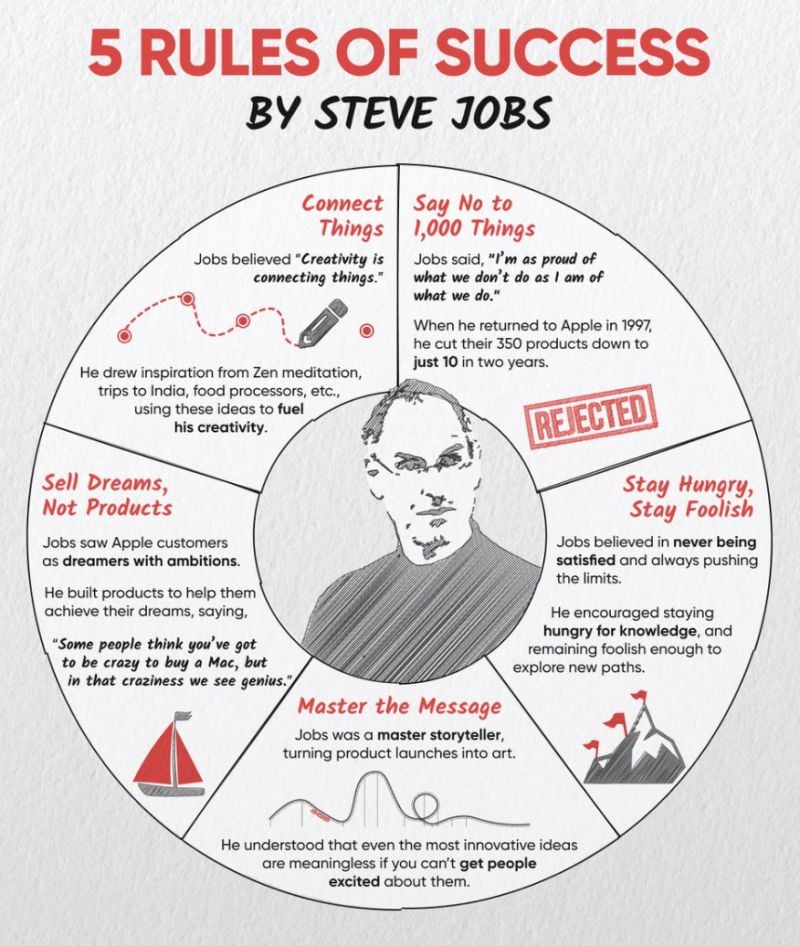

5 rules of success by Steve Jobs:

#1: Say no to 1,000 things. #2: Never be satisfied, Stay hungry for knowledge, explore new paths. #: Master the Message: be a story teller and get people excited about your ideas #4: Sell Dreams, Not Products #5: Connect things Source: Investment Books (Dhaval)

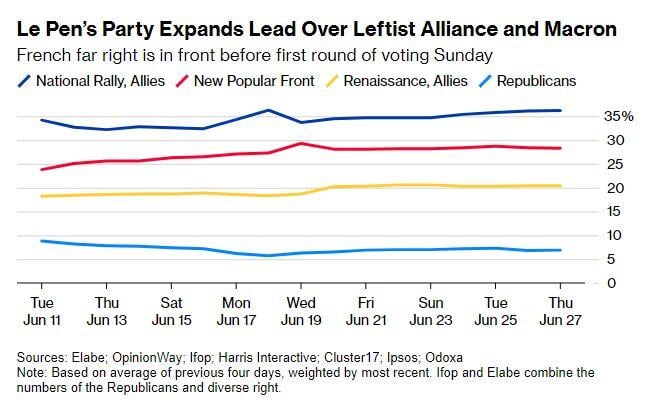

France | Macron’s Approval Drops Two Days Ahead of French Election

President Emmanuel Macron’s approval rating fell to the lowest level in three months, delivering a boost to Marine Le Pen’s far-right National Rally party just two days before voting starts in France’s legislative election. Support for Macron dropped six points to 36%, the worst showing since March, according to a Toluna-Harris Interactive poll for LCI TV published on Friday. Source: Bloomberg

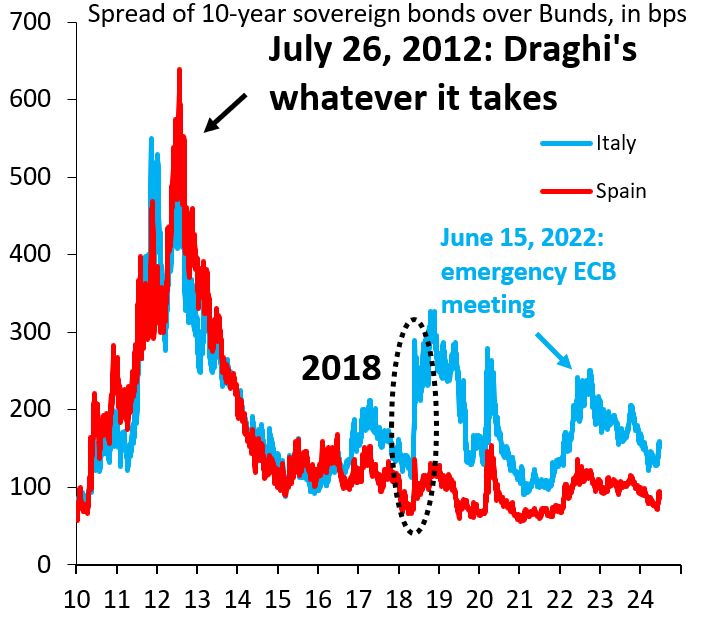

A 2nd Trump term is a problem for the Euro periphery. US deficits will widen, putting upward pressure on global yields as the US sucks in capital.

That's bad news for high debt Italy and Spain. Both countries had all the time in the world to cut debt. Both countries did nothing. Source: Robin Brooks

Investing with intelligence

Our latest research, commentary and market outlooks