Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

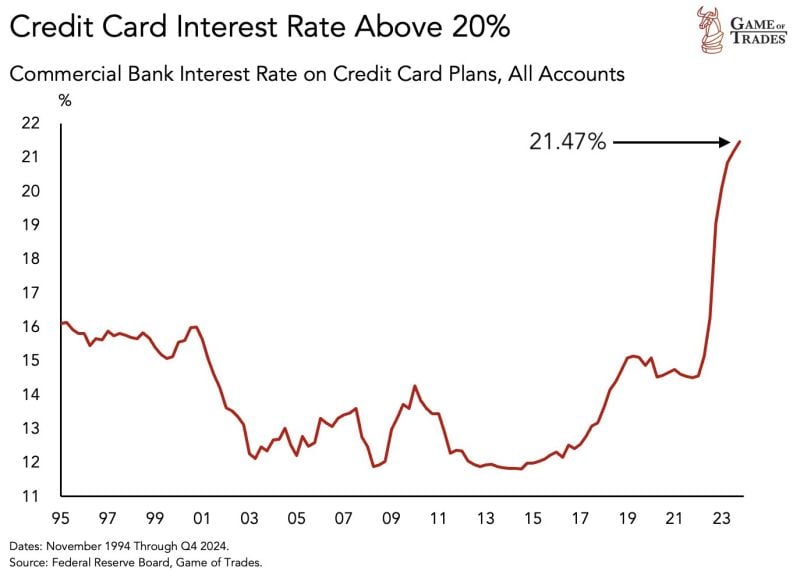

CAUTION: In the US, Credit card interest rates have skyrocketed to a shocking 21.47%

Moreover, credit card debt has crossed the $1 trillion mark. And personal interest payments have risen to over $500 billion. To make things worse, excess savings have now run out Source: Game of Trades

Nvidia, $NVDA, is making some INSANE moves:

From June 20th through June 24th, Nvidia lost $600 BILLION of market cap in 3 trading days. Today, the stock has added $250 BILLION in market cap from its pre-market low. That's an $850 billion swing in market cap over just 4 trading days. To put this in perspective, that's a swing of 1.5 TIMES the value of Tesla, $TSLA, in just 4 days. Nvidia is casually swinging almost $1 trillion of market cap in just 4 days with no news. Truly historic. Source: The Kobeissi Letter

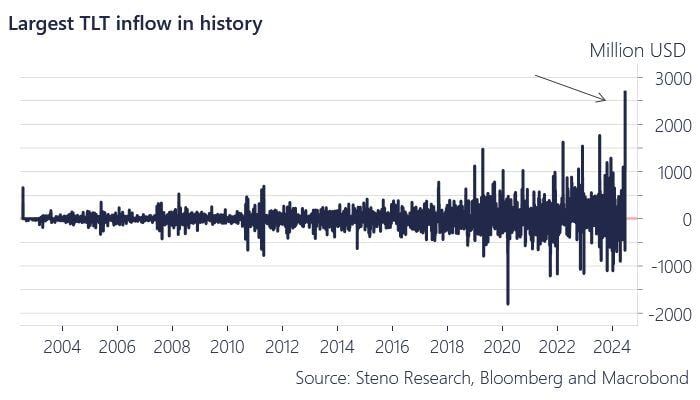

Net inflow to TLT! Is the rate cut hope-timism back?

Source: Andreas Steno Larsen, Steno Research, Macrobond

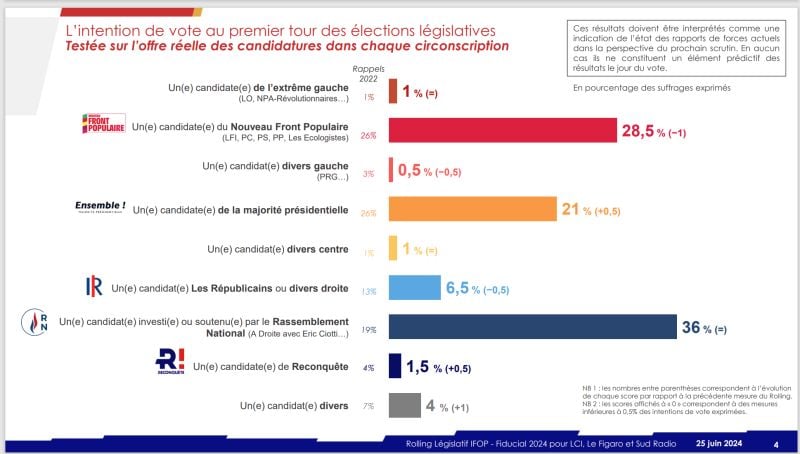

Latest IFOP poll for lower-house snap election in France

This shows far-right way ahead (36% in blue) ahead of far left coalition (28.5% in red) while incumbent Macron's center-right party comes 3rd (21% in orange). It seems that far-right will at least win relative majority

Investing with intelligence

Our latest research, commentary and market outlooks