Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

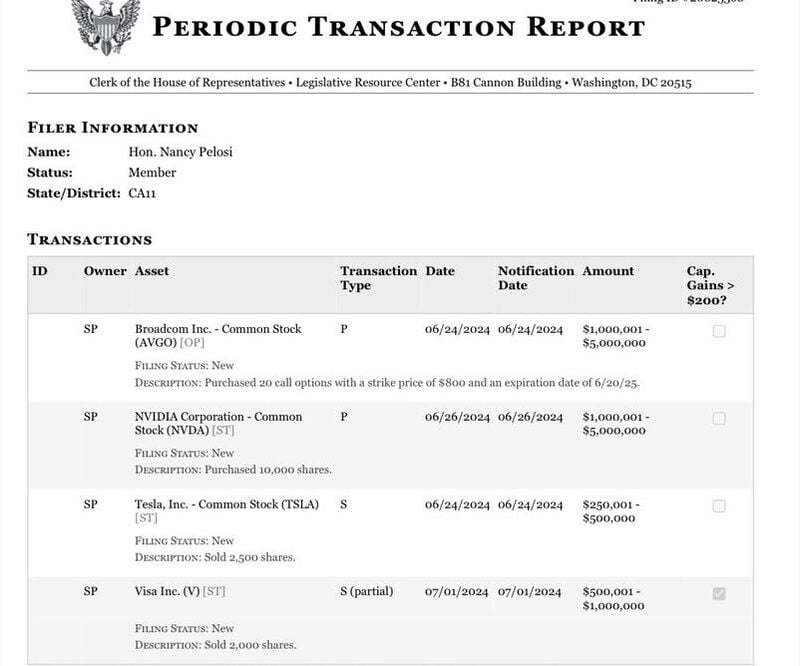

BREAKING: Nancy Pelosi has sold her Tesla, $TSLA, position worth ~$500,000.

She has also purchased an addition $1.2 million of Nvidia, $NVDA, and $5 million of Broadcom, $AVGO. Nancy Pelosi made millions buying nvidia, $NVDA, over the last two years. It appears that she is now doubling down on semiconductors stocks. Are chip stocks setting up for favorable legislation and/or US support ⁉ Source: The Kobeissi Letter

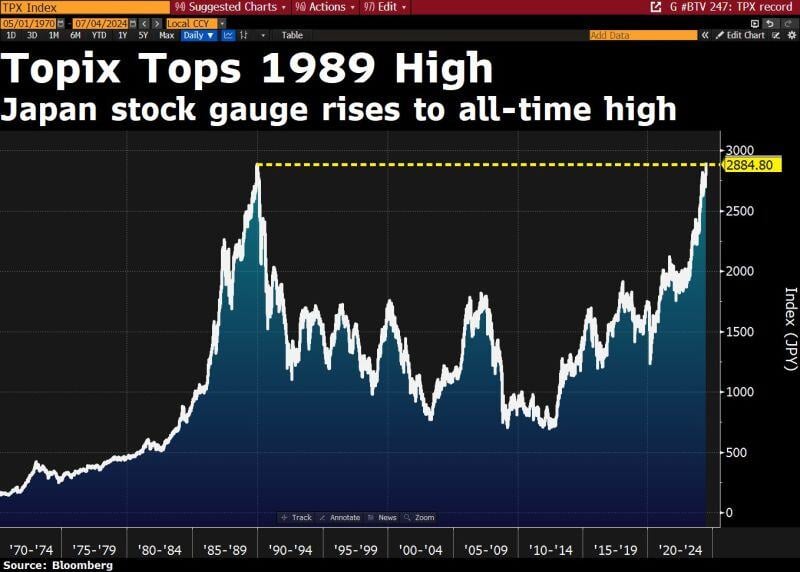

What is the link between the Japanese index Topix and Taylor Swift?

Finally after 35 years Japan's Topix has topped its 1989 high, which on a completely unrelated note was hit a few days after the birth of Taylor Swift... Source: David Ingles, Bloomberg

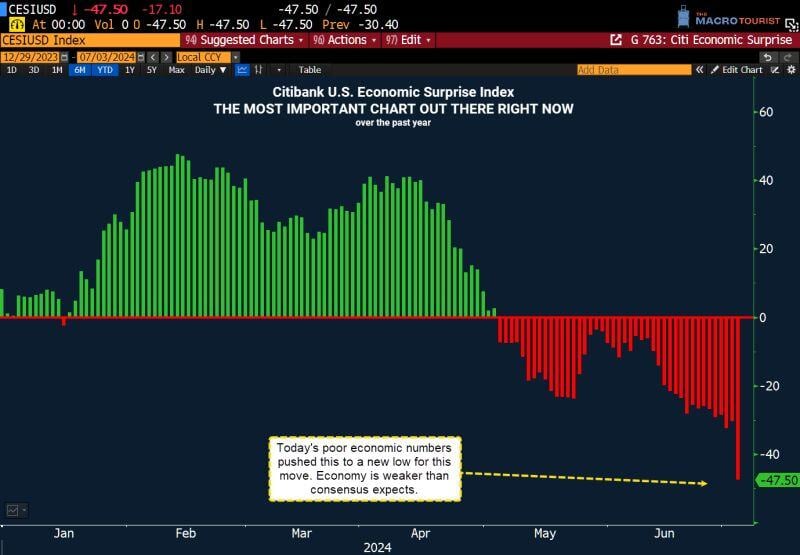

Another new low for the Citigroup US surprises index on the back of poor macro numbers this week (ADP employment, ISM services, etc.)

Source: Bloomberg, Ronald-Peter Stoeferle, CMT, CFTe, MSTA

Here's the link to a great article from Sequoia which argues the tech industry needs $600B in AI revenue to justify the money spent on GPUs and data centers:

https://lnkd.in/exFU9Wdp Bottom-line >>> OpenAI is the biggest AI pure play and is at $3.4B annual run rate. This feels like a bubble unless products worth buying show up. Source: Sequoia, Dare Obasanjo @Carnage4Life

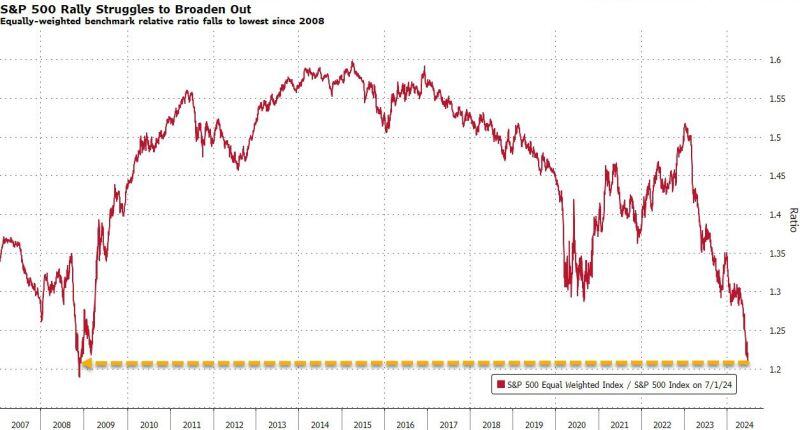

The last time the market was this lopsided, Lehman filed for bankruptcy

Source: www.zerohedge.com, Bloomberg

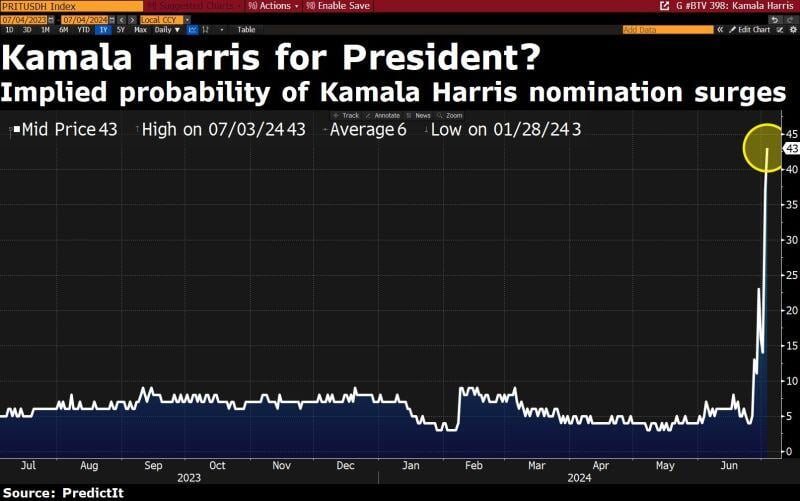

Bets of a Kamala Harris nomination are exploding

Source: Bloomberg

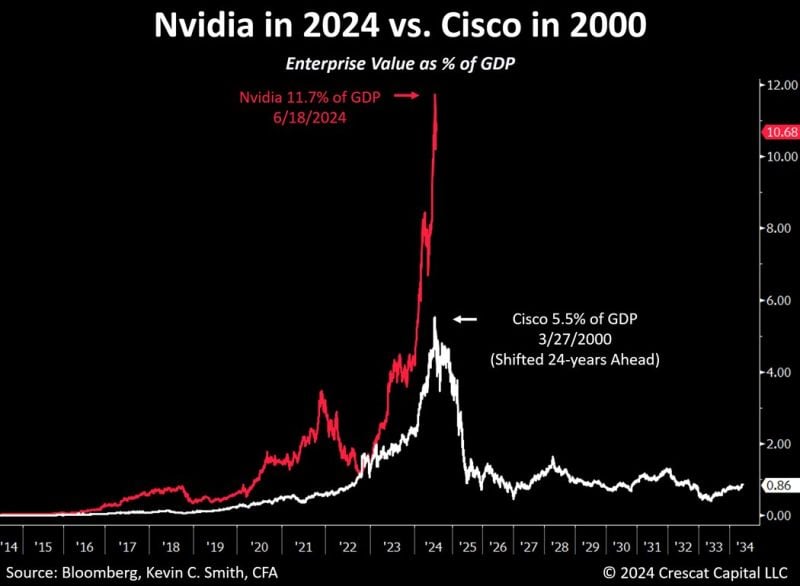

Nvidia in 2024 vs. Cisco Systems in 2000..

Nvidia recently earned the most valuable company in the world status with an EV of $3.3 trillion, a record 11.7% of total US GDP at its recent peak on June 18, more than twice as high as Cisco’s achievement in 2000. It also has an even richer multiple of 41 times revenues. Will be future growth be up to the lofty market expectations? Source: Crescat Capital, Bloomberg, Tavi Costa

Investing with intelligence

Our latest research, commentary and market outlooks