Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

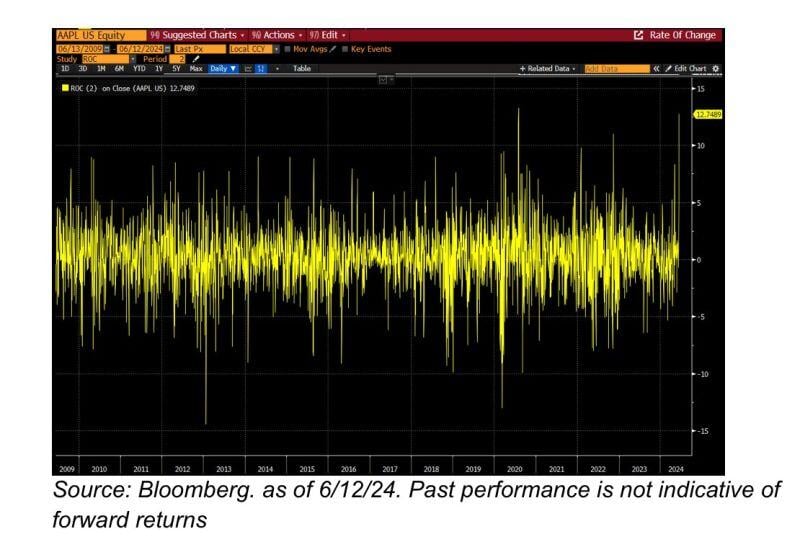

Apple $AAPL … stock up ~12.5% in 2-days, the biggest 2-day move in 15+ years (save a 2-day stretch in Mar’20 off the COVID lows) …

over this stretch, Apple has added nearly ~$400bn in mrkt cap .. larger than the current market cap of 480 co’s ..” - GS desk Source: Carl Quintanilla, Bloomberg

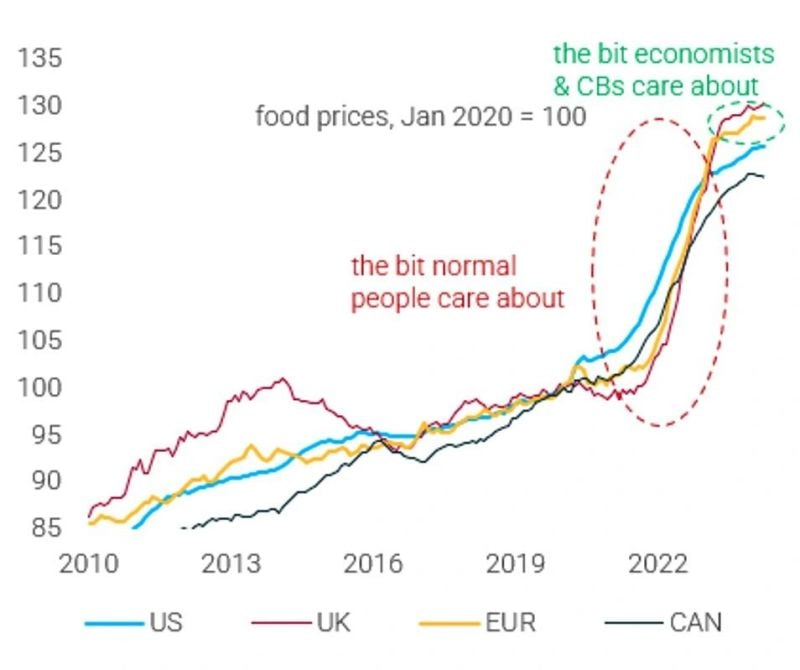

This chart from BofA is among Powell worst nightmares... and explain the FED reluctance in cutting rates too fast.

They will remain data dependent.

Mains Street vs. Wall Street: "Normal people have a different way of looking at inflation compared to economists/central bankers."

(There is one consequence of this dichotomy by the way: the rise of populists parties which will increase public spending bringing in more inflation...) Source: TS Lombard Research Partners Dario Perkins via Daily Chartbook

With fiscal deficit over 5% during good times France is at risk of facing a debt crisis whoever wins next elections

Source: Bloomberg, Michel A.Arouet

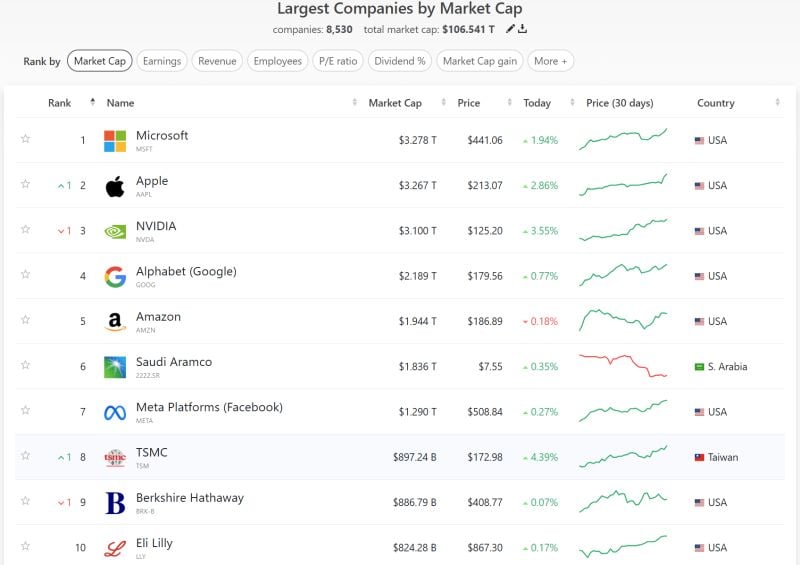

Apple almost overtook Microsoft as the largest market cap in the world.

Source: Companies Marketcap

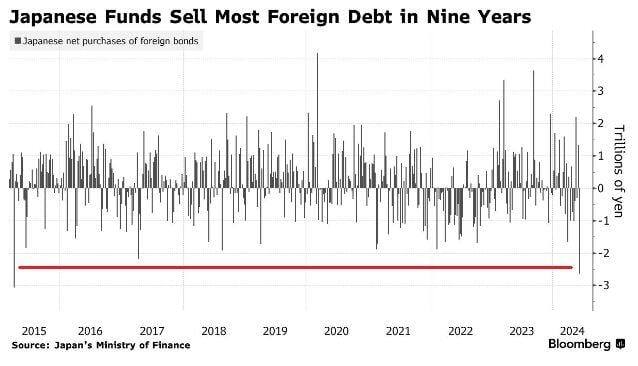

japan just sold $17 billion worth of Foreign Debt, the largest sale in 9 years...

Source: Bloomberg, Barchart

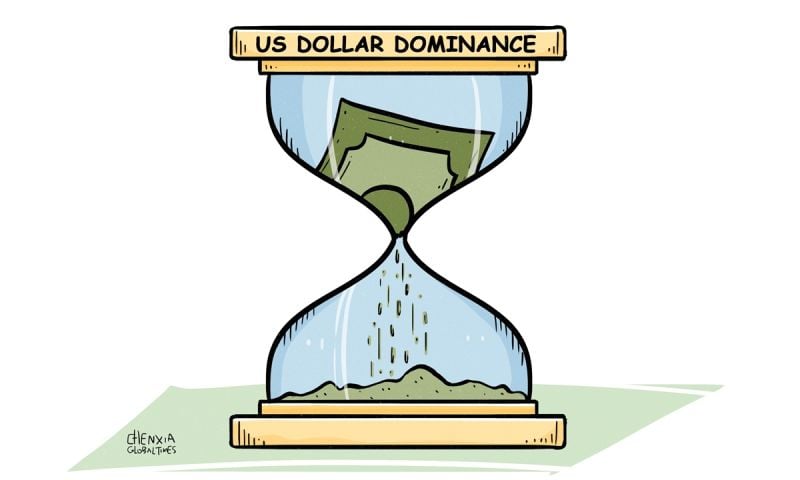

s de-dollarisation (or at least attempts of de-dollarisation) accelerating?

=> Saudi Arabia ditches US dollar and will NOT renew the 50 year 'petro-dollar' agreement with the United States. Saudi Arabia will now sell oil in multiple currencies, including the Chinese RMB, Euros, Yen, and Yuan, instead of exclusively in US dollars. => Russia's Moscow Stock Exchange suspends all trading in $USD & $EUR => El Salvador securities market launching on liquid with trading pairs in Bitcoin Source: radar, Global Times

BREAKING: May PPI inflation was unchanged, at 2.2%, below expectations of 2.5%.

Core PPI inflation fell to 2.3%, below expectations of 2.4%. This ends the first 3 consecutive monthly increase in PPI inflation since April 2022. Another welcomed sign by the Fed after CPI. YoY Growth: PPI (May), 2.2% Vs. 2.5% Est. (prev. 2.2%) Core PPI, 2.3% Vs. 2.5% Est. (prev. 2.4%) MoM Growth: PPI (May), -0.2% Vs. 0.1% Est. (prev. 0.5%) Core PPI, 0.0% Vs. 0.3% Est. (prev. 0.5%)

Investing with intelligence

Our latest research, commentary and market outlooks