Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

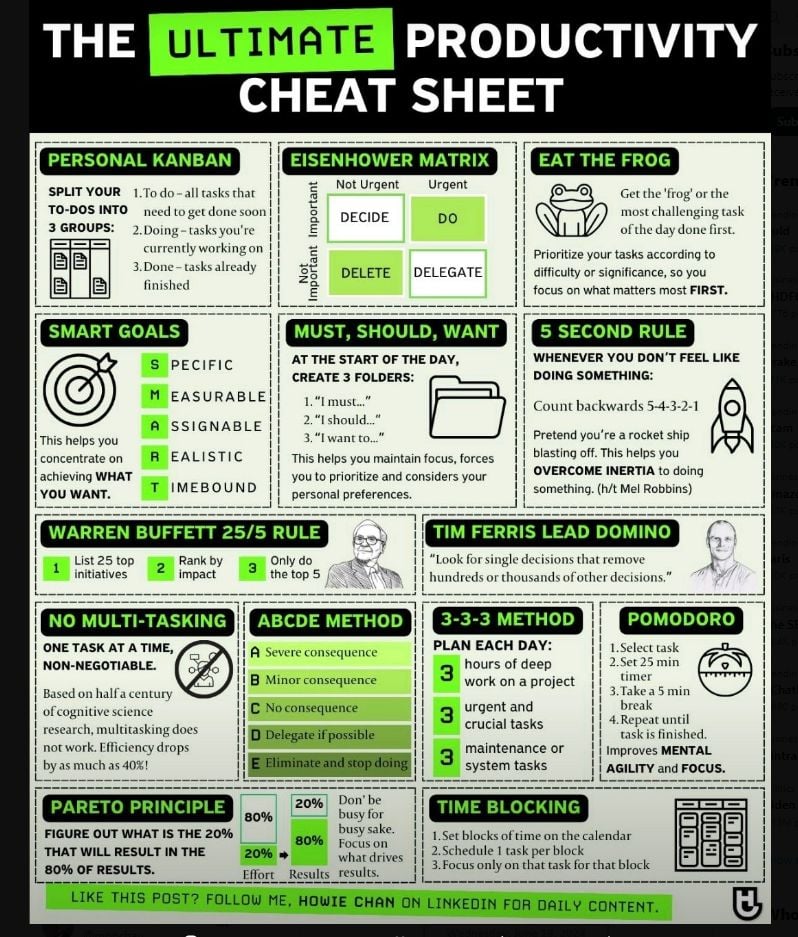

The Ultimate Productivity Cheat Sheet

Investment Books (Dhaval)

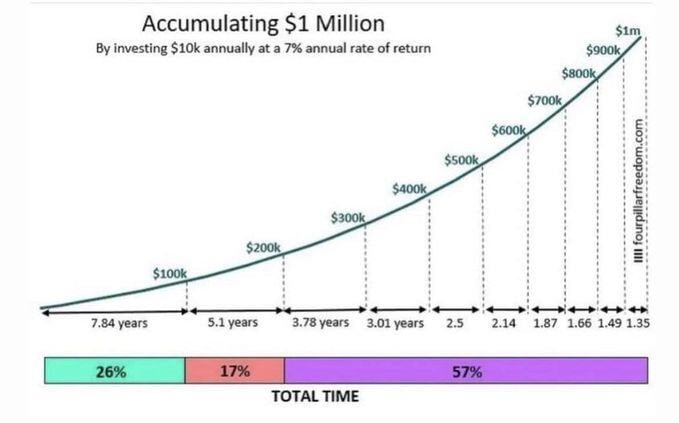

Compounding starts slowly but gets more and more crazy over time

Source: Rene Sellmann

JUST IN: 🍏 Apple stops work on the Apple Vision Pro 2 due to slow demand

Apple is now working on a cheaper model to launch late 2025 Radar🚨

According to Nikkei, Japans Norinchukin Bank:

Japan's 5th largest bank with $840 billion in assets - will sell more than 10 trillion yen ($63 billion) of its holdings of U.S. and European government bonds during the year ending March 2025 "as it aims to stem its losses from bets on low-yield foreign bonds, a main cause of its deteriorating balance sheet, and lower the risks associated with holding foreign government bonds."

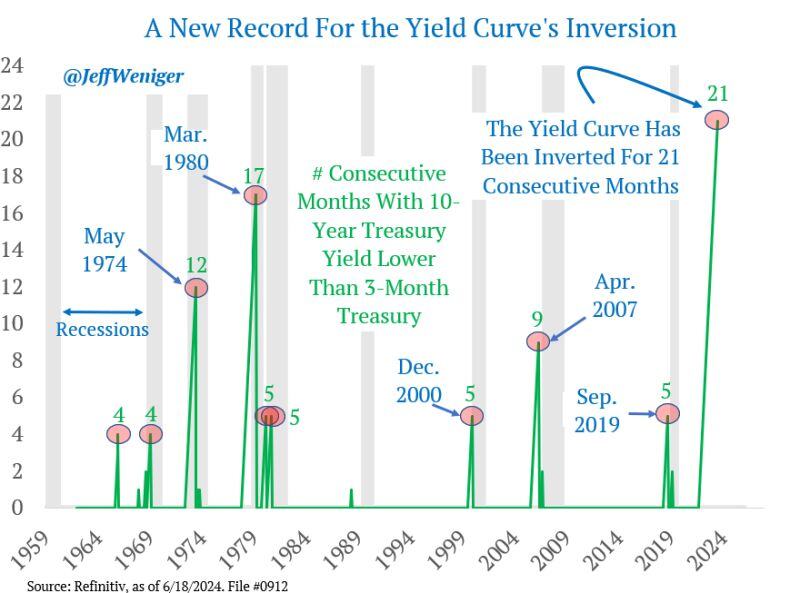

The count on this US yield curve inversion is up to 21 consecutive months, an all-time record. How long this goes, nobody knows

Source: Jeff Weniger

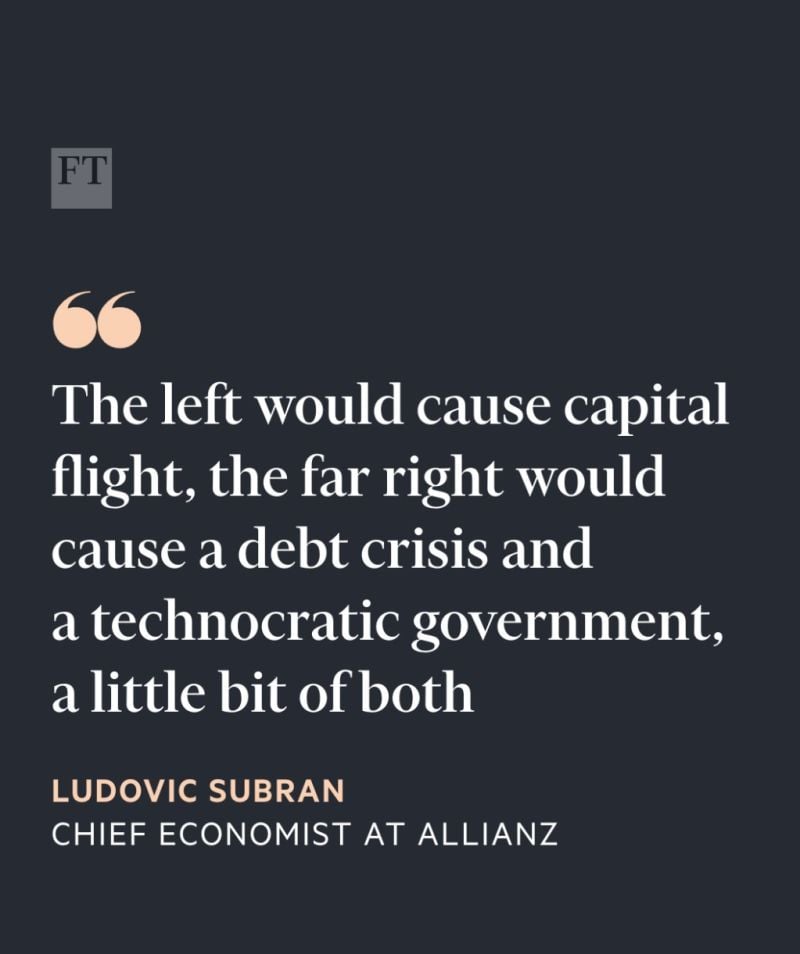

What would a far-right or left-wing government mean for France’s economy?

Source: FT

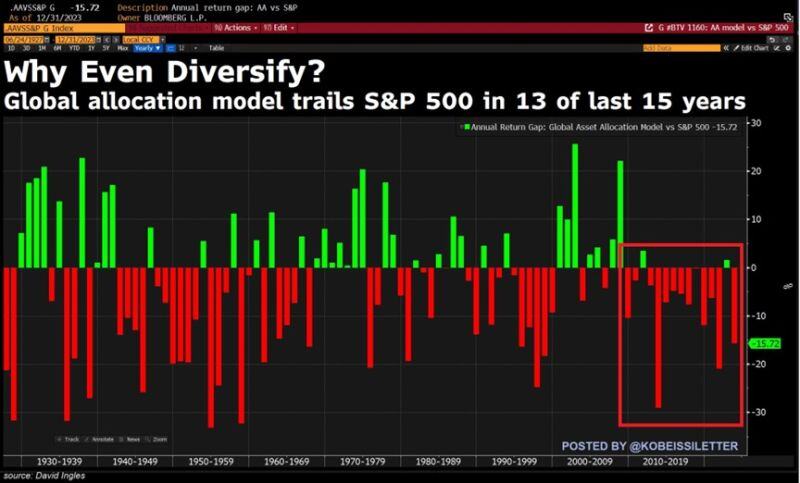

Is diversification a thing of the past? The sp500 has significantly beaten money managers who diversify investments globally in 13 of the last 15 years

The only 2 years where diversification worked over this period were 2012 and 2023. Such a streak has never happened before. During the 15-year timeframe, the largest outperformance by the S&P 500 occurred in 2015, by nearly 30%. Meanwhile, the S&P 500's return has exceeded global investment assets by 15% year-to-date. Source: The Kobeissi Letter, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks