Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

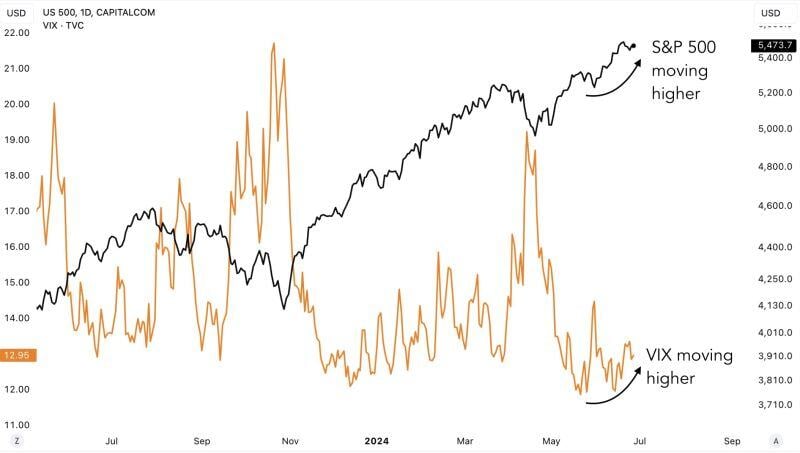

Major divergence spotted:

The VIX has been trending higher since mid-May. But even the SP500 has been moving higher. This is an anomaly. Source: Game of Trades

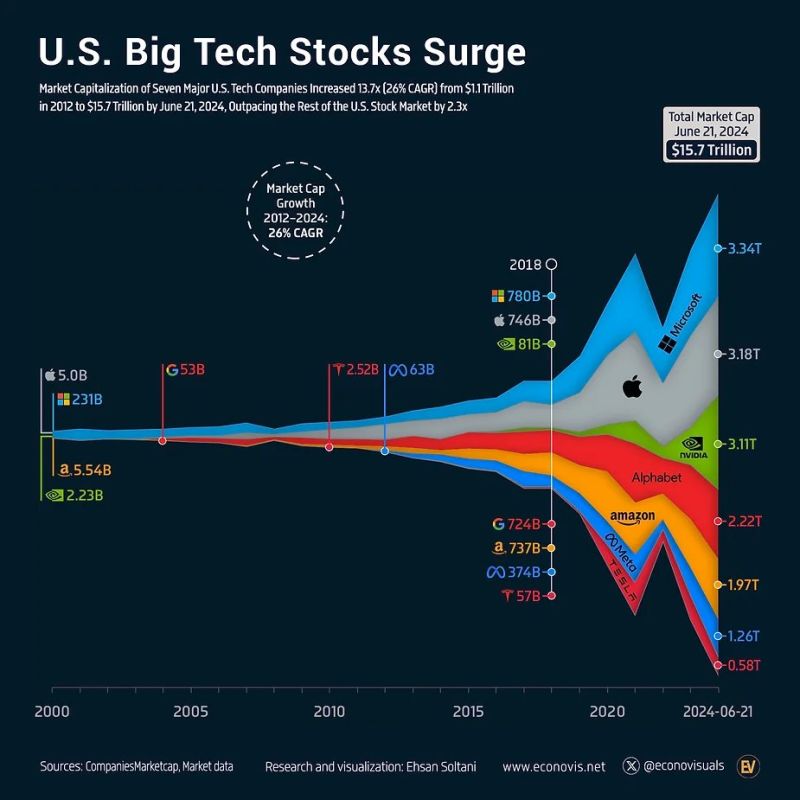

Amazon enters elite $2tn club as AI optimism fuels rally.

Amazon up ~27% this year, driven by improving growth trends as AI re-accelerates its cloud-computing business. The milestone puts Amazon into an exclusive club of comps worth $2tn or more: Alphabet crossed the level in April, while Nvidia, Microsoft, and Apple are all worth north of $3tn. (via BBG)

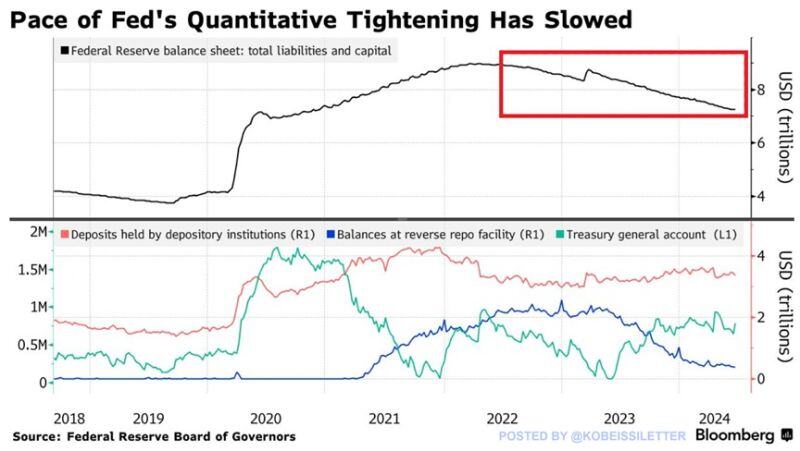

The Fed has been shrinking its balance sheet at the fastest pace ever:

Since April 2022, the Federal Reserve has reduced its balance sheet by $1.71 trillion to $7.25 trillion, a 19% decline. By comparison, from 2017 to 2019 the Fed’s balance sheet runoff amounted to 16%. However, the Fed's balance sheet still stands $3.1 TRILLION above pre-pandemic levels. Meanwhile, the Fed slowed the pace of runoff from $95 billion to $60 billion a month at the beginning of June. Will the Fed's balance sheet ever reach pre-pandemic levels?

Visualizing the incredible surge in tech stocks 📊

Markets & Mayhem 🤖

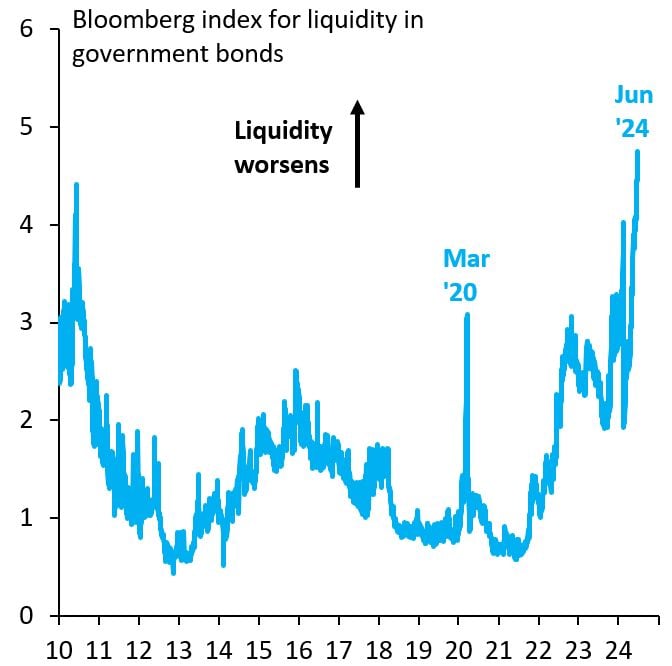

BREAKING 🚨: U.S. Treasury Market

Treasury liquidity is now at its worst point in AT LEAST the last 14 years, surpassing even the onset of Covid Source: Barchart, Robin Brooks

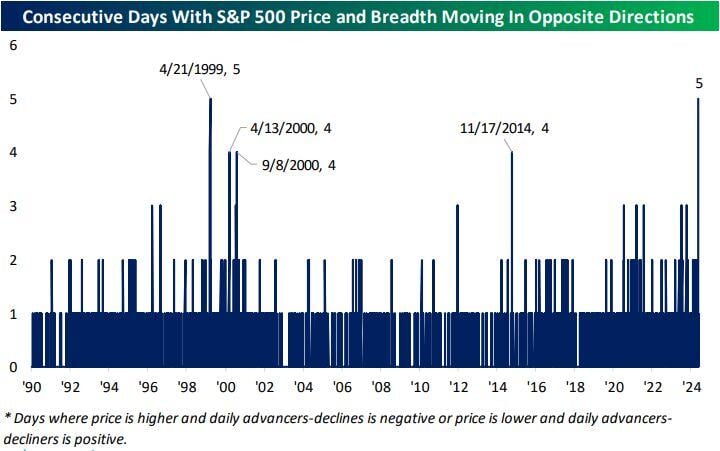

Yesterday the SP500 managed to rise on negative breadth.

It's now been five days in a row where price has gone in one direction and breadth has gone in the other. That ties the record streak from April 1999. Source: Bespoke

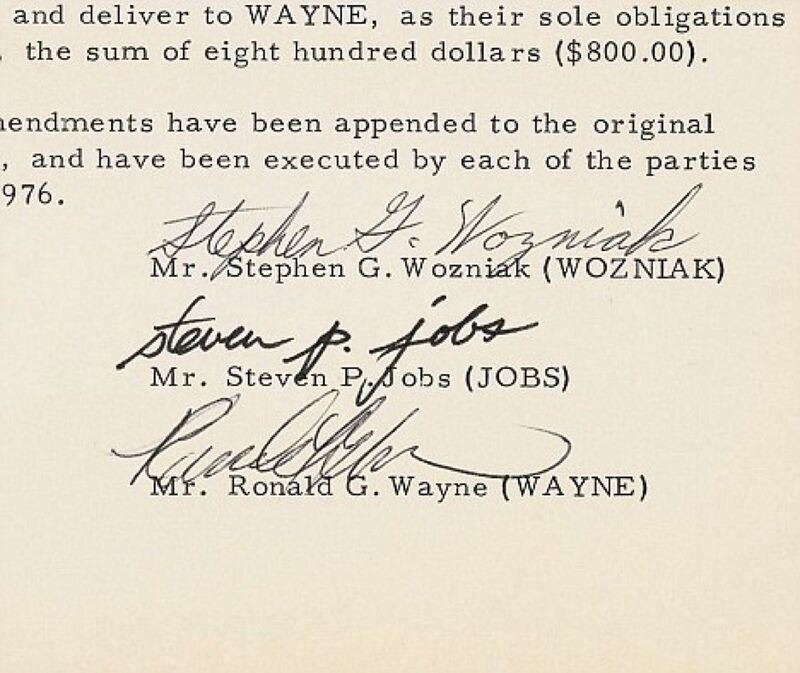

If you ever get upset for selling too early just know it could have been worse.

Meet Ronald Wayne Apple's 3rd co-founder who sold his entire 10% stake in the company for $800 back in 1976. 10% of Apple $AAPL is currently worth ~$328 Billion... Source: Evan

Investing with intelligence

Our latest research, commentary and market outlooks