Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

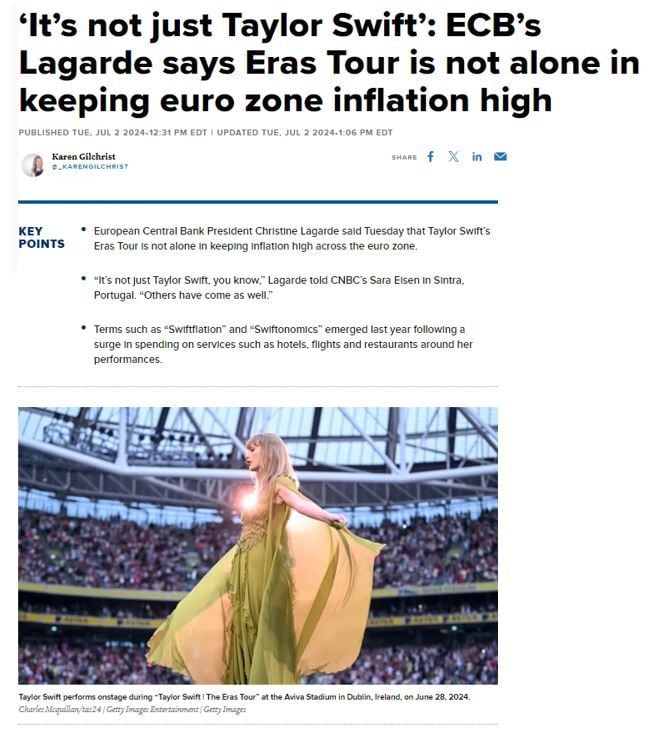

Good to know Mrs Lagarde...

ECB President Christine Lagarde said Tuesday that Taylor Swift’s Eras Tour is not alone in keeping inflation high across the euro zone. “It’s not just Taylor Swift, you know,” Lagarde told CNBC’s Sara Eisen in Sintra, Portugal. “Others have come as well.” Terms such as “Swiftflation” and “Swiftonomics” emerged last year following a surge in spending on services such as hotels, flights and restaurants around her performances.

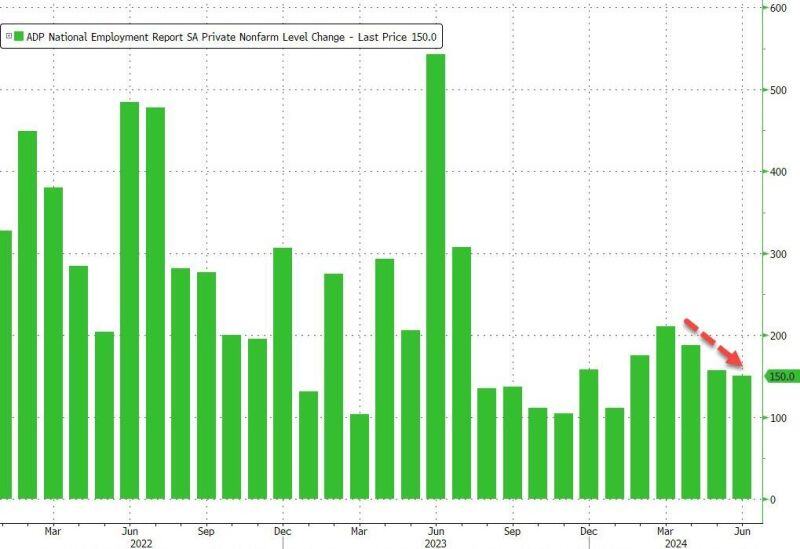

US private payrolls

DP reported 150k job additions in June (well below the 165k expected) - the third straight monthly decline in job additions and the weakest since January... "Job growth has been solid, but not broad-based. Had it not been for a rebound in hiring in leisure and hospitality, June would have been a downbeat month," said Nela Richardson Chief Economist, ADP. Source: www.zerohedge.com, Bloomberg

A great quote from Charlie Munger...

try to be a little wiser every day... in small steps Source: Invest in Assets

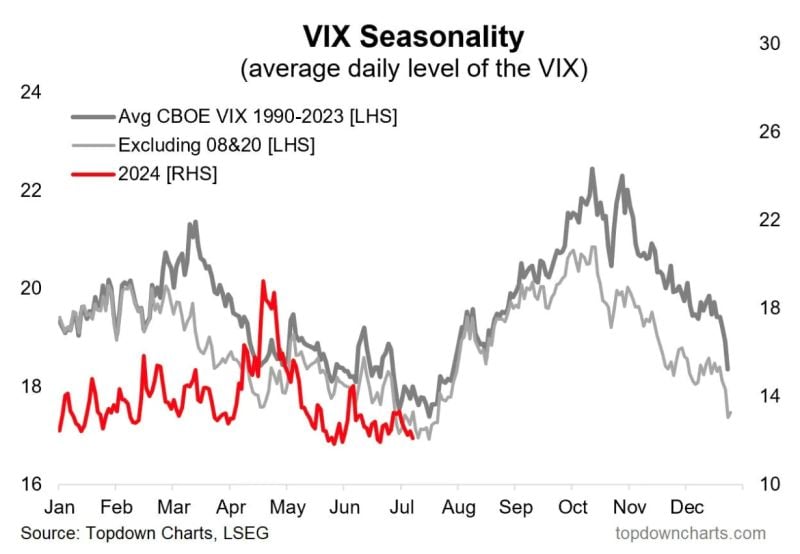

During Presidential election years, volatility tend to pick up EXACTLY at this time of the year

Source: Topdown Charts

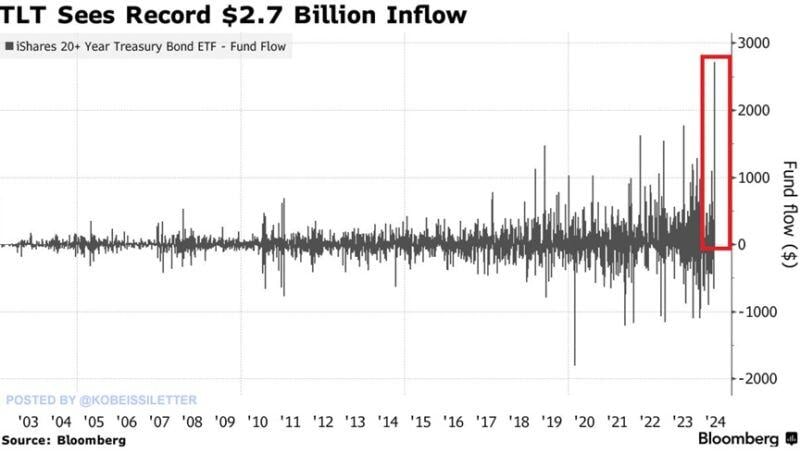

$TLT, a popular bond-tracking ETF recorded a $2.7 billion inflow last Monday, the largest inflow on record.

Year-to-date, the ETF has seen inflows of $4.4 billion, on track for its largest annual inflow on record. To put this into perspective, $TLT has $54 billion in assets under management. This is all despite $TLT falling -4% YTD and -37% over the last 4 years. Source: The Kobeissi Lettr, Bloomberg

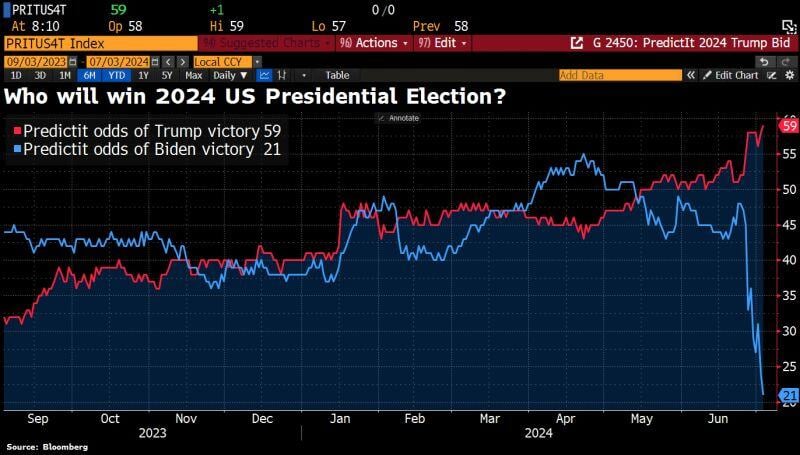

Biden betting odds in free fall as support within the Democrats crumbles.

Source: HolgerZ, Bloomberg

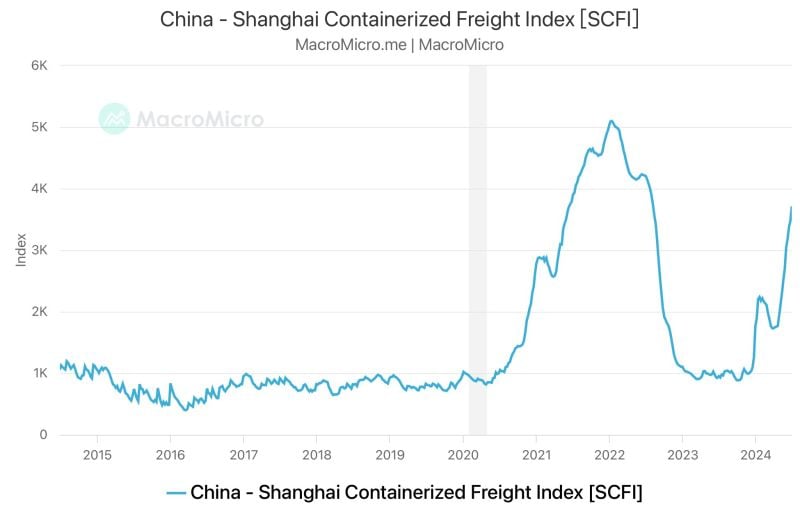

Shanghai Containerized Freight Index (SCFI) keeps climbing, rising another 6.87% to 3714.32 points.

It has now increased for 12 consecutive weeks, reaching its highest level since early 2022. Source: MacroMicro

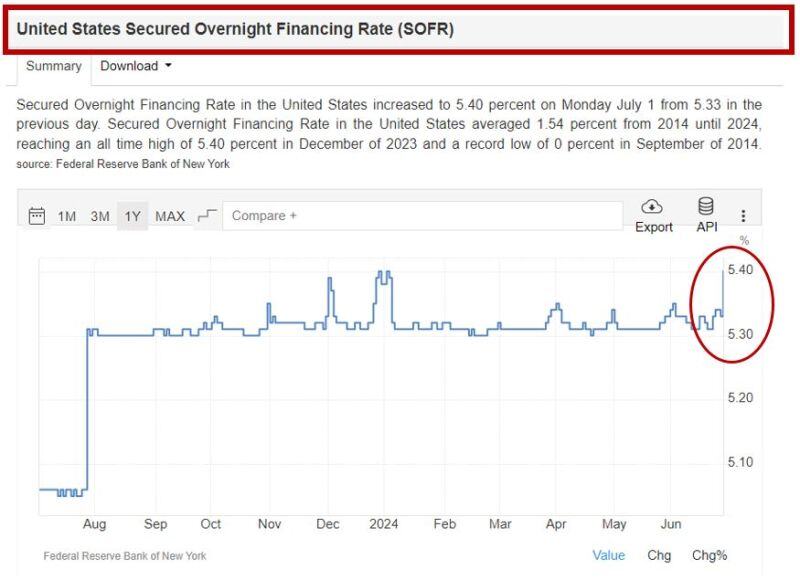

The Secured Overnight Financing Rate, a benchmark connected to overnight repo transactions, is back to the all-time-high of 5.40% , according to New York Fed data published yesterday.

Clogged bank balance sheets are behind the spike of this key repo funding rate. This move is similar to funding market pressures seen in late-2023. The Secured Overnight Financing Rate spiked seven basis points to 5.40% on July 1, according to Federal Reserve Bank of New York data published Tuesday. The return of such swings in SOFR is largely thanks to the Federal Reserve, which is still removing liquidity from the system via quantitative tightening, or QT, albeit at a slower pace with the intention to reduce potential strains on the market. Still, that’s reawakened volatility around key quarter-end funding periods as seen last week, when banks tend to pare repo activity to shore up balance sheets for regulatory purposes and borrowers either find alternatives or pay up. At the same time, the glut of government debt sales means more collateral needs financing from the repo market.

Investing with intelligence

Our latest research, commentary and market outlooks