Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

#french #elections: Former President François Hollande back to business?

Hollande is running for a seat in Parliament and Macron didn't put any candidate in front of him. In the (plausible) scenario of a hung parliament, Hollande could be chosen by Macron as Prime Minister of a unity government.

🚨CANADA INFLATION UNEXPECTEDLY RE-ACCELERATES.

May CPI +2.9% vs 2.6% expected. Did they cut rates too soon? Should the Fed worry about cutting too soon as well? Source: CTV News

$525 billion in bank losses should concern everyone.

Source: BofA, Red pill rick

BREAKING: Donald Trump is reportedly in talks to speak at the 2024 Bitcoin convention in July.

This would make Trump the first presidential candidate to speak at a crypto event. Most recently, Trump said he "will end Biden's war on crypto" at a rally in Wisconsin. Source: The Kobeissi Letter

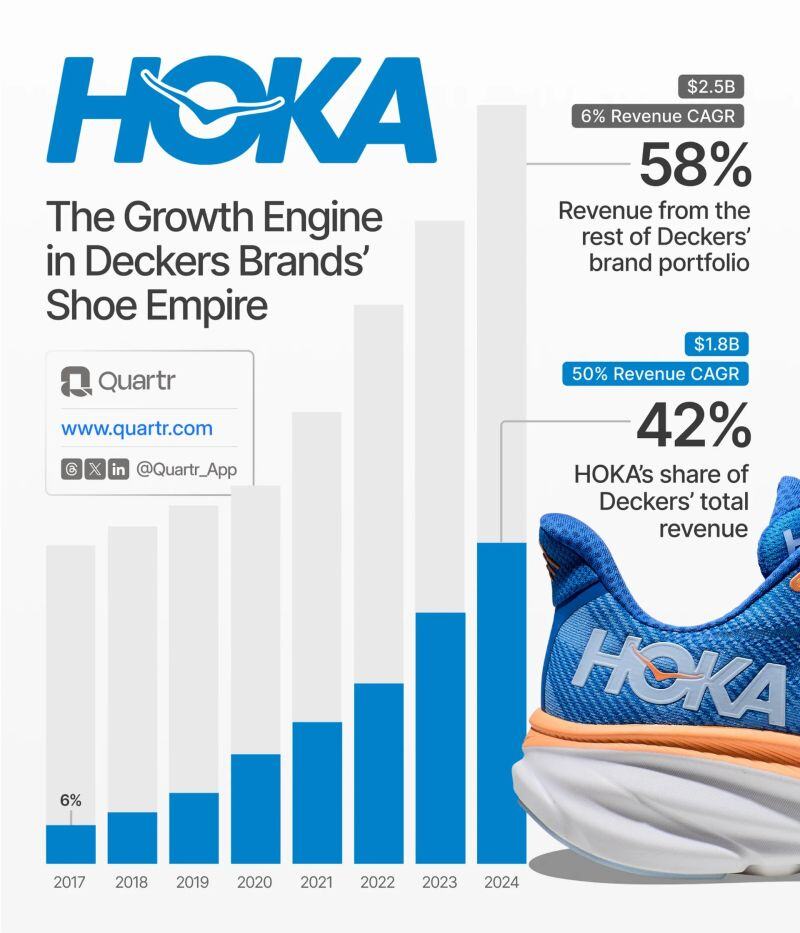

$DECK bought HOKA in 2012 for ~$1.1 million.

A decade later, the company has grown HOKA's revenue from less than $3M to over $1.4B (FY23). That's close to a 500x increase. Is HOKA one of the most impressive consumer product acquisitions of all time? Source: Quartr

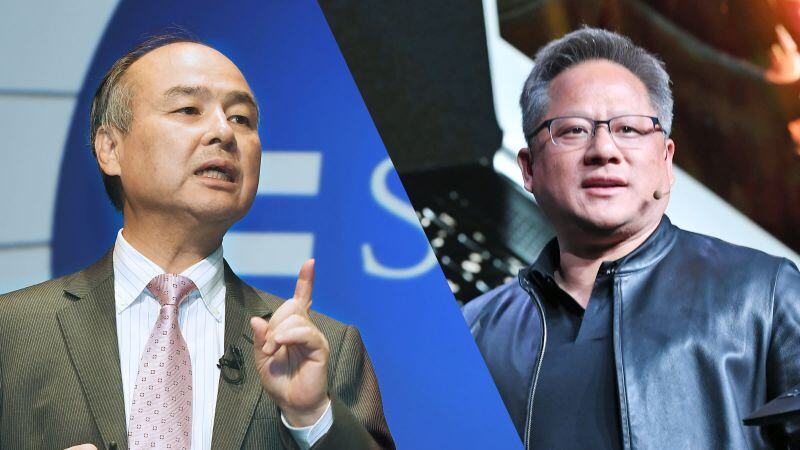

If you ever feel bad, remember that in 2019 SoftBank owned 4.9% of $NVDA and sold it all for a $3.3B profit

Today, that stake would have been worth over $160 BILLION. Source: Stocktwits

Investing with intelligence

Our latest research, commentary and market outlooks