Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

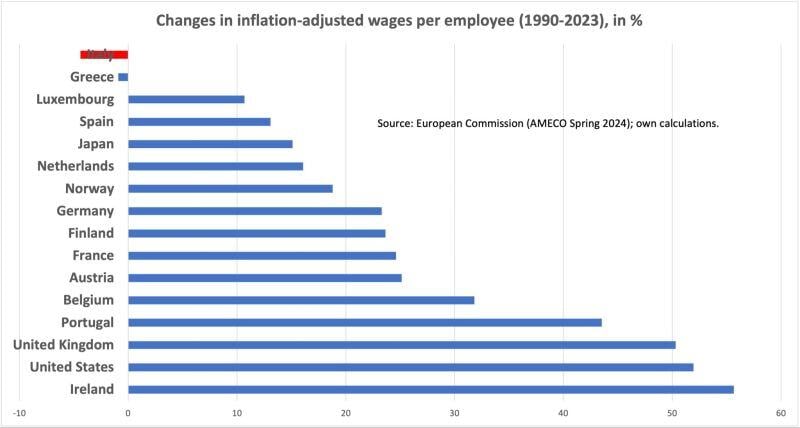

Italians make in real terms less today than they used to in 1990, one really needs to admire how calm they stay about it.

Chart: Michel A.Arouet, @heimbergecon

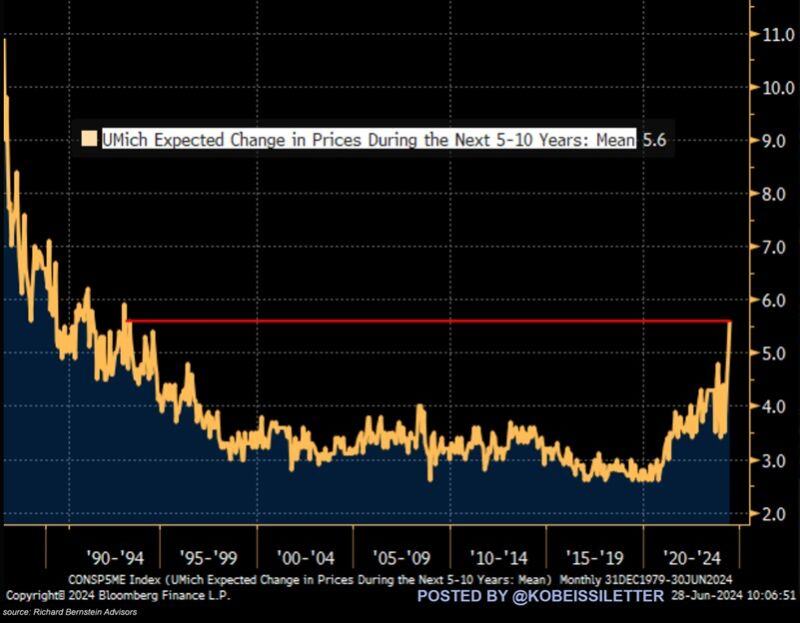

BREAKING: US consumers' average 5-10 year inflation expectations have spiked to 5.6%, the highest in 31 years.

This measure increased by ~2 percentage points in just a few months. By comparison, median inflation expectations are around 3%, in-line with the readings seen over the last 3 years. Meanwhile, CPI inflation has been above 3% for 38 consecutive months, the longest streak since the 1990s. Will inflation stay a major issue in H2 2024? Source: The Kobeissi letter, Bloomberg

Tesla is making the comeback of the year...

Tesla, $TSLA, is now the 12th largest public company in the world. Since the April 2024 low, Tesla stock is now up over 80% and has added $350 BILLION in market cap. The stock is also now just 1.5% away from being UP year-to-date after falling nearly 40% in the first 4 months. If $TSLA hits ~$257 per share, it will be one of the top 10 largest public companies in the world. Just 2 months ago, Tesla briefly fell off the top 20 list as worries over the EV market arose. Source: Kobeissi Letter

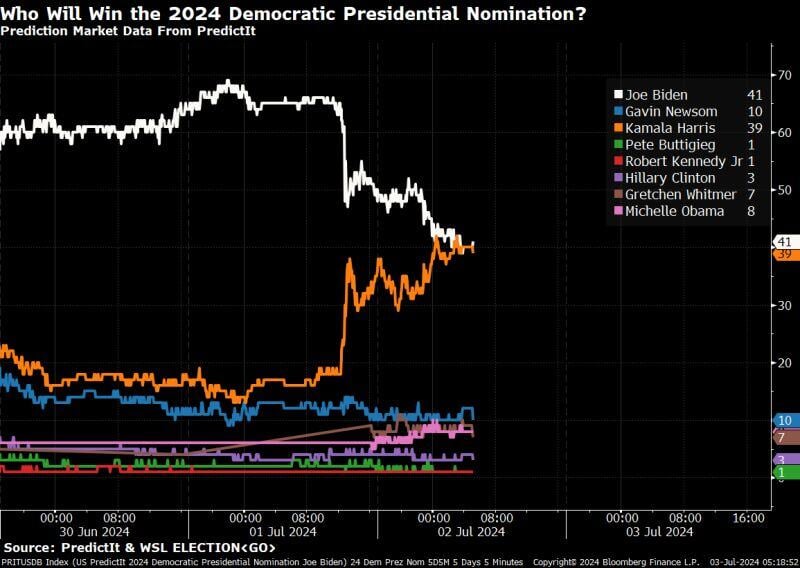

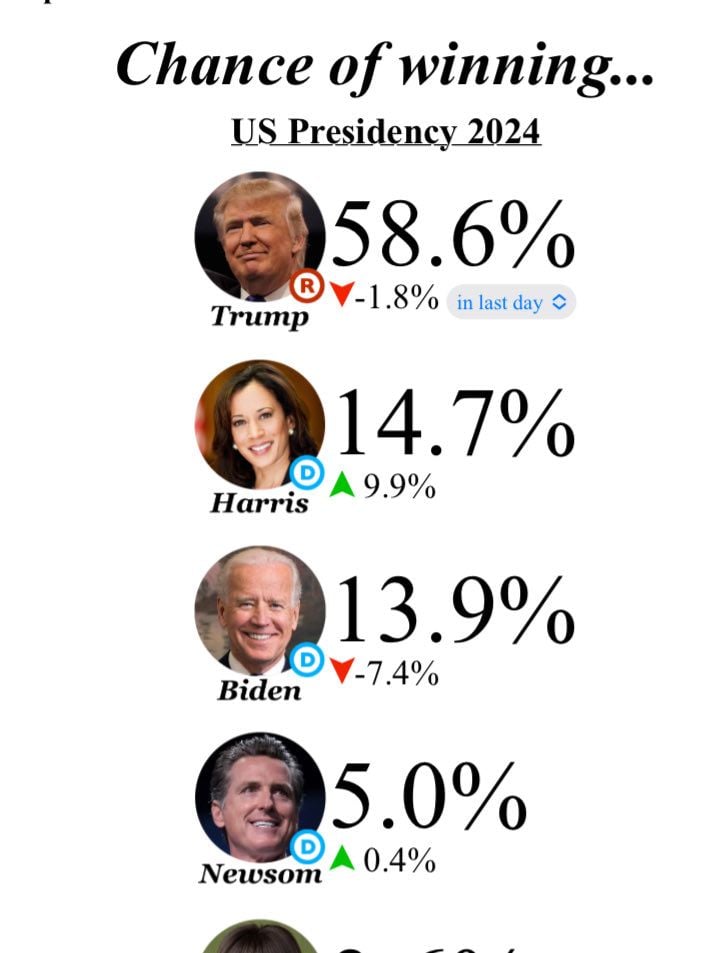

Kamala Harris and Joe Biden's odds of securing the Democratic presidential nomination have converged...

Source: Bloomberg, Michael McDonough

Odds of Biden winning democratic 2024 presidential nominee are collapsing as NYT said Biden told ally he is weighing whether to continue in race

.

As of this morning, betting markets are giving VP Harris higher odds of being President after the 2024 Election than current President Biden.

The cross has happened. Source: Bespoke

Investing with intelligence

Our latest research, commentary and market outlooks