Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Just in: BlackRock just launched a "buffer fund", a stock ETF with a 100% downside hedge.

The iShares Large Cap Max Buffer Jun ETF started trading on Monday under the ticker symbol $MAXJ What’s a buffer fund? These funds offer hedged exposure to stocks by limiting losses while also capping gains, and they’re not exactly a new concept. Since their inception, they’ve attracted industry giants like BlackRock, and they’ve drawn about $5 billion in inflows so far this year. But even before they came around, investment banks were offering their clients “structured notes” – a hybrid product that combines bits and pieces of different financial instruments into one to create customized risk-reward profiles. While there are many different types of structured notes out there, “buffer participation notes” are among the most popular. The notes and buffer funds work in the exact same way – they’re just packaged as different investment vehicles. Having said that, buffer funds are a lot more accessible for retail investors. Buffer participation notes, like most structured notes, are typically offered by investment banks only to sophisticated, high-net-worth clients. Buffer ETFs, by contrast, can be bought and sold just like any ordinary stock. Source: Finimize

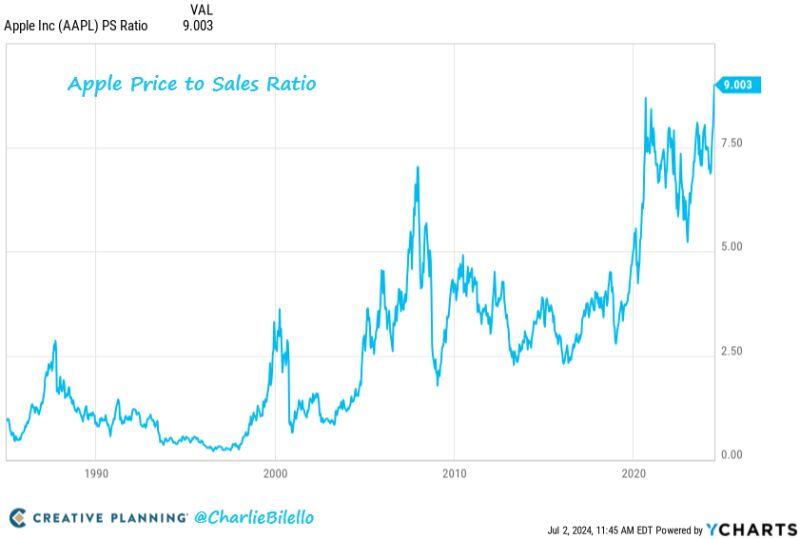

Apple's Price to Sales ratio just moved above 9, the highest valuation level in company history.

$AAPL Source: Charlie Bilello

SUMMARY OF FED CHAIR POWELL'S COMMENTS (7/2/24):

1. The trend of disinflation appears to be resuming 2. Need to be more confident before reducing rates 3. Fed doesn't see 2% inflation "this year or next year" 4. Budget deficit is very large and unsustainable 5. 4% unemployment is still a very low unemployment rate 6. Moving too fast creates risk of inflation returning The Fed needs more data before rate cuts can begin. Source: The Kobeissi Letter

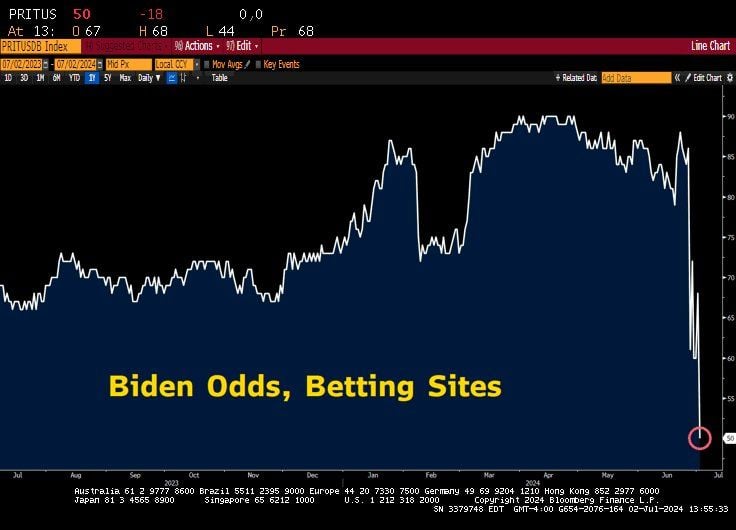

Odds of Biden being nominated as Democrat candidate are plummeting today (Betting sites).

What's going on? Source: Bloomberg, Lawrence McDonald

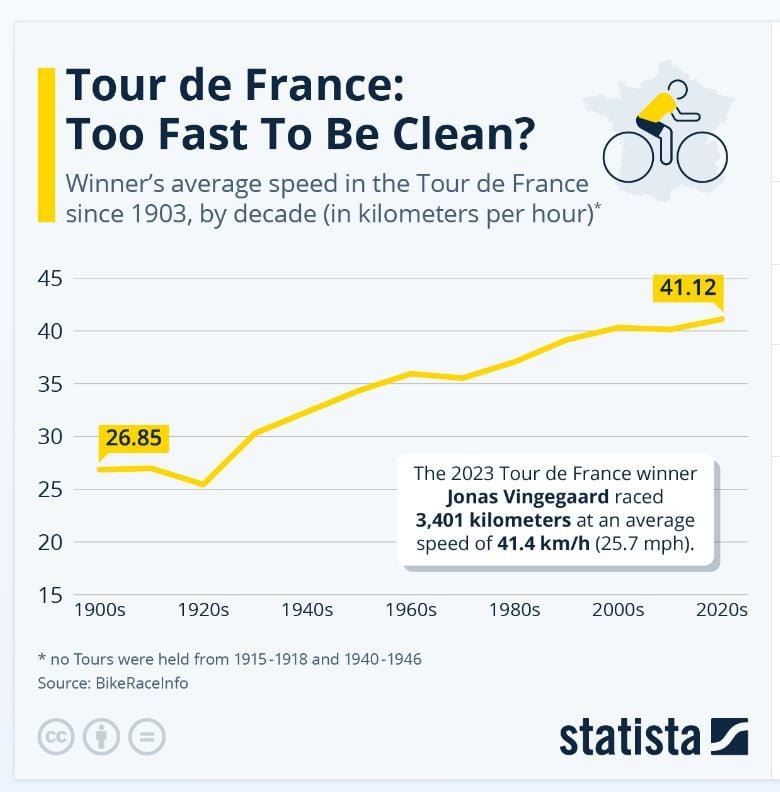

On the way to his second Tour de France victory last year, Denmark's Jonas Vingegaard was facing tough questions regarding his pace before he even arrived in Paris.

How was he going so fast? How was it possible to be over seven minutes ahead of a cyclist of Tadej Pogačar's caliber? Some reporters even explicitly asked: "Are you cheating?". In 2023, Vingegaard completed the grueling 3-week, 3,401 kilometer competition at an average speed of 41.4 km/h (25.574 mph). Given cycling's deservedly bad reputation, it is perhaps understandable that exceptional performances like that still raise suspicions. As Statista's Felix Richter shows in the chart below, the Tour de France has not slowed down since the doping-infested years of the early 2000s. Whether that's due to super-fast carbon bikes, favorable routing or the use of performance-enhancing substances is a question the sport is not yet fully able to answer.

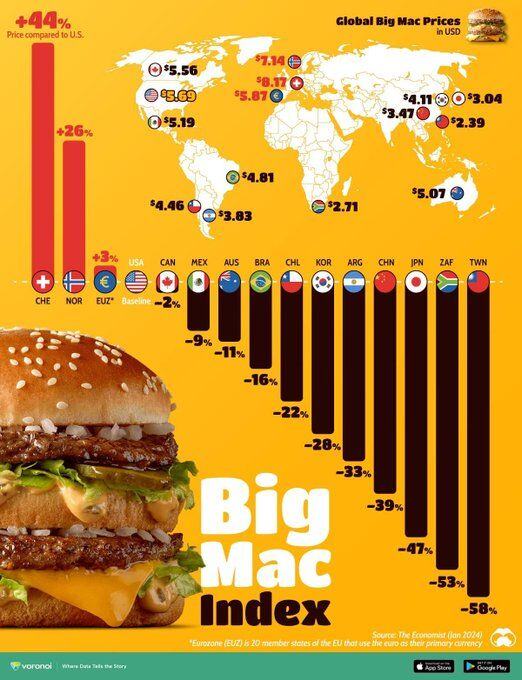

The price of a Big Mac vs. the US in selected countries

Source: Voronoi

Investing with intelligence

Our latest research, commentary and market outlooks