Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The Japanese Yen is at its lowest level since 1986 against the US Dollar, losing 53% of its value from the 2011 peak.

Markets know that japan has a binding constraint: the fiscal one. They thus need to intervene to keeps yield low which means that they can NOT intervene to strengthen the yen. And so the Yen keeps falling... $JPYUSD Source: Charlie Bilello, Robin Brooks

APPLE IS EXPECTING BIG IPHONE 16 SALES, BASED ON CHIP ORDERS.

STOCK CLOSED UP NEARLY 3% Apple $AAPL has reportedly increased its chip order with TSMC $TSM, With the increased order in place, Apple is supposedly preparing to sell between 90M and 100M units of the iPhone 16 - Apple Insider

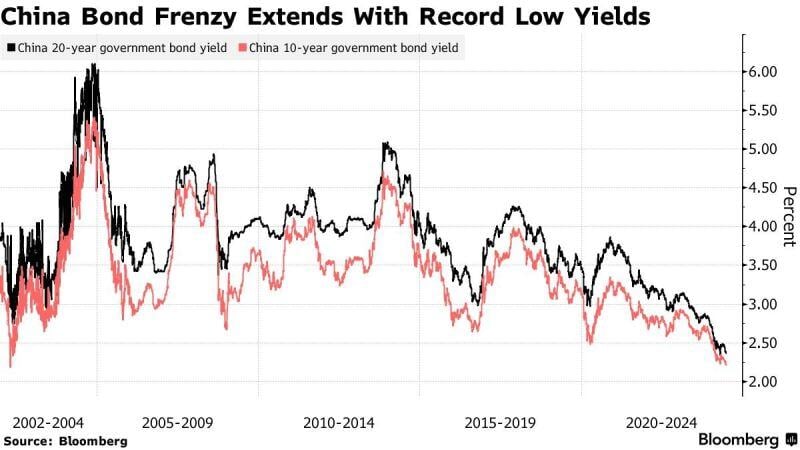

China 10-year yield declines to historic low as rally extends

The yield on China’s benchmark bonds fell to a record low as investors continued to snap up the notes amid pessimism about the domestic economy. The onshore 10-year government yield declined two basis points to 2.18%, set to close at the lowest since Bloomberg began tracking the data in 2002. Yields on the 20- and 50- year bonds have been trading at their historic lows for months. Source: Bloomberg

Bridgewater Associates is launching a fund that uses machine learning as the primary basis of its decision-making.

The vehicle will debut with almost $2 billion of capital from more than a half-dozen clients and begin trading Monday, according to people familiar with the matter, who asked not to be identified discussing the strategy. Source: Bloomberg

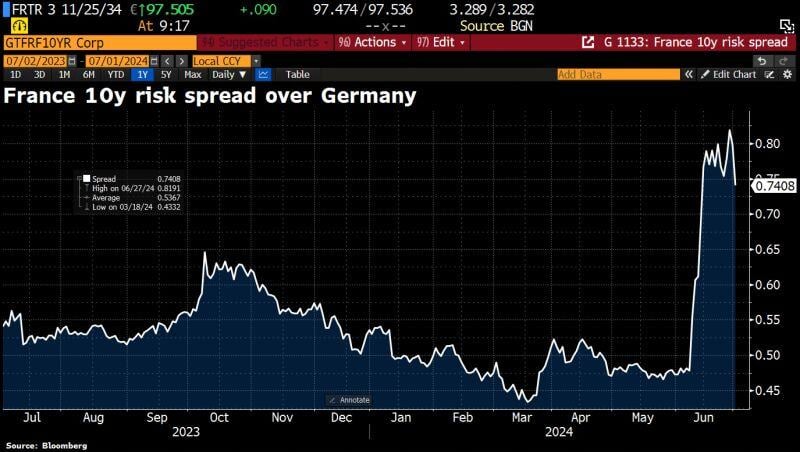

France's 10y risk spread over German bunds drops to 74bps on speculation Marine Le Pen’s far-right party will struggle to win an outright majority in French elections.

Source: HolgerZ, Bloomberg

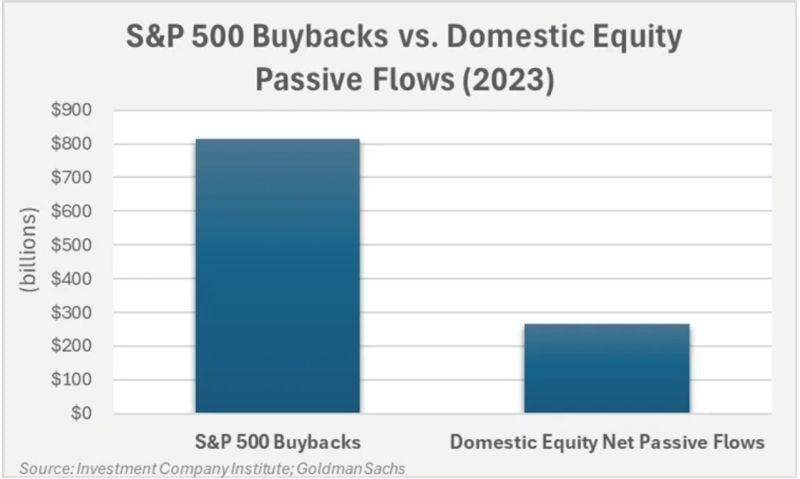

S&P 500 buybacks have been much more powerfuil than passive flows

Source: GS

The US Treasury market remains volatile

The 10-year note yield is now up over 20 basis points in since Friday's intraday low. That's 20 basis points in a matter of hours without any material news? Or is it a Trump effect? UST over-supply? Whatever the reason, for the first time in almost 5 weeks, the 10-year note yield is set to break above 4.50%... Source: The Kobeissi letter

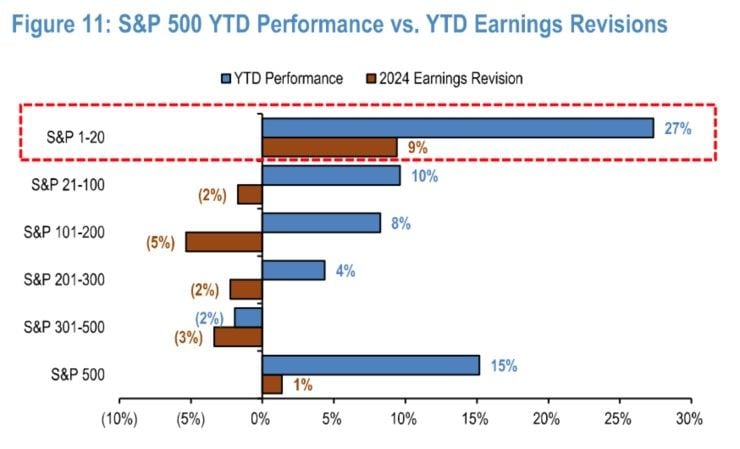

S&P EPS positive revisions have been a tailwind for the market.

However, note that EPS revisions outside of the top 20 have been NEGATIVE YTD and during the last 12 months. Source: JP Morgan

Investing with intelligence

Our latest research, commentary and market outlooks