Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

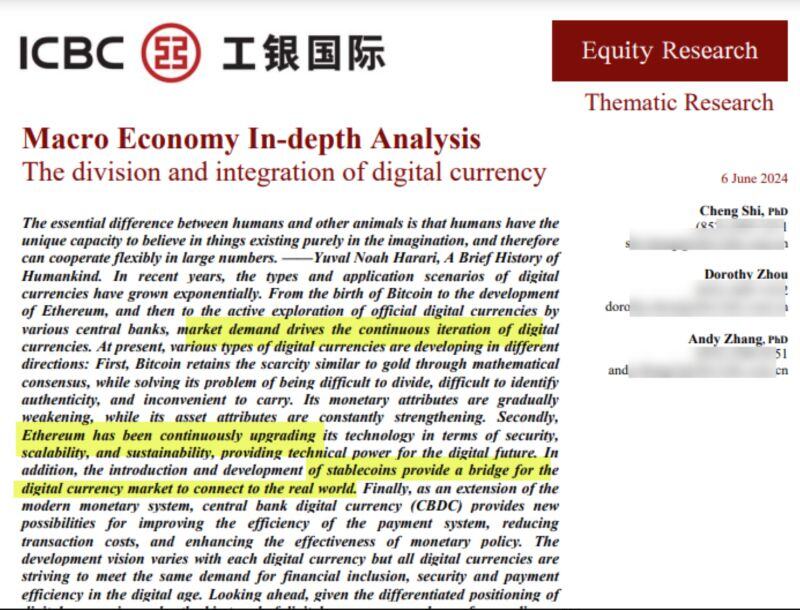

🚨WORLD'S LARGEST BANK, ICBC, CALLS ETHEREUM "DIGITAL OIL"

ICBC: “Ethereum has been continuously upgrading its technology in terms of security, scalability and sustainability, providing technical power for the digital future. In addition, the introduction and development of stablecoins provide a bridge for the digital currency market to connect to the real world.” ICBC described Ethereum as the “digital oil.” Being Turing-complete and having its own programming language, Solidity, allows developers to deploy complex smart contracts and dApps. This has made Ethereum the mainstay in inventive new fields such as NFTs and DeFi “and is gradually extending to the physical infrastructure network.” Source: Crypto News Flash thru Mario Nawfal

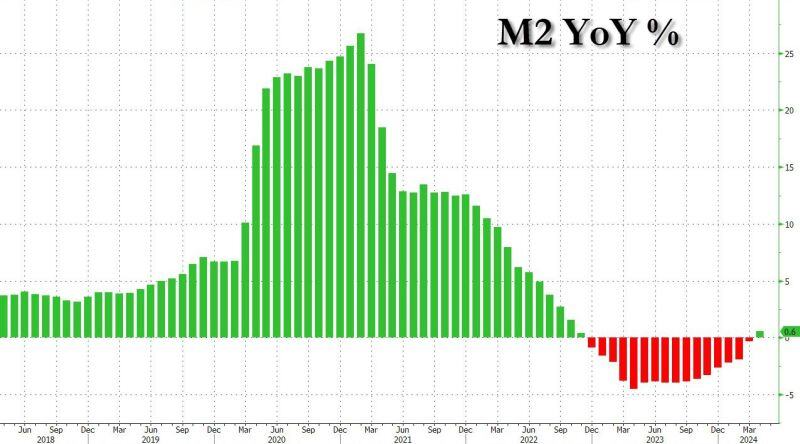

M2 is now positive in the US (with rates at 5.5%). Are rate cuts, QE and YCC just a matter of time?

Source: www.zerohedge.com, Bloomberg

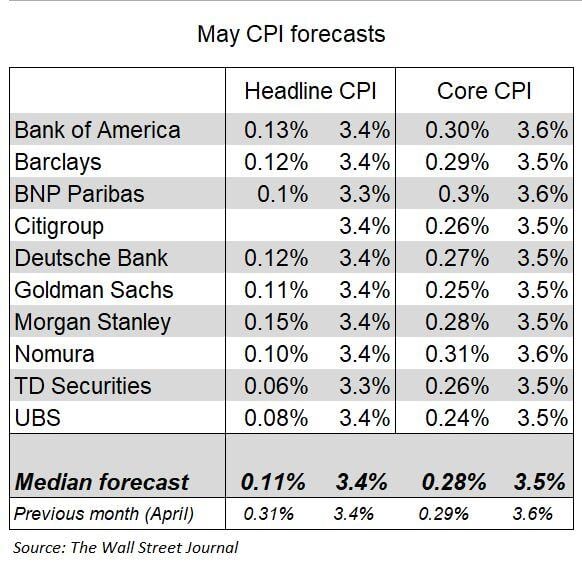

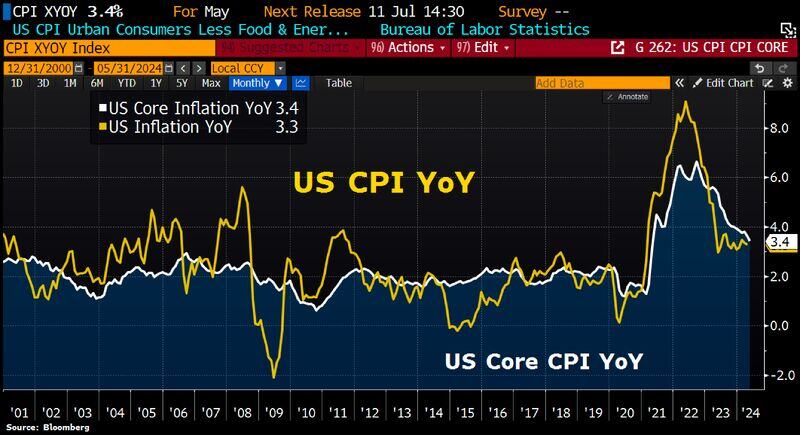

Inflation forecasters see the core US CPI posting roughly a similar increase in May as in April.

An increase of 0.28% in the core CPI would lower the y/y rate to 3.5% Source: Nick Timiraos, Wall Street Journal

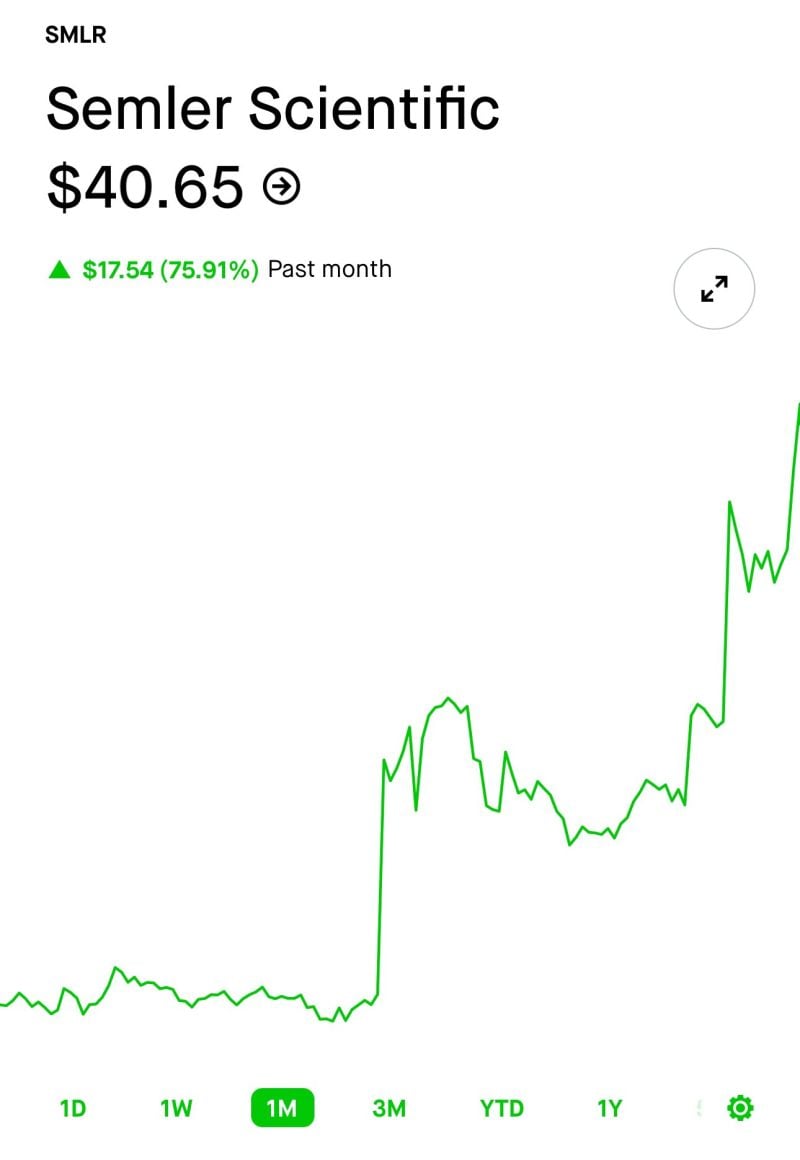

Semler Scientific ($SMLR) is up over 75% in the last month thanks to adopting a Bitcoin strategy.

Source: Walker⚡️@WalkerAmerica

Bonds, stocks, gold and cryptos rally following cooler-than-expected US inflation data.

May headline CPI slowed by 10bps to 3.3% YoY vs 3.4% expected. Core slowed 20bps to 3.4% vs 3.5% expected. Super Core CPI TURNED NEGATIVE (!) -0.05% MoM - its first drop since Sept 2021 (but that left the YoY level still above 5.0%). Details: CPI data for May 2024 • Inflation was softer than expected in May: headline 0.0% MoM vs +0.1% expected; “core” inflation +0.2% MoM (+0.163% unrounded) vs +0.3% expected • As a result, the yearly headline inflation rate is down to +3.3% (after +3.4% in April) and the “core” inflation rate is down to +3.4% (+3.6% in April), its lowest level in three years. • Inflation is still above the Fed’s target of 2% but the trend toward slower inflation has resumed, after the upside surprises of the first quarter of the year. - Housing (shelter) inflation remains firm, but CPI inflation excluding shelter (+2.1% YoY%) is now back (almost) at the level targeted by the Fed. - Inflation in services, that has been strong in the previous months, is finally slowing down (+0.2% in May vs +0.4% in April and +0.5% in March). - Prices of durable and nondurable goods have declined in May (-0.5% and -0.4% respectively). • Those data confirm our scenario of a gradual disinflationary trend at play in the US, as labor market tensions ease and consumer demand loses some momentum. Impact on the hashtag#Fed • Following the release, and ahead of the Fed’s meeting tonight, the probability of a Fed rate cut in September has increased to 62%, • A Fed rate cut at the November meeting (two days after the US Presidential elections) is now fully priced in. • Future markets also fully price a second rate cut at the December meeting. • After the FOMC meeting tonight (no rate cut expected), Fed’s members will update their economic and rate projections. • Those CPI data are probably a relief for the Fed and will likely prevent hawkish surprises and significant revisions to the upside on the expected path of Fed Fund rates in 2024 and 2025. Source: HolgerZ, Bloomberg

“Should you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted to patching leaks.”- Warren Buffett

Source: Masterinvest.com

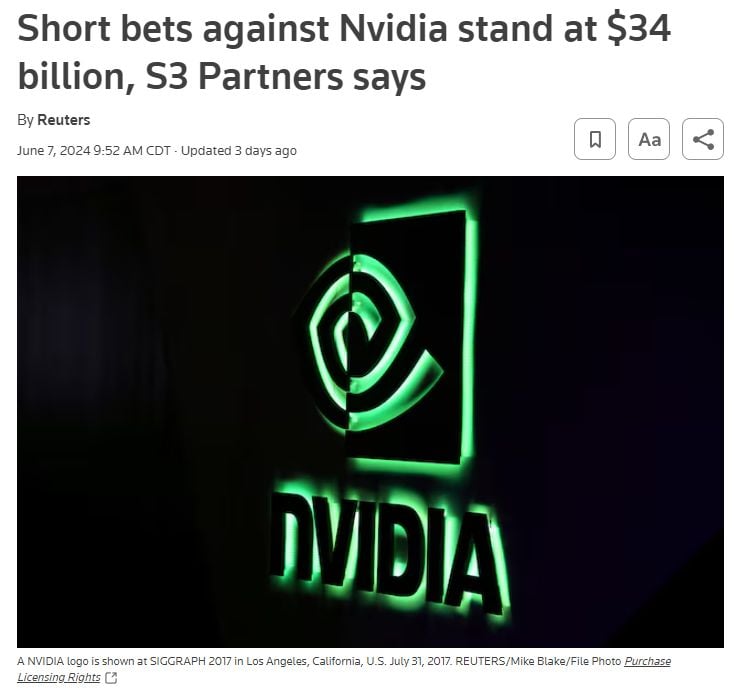

Short bets against Nvidia $NVDA hit $34 billion, almost double the total short bets against Apple $AAPL and Tesla $TSLA

Source: Barchart

The SP500 closed the week at new all-time highs.

And a whopping 33 stocks on the NYSE closed at new highs. That's only 1.4% of stocks on the most important exchange in the world hitting new highs. Source: J.C. Parets @allstarcharts

Investing with intelligence

Our latest research, commentary and market outlooks