Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US 10 year yield breaks <4.3% on PPI.

The producer price index unexpectedly declined the most in 7mths, adding to evidence that inflationary pressures are moderating. The odds of a Fed rate cut in Sep shot up to 65% following PPI reading. Source: Bloomberg, HolgerZ

BREAKING >>>

Tesla Inc. investors voted for Chief Executive Officer Elon Musk’s compensation package and moving the company’s state of incorporation to Texas, signaling confidence in his leadership despite slumping sales and a precipitous drop in the stock price. The electric-car maker announced the results at its annual meeting Thursday in Austin without disclosing the breakdown of votes. Musk had foreshadowed the outcome the night before in a post on X, saying both resolutions were “passing by wide margins.” The pay vote is only advisory and doesn’t guarantee Musk will get his money. A Delaware judge nullified Musk’s 2018 compensation plan in January, and Tesla is expected to appeal. If that appeal fails, moving the company’s legal home to Texas would allow the board to revive the pay package in a new state with potentially more favorable courts. Source: Bloomberg

Inflow mania >>

Rubner: "Global equity funds have seen $190.5 Billion inflows YTD. This is the second largest equity inflows on record (only 2021 saw more inflows). This is +$1.7B worth of equity inflows per day." Source: The Market Ear

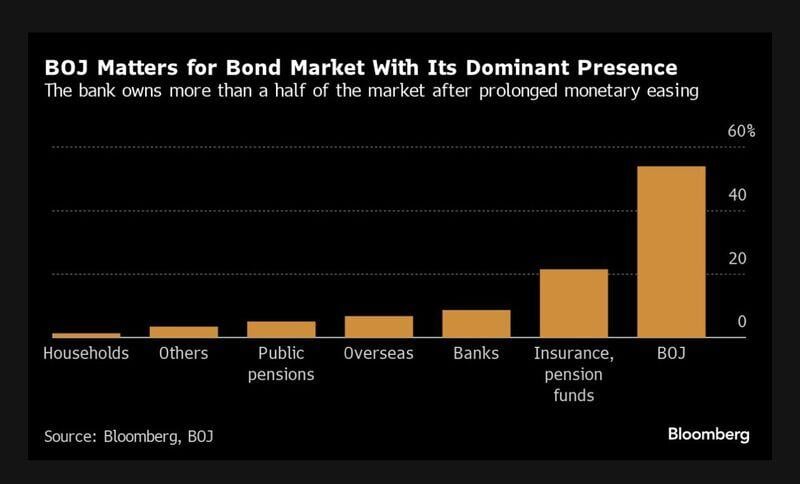

📢 📢 📢 The Bank of Japan kept its benchmark interest rate unchanged on Friday, but indicated it’s considering the reduction of its purchase of Japanese government bonds.

The central bank left short-term rates unchanged at between 0% to 0.1% at the end of its two-day policy meeting, as widely expected. But notably, the bank said in its statement it could reduce its purchases of Japanese government bonds after the next monetary policy meeting, scheduled for July 30 and 31. QE tapering in Japan has a lot more potency than in the U.S., sheerly because of how much of the bond market the BOJ owns. Following the BOJ decision, the Japanese yen weakened 0.5% to 157.8 against the U.S. dollar, while the yield on 10-year JGB fell 44 basis points to 0.924. So absolutely no panic... Source: Bloomberg, CNBC

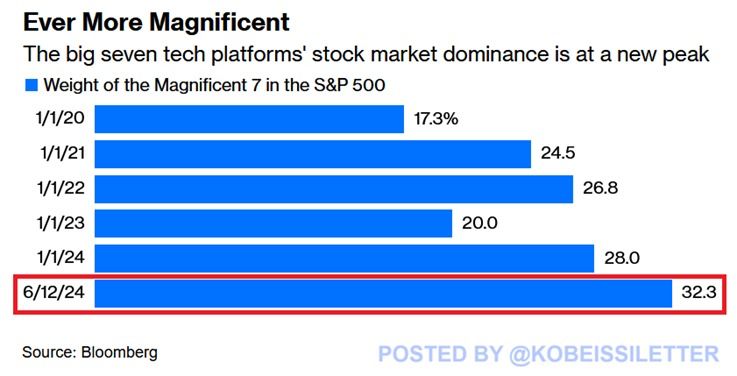

The Magnificent 7's share of the SP500 just hit another all-time high of 32%.

This is 12 percentage points higher than at the beginning of 2023. The weight of these 7 stocks in the index has almost DOUBLED in just over 4 years. This comes as the 3 largest stocks, Apple, Microsoft, and Nvidia, are all officially worth over $3 trillion. Meanwhile, the technology sector just hit another all-time high relative to the S&P 500. Tech is becoming even more dominant. Source: Bloomberg, The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks