Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Thursday night US presidential election debate in one image

Source: USA today

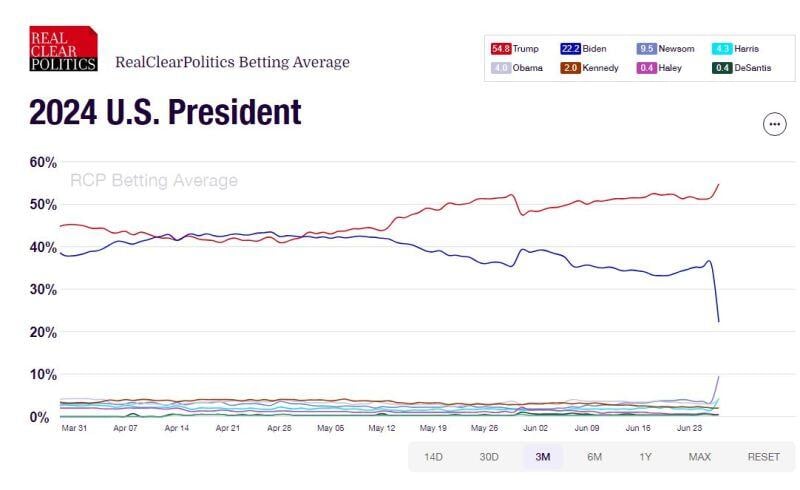

US yield curve steepens sharply after US presidential debate w/PredictIt’s live betting odds have jumped in Trump’s favor to almost 60%

US 2s/10s spread jumps by 7bps to -36bps. Source: HolgerZ, Bloomberg

BREAKING: The odds of President Biden winning the 2024 Democratic nomination are down by 24% in 2 HOURS.

Prior to the debate, markets saw an 86% chance that Biden would win the nomination. Now, there's a 38% chance that he WON'T be nominated as the Democratic candidate. There's a 22% chance that Gavin Newsom wins the nomination and a rising 14% chance of Kamala Harris being the nominee. The one of the largest shifts in market implied odds of all time for an election that is less than 5 months out. Source: The Kobeissi Letter

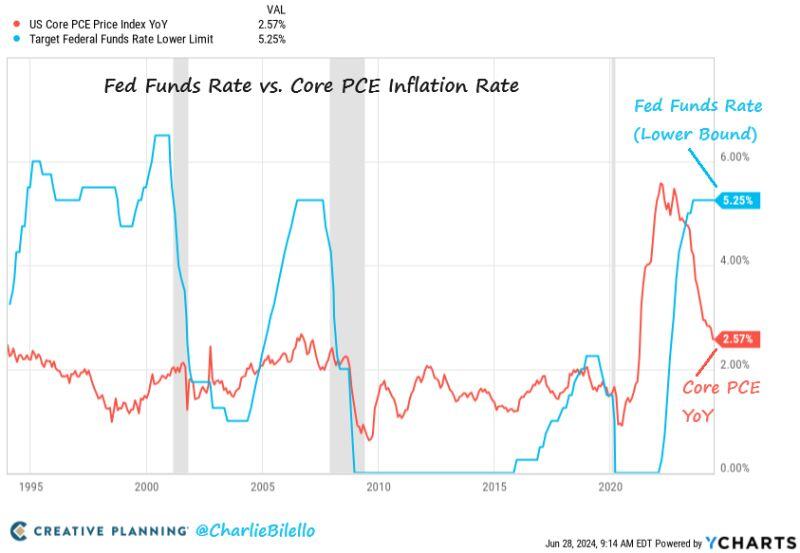

BREAKING: The Fed's preferred measure of inflation (Core PCE) moved down to 2.6% in May, in-line with expectations and the lowest since March 2021.

Core PCE inflation fell to 2.6%, in-line with expectations of 2.6%. So Both headline and Core PCE inflation declined last month. Another welcomed sign by the Fed. Note that "Supercore" PCE rose by 0.1% in May, its smallest monthly increase since August 2023. Health Care (light blue) was the dominant contributor, and 5 of the main sub categories actually declined (if it wasn't for soaring health insurance costs, supercore would be negative). The Fed Funds Rate is now 2.7% above Core PCE, the most restrictive monetary policy we've seen since September 2007. Source: Charlie Bilello

What a difference a single debate can make...

Odds of Trump winning Presidential election has surged to 60% (red line below) while odds of Biden winning has collapsed (blue line below) due to the very poor performance of incumbent President during yesterday's evening political debate with Trump. As highlighted by Politico >>> "The alarm bells for Democrats started ringing the second Biden started speaking in a haltingly hoarse voice. Minutes into the debate, he struggled to mount an effective defense of the economy on his watch and flubbed the description of key health initiatives he’s made central to his reelection bid, saying “we finally beat Medicare” and incorrectly stating how much his administration lowered the price of insulin. He talked himself into a corner on Afghanistan, bringing up his administration’s botched withdrawal unprompted. He repeatedly mixed up “billion” and “million,” and found himself stuck for long stretches of the 90-minute debate playing defense. And when he wasn’t speaking, he stood frozen behind his podium, mouth agape, his eyes wide and unblinking for long stretches of time"... Rumors are now running wild on whether the Democrats should replace their candidate in a last minute turnaround

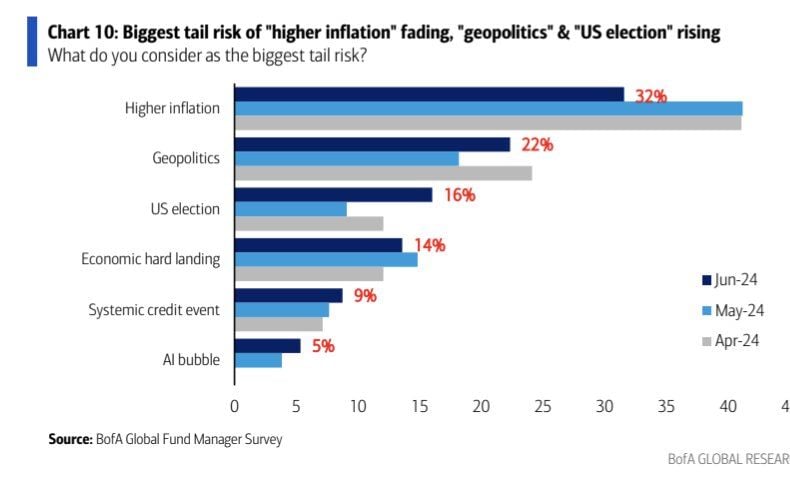

According to BofA fund managers survey, the biggest tail risk is still higher inflation.

WHAT IF the true risk is UNDERESTIMATING the current disinflation trend? PCE numbers today will give us more clue about where inflation is going next? Source: Ryan Detrick

1.285 million barrels of oil were added to the Strategic Petroleum Reserve last week, the largest addition since June 2020

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks