Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

⚠️ JUST IN: *DELL, NVIDIA AND SMCI COLLABORATE TO POWER ELON MUSK'S GROK AI FACTORY

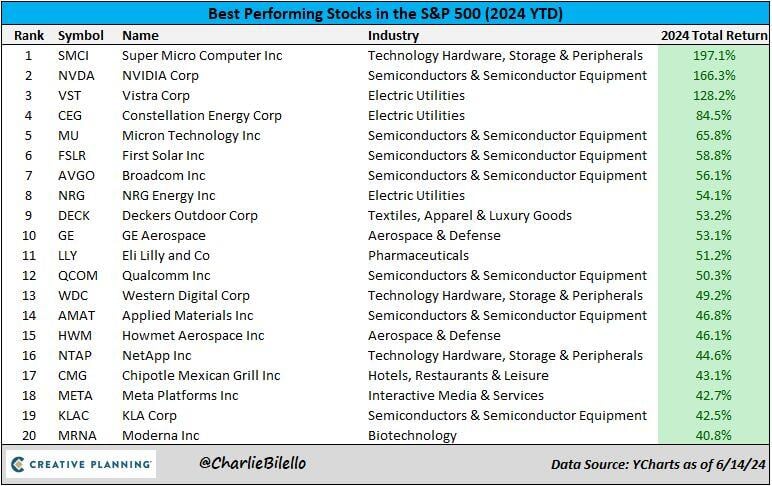

$SMCI and $NVDA, rose over 4% in overnight trading after Elon Musk says they are working on AI supercomputer for xAI. $DELL has announced a partnership with hashtag#NVIDIA to construct an AI Factory designed to boost the capabilities of Grok, an AI model developed by Elon Musk's company, xAI. Source: www.investing.com, www.msn.com

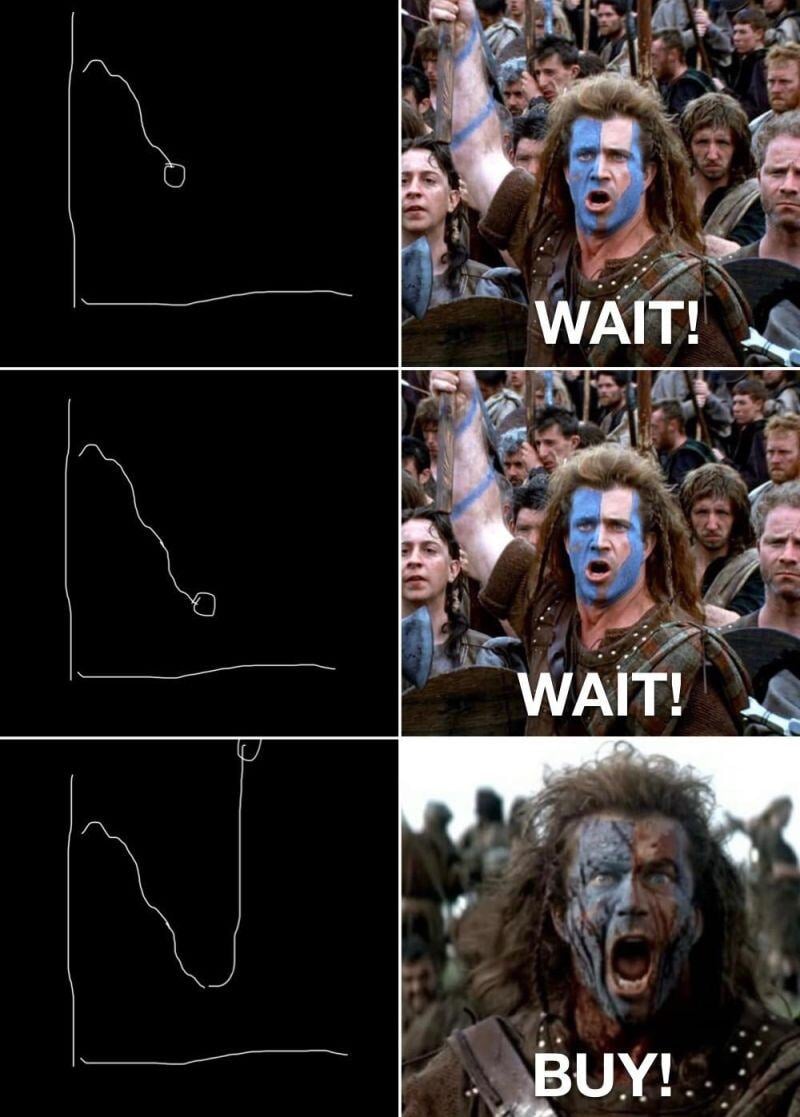

The first “grand illusion” of investments is market timing

Source: naiive meme

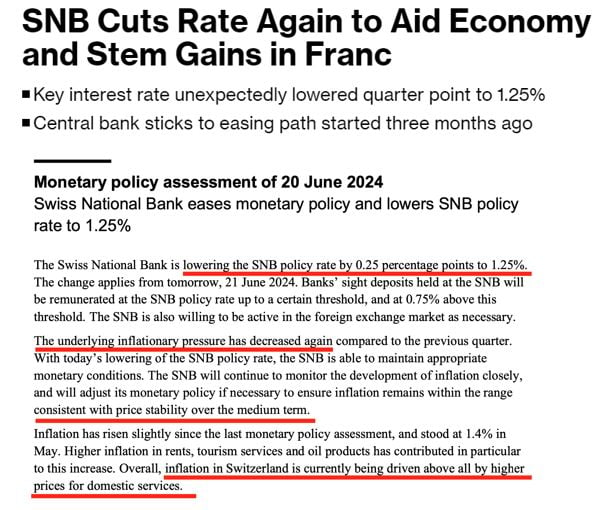

The SNB has lowered its key rate again today, to 1.25%, after the previous 25bp cut decided in March

The view by our Chief Economist Adrien Pichoud: • Going forward, we believe that the SNB is now done with the recalibration of its monetary policy and that it shouldn’t cut rate further this year. • Swiss monetary policy can now be deemed as “neutral” for inflation and economic activity, as the real short term rate is close to 0% (actually just below with a cash rate of 1.25% and an inflation rate of 1.4%). • Provided growth remains on a gradual upward trend toward potential in 2025 (1.5%) and there is no unexpected development on the inflation front, there will be no reason for the SNB to lower further the CHF short term rate. • Should European or global developments trigger volatility and upward pressures on the CHF, we believe the SNB would rather resort to interventions on the FX market to manage the impact on the economy, rather than use the interest rate lever.

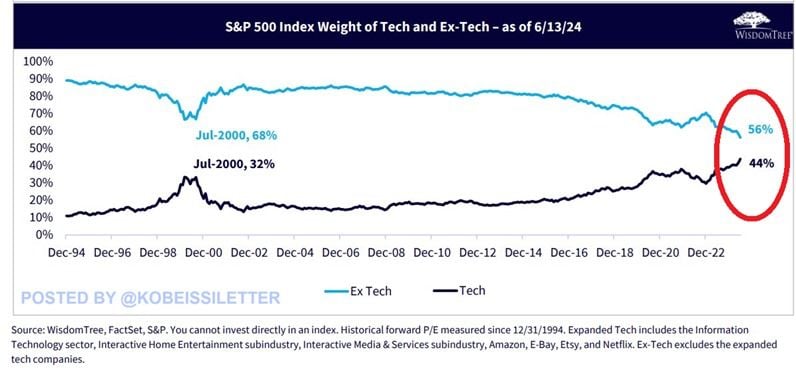

The market cap of technology stocks as a percentage of the S&P 500 just hit a record 44%

This percentage is now ~12% higher than after the 2000 Dot-com bubble peak of 32%. Over the last 10 years, this share has more than DOUBLED. Also, since 2014 Nasdaq 100 has added 426% compared to a 182% gain in the S&P 500. Are tech stocks set to account for the majority of the S&P 500? Source: The Kobeissi Letter

As per The Kobeisi Letter >>> The S&P 500 is now up 34% in under 8 MONTHS

Since the October 2023 low, the S&P 500 has added 1,370 points or $11.5 TRILLION in market cap. In other words, the S&P 500 has added ~$1.4 trillion in market cap PER MONTH for the last 8 months in a row. This means that the S&P 500's return since October 2023 is now 3 times the average annual return. Nvidia stock alone, $NVDA, has added $2.2 trillion in market cap over this time period. That's ~20% of the S&P 500's market cap gains coming from just one stock...

Investing with intelligence

Our latest research, commentary and market outlooks