Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

India is set to welcome billions of dollars of foreign inflows when JPMorgan adds the country’s sovereign debt to its emerging markets index on Friday

A move that some analysts say will leave it more vulnerable to fickle flows of hot money. The inclusion of India marks the first time the bonds of the world’s fastest-growing large economy have been included in a major benchmark and is the latest move to open up a once closed-off market. It was only in 2020 that India removed foreign ownership restrictions on some rupee-denominated debt. The inclusion of 28 government bonds worth more than $400bn will give India a 10 per cent share of the widely tracked measure, according to JPMorgan. About $11bn has flowed into Indian bonds as investors position themselves ahead of the formal inclusion, according to Goldman Sachs. The bank expects a further $30bn to arrive as the bonds are gradually incorporated into the index over the next 10 months, raising foreign ownership from around 2 per cent to about 5 per cent. Source: FT Link to the article >>>

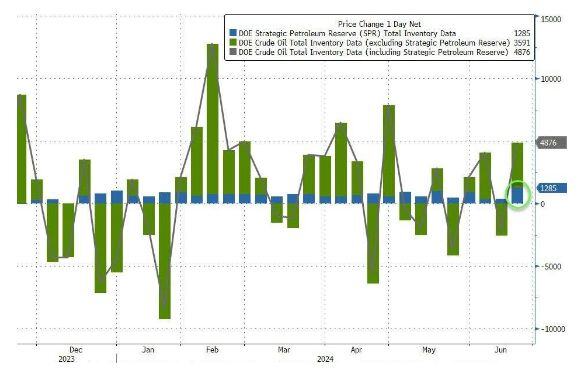

1.285 million barrels of oil were added to the Strategic Petroleum Reserve last week, the largest addition since June 2020

Source: Barchart

BREAKING: Walgreens stock, $WBA, crashes nearly 25% after drugstore chain cuts profit guidance due to "challenging" consumer environment.

"We assumed the consumer would get somewhat stronger” but “that is not the case,” Walgreens CEO said. Walgreens cut their earnings per share outlook by 12.5% yesterday. The stock is now down 88% from its all time high and 55% in 2024. Another sign that consumers are struggling? Source: The Kobeissi Letter

France vs German 10 year spread keeps moving even higher...

Source: The Market Ear

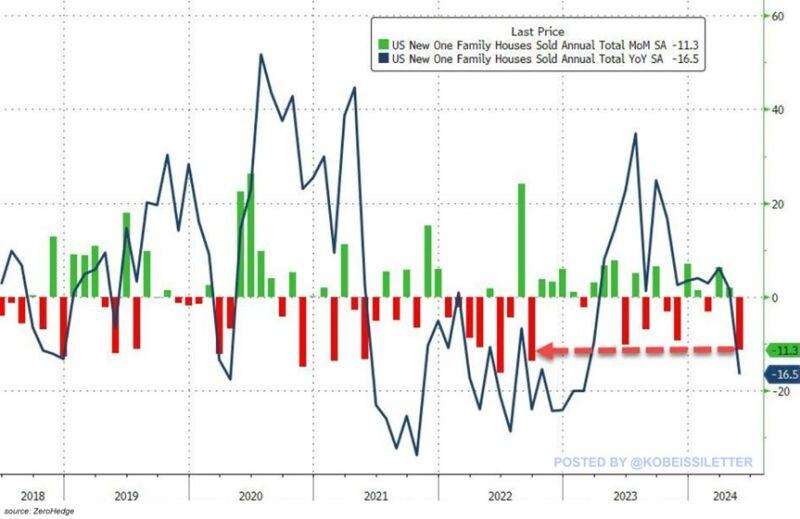

BREAKING: US new home sales plummeted -11.3% month-over-month to 619,000 in May, well below the estimated -0.2% decrease.

This was the largest decline since September 2022 when new home sales fell by ~14%. Year-over-year sales dropped by a whopping 16.5%, the most since February 2023. This also follows the Pending Home Sales decline to their lowest level since April 2020. Meanwhile, the supply of homes available for sale rose to 481,000, the highest since the 2008 Financial Crisis. The US housing market is slowing. Source: The Kobeissi Letter

Will Biden run for President after yesterday's night debate???

It seems that Democrats will look urgently for a new nominee. Indeed, Many of the Democratic Party’s top fundraisers are privately sounding the alarm after President Joe Biden’s disappointing debate performance Thursday against Republican former President Donald Trump. “Disaster,” said a Biden donor who plans to attend a fundraiser with the president on Saturday in the Hamptons. “This is terrible. Worse than I thought was possible. Everyone I’m speaking with thinks Biden should drop out,” said the person, who was granted anonymity in order to recount private conversations. CNBC began hearing from worried Democratic campaign donors and fundraisers less than 20 minutes into the 90-minute debate hosted by CNN. “Game over,” said a longtime Democratic campaign advisor, who has been raising money for congressional leaders for over a decade and helped raise money for Biden’s 2020 White House bid. https://lnkd.in/eWanGba8

Investing with intelligence

Our latest research, commentary and market outlooks