Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

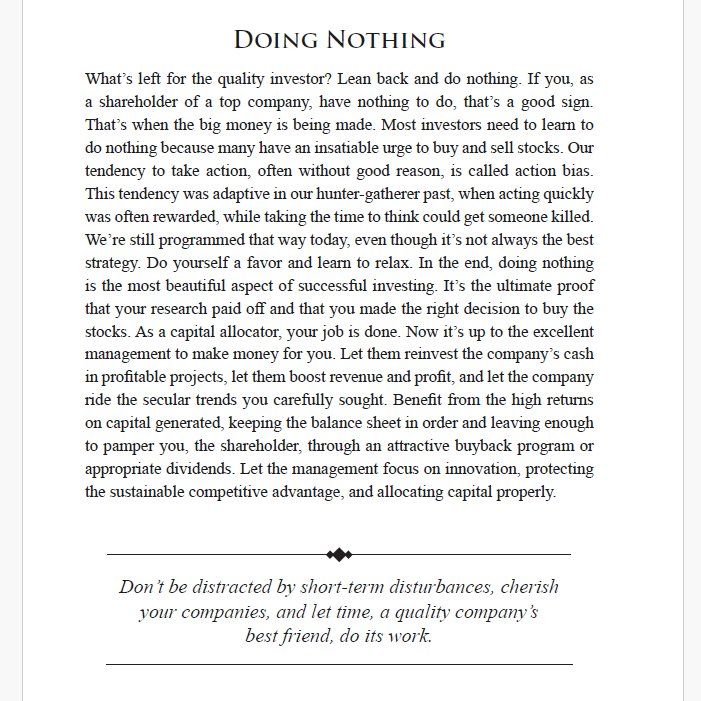

Book: The Art Of Compounding Quality

"What's left for the quality investor? Lean back and do nothing" "Don't be distracted by short-term disturbances, cherish your companies, and let time, a quality company's best friend, do its work" Source: investmentbooks

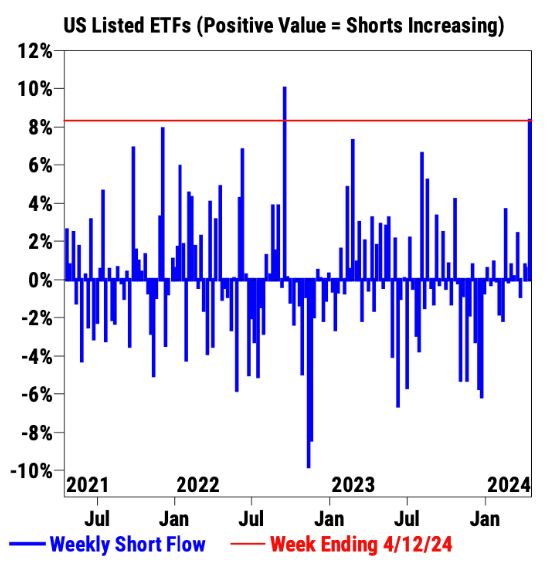

Hedge funds increased ETF short positions by largest amount in 20 months according to Goldman Sachs

Source: barchart

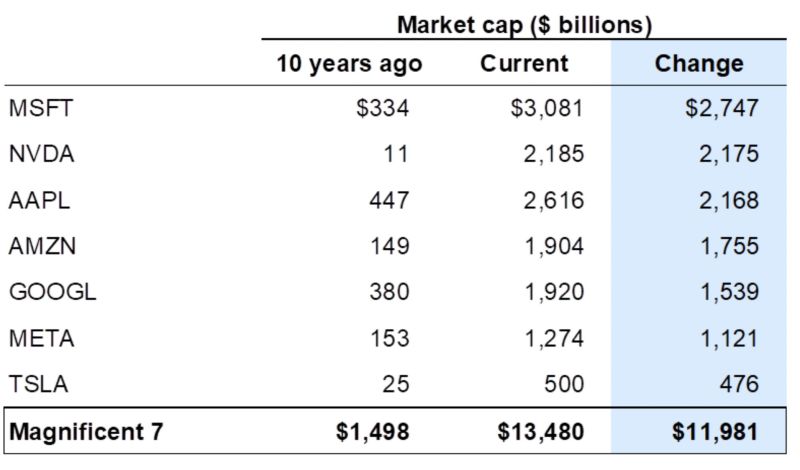

An exciting stat from Goldman: Just 10y ago, the collective market cap of the Mag 7 was $1.5tn.

Today, that stands at $13.5tn. Source: GS, HolgerZ

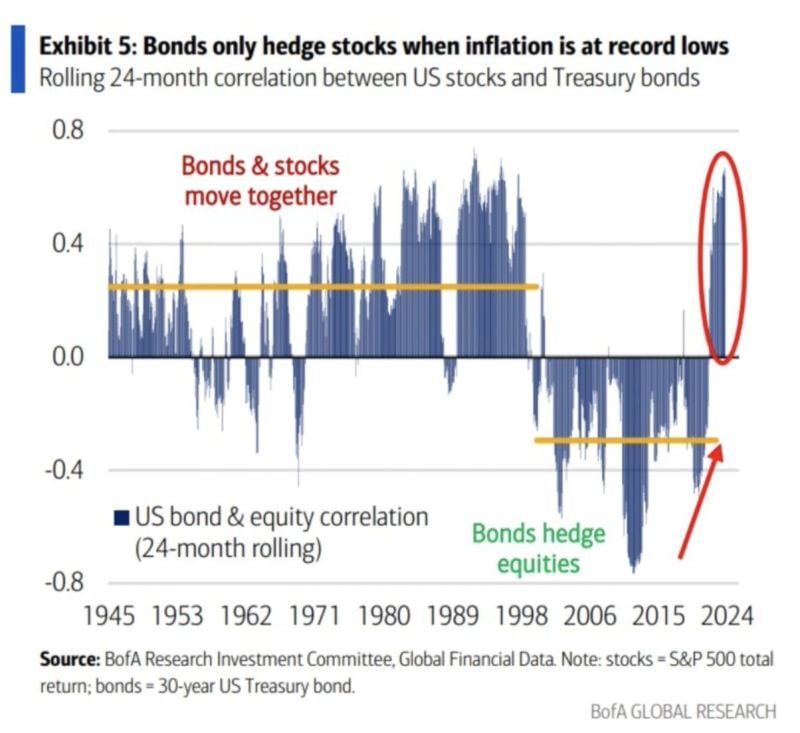

"The stock-bond correlation switch is the ultimate diversification regime shift."

"You don't have as great a need for alternatives when the correlation is negative. Investor search for diversification should be at a heightened level." Source: BofA, Darren

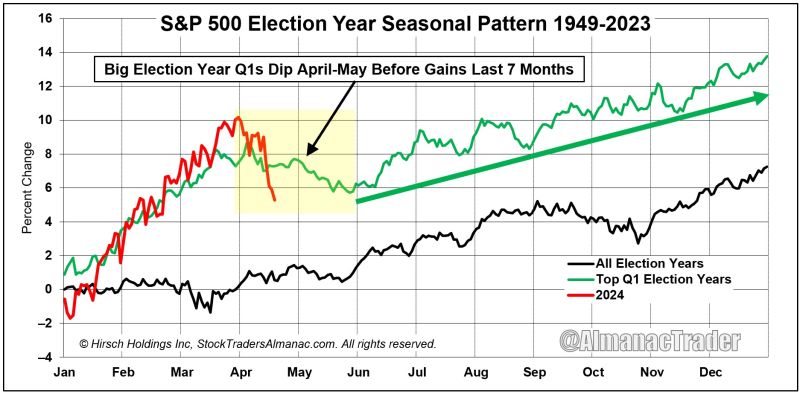

Big Election Year Q1s Dip April-May Before Gains Last 7 Months.

2024 is 3rd best Election Q1 since 1950 tracking. Historically, there is a dip in April-May before gains till year-ned. There was only 2 losses in the last 7 months of election years since 1950 (2000 & 2008) Source: Ryan Detrick, CMT, AlmanacTrader

As shown by Jeroen Blokland >>> The Ishares 20+ Year Treasury Bond ETF is down 48% since April 2020.

This means investors have realized a negative return of 15% annually on long-duration bonds over the last four years. Moreover, this 'return' was realized with structurally higher volatility and, on average, a positive correlation with stocks. It also means the market for long-duration bonds has to double(!) to erase losses. Source: Jeroen Blokland

(Bloomberg) - A surprising thing is happening to some women on weight-loss drugs who’ve struggled with fertility issues: They’re getting pregnant...

Source: Bloomberg, Carl Quintanilla

Investing with intelligence

Our latest research, commentary and market outlooks