Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

BREAKING: SPOT GOLD PRICE TUMBLED BY $20 PER OUNCE AS CHINA'S PBOC STOPPED GOLD RESERVES BUILDING.

China's end-May forex reserves are $3.2320 trillion, higher than the previous $3.2008tln. Gold reserves were unchanged at 72.80 million ounces, and the value of gold reserves was $170.9bln vs the previous $167.9 bln as gold price increased in May. Source: CN Wire

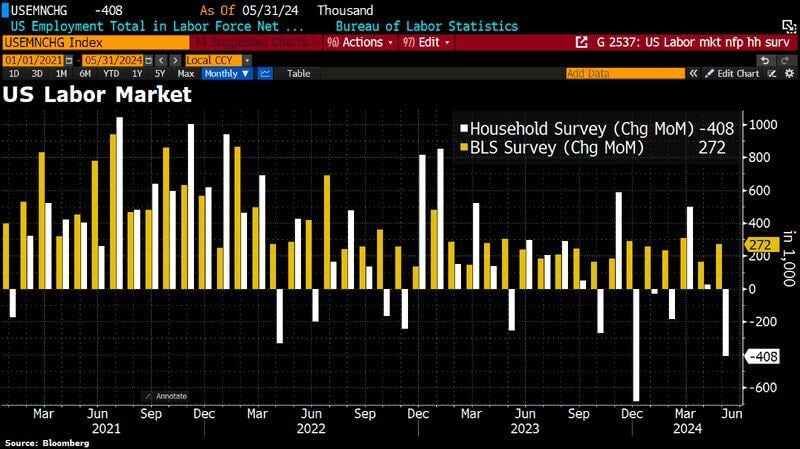

US employment data are out - here we go again with jobs numbers that don't add up...

here we go again with jobs numbers that don't add up... The Establishment survey by BLS reports 272k new jobs for May, smashing estimates (+185K consensus) and much strong than April (+165K). The labor market continues to show signs of resiliency in the face of higher Fed interest rates. This seems to decrease the odds that the hashtag#Fed could cut rates in September... BUT: - Labor force shrank: This is why the US unemployment rate has risen from 3.9% to 4% (first month with 4.0%+ unemployment since February 2022) despite a lower labor participation rate (Indeed, the labor supply as week, and as Unemployment Rate = Number of unemployed / labor force, a weak labor force implies higher unemployment rate despite rise in job creation). - Wage growth surprised to the upside: this could be linked to a reduction in the supply of labor which might be causing some bottlenecks given the still-robust job creation. Wage growth continues to remain a sticky source of inflation, rising at a 4.1% pace, which is still way too hot for the Fed. - The Household survey shows a large drop in the number of employed, down 408k jobs (see white bar below). - Full time jobs actually SHRUNK by 625k (This is the biggest drop in full-time employment since December 2023) while part time jobs rose by 286k. - Between the household and establishment surveys, the numbers are retarded and unusable. This makes economic data analysis very difficult. Bottom-line: Key Takeaway: All things considered, the May jobs report does not point to imminent Fed rate cuts. The pickup in jobs growth supports the case that the resilient labor market remains strong, and the economy continues to hold up better than expected. Source: Bloomberg

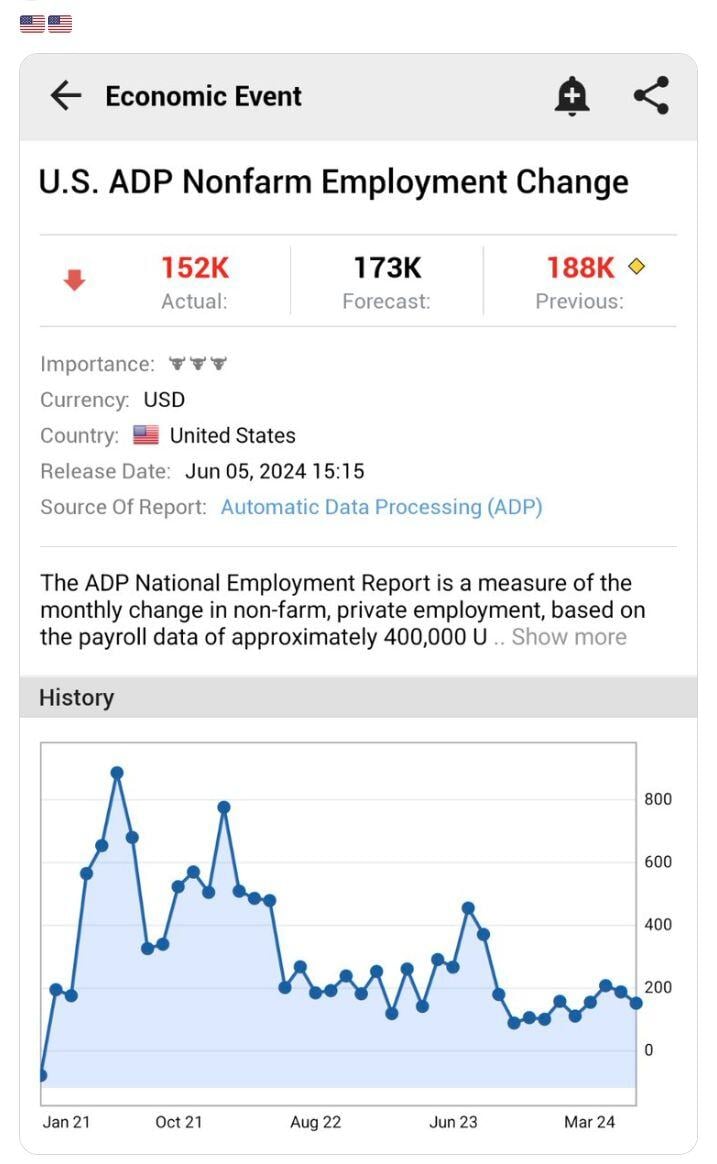

*U.S. MAY ADP NONFARM PAYROLLS REPORT*

1. The U.S. economy added a lower-than-expected 152,000 jobs in May, as per ADP, missing forecasts for a gain of 173,000 (previous was 188,000). 2. This is the lowest number since February 3. The number of job gains for April was revised down from +192,000 to show a gain of +188,000. Key Takeaway: The weak ADP report adds to evidence of a slowing labour market. September rate cut bets will grow stronger as cracks begin to emerge in the economy. Source: www.investing.com

BREAKING: Nvidia stock, $NVDA, officially crosses above $1,200 for the first time in history.

Nvidia now has a market cap of $2.95 TRILLION and is just 3% away from passing Apple, $AAPL, as the largest public company in the world. To put things into perspective: the market cap per employee of Nvidia has hit almost $100,000,000. Source: Bloomberg, HolgerZ

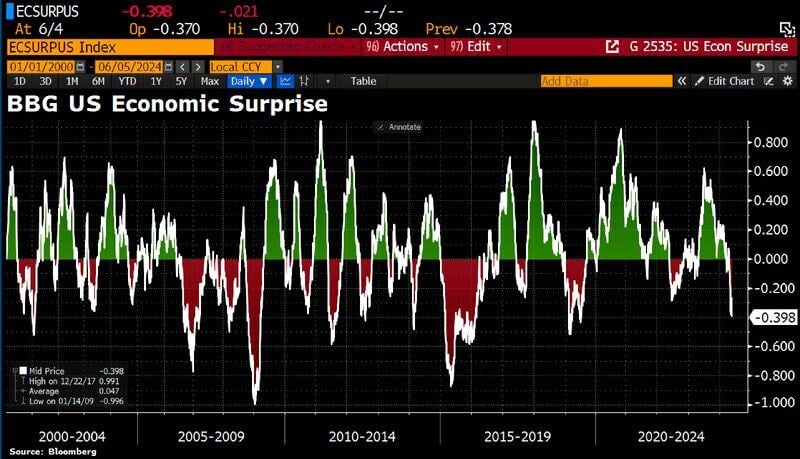

As economic data continues to underwhelm (ISM Manufacturing, JOLTs), the BBG US economic surprise index has plunged to its lowest level in 5 years.

Source: Bloomberg, HolgerZ

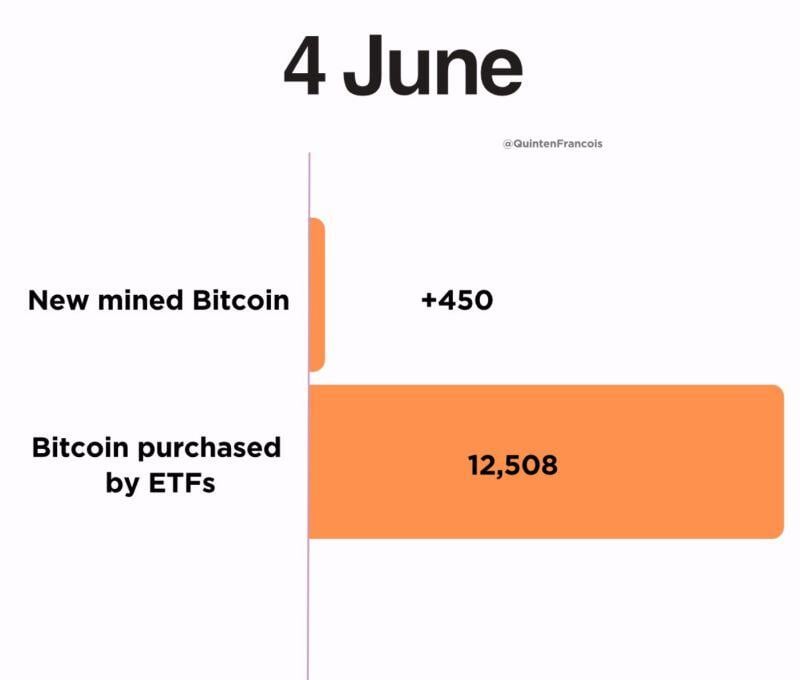

NEW: Spot Bitcoin

ETFs bought 12,508 BTC yesterday, while miners only produced 450 BTC.

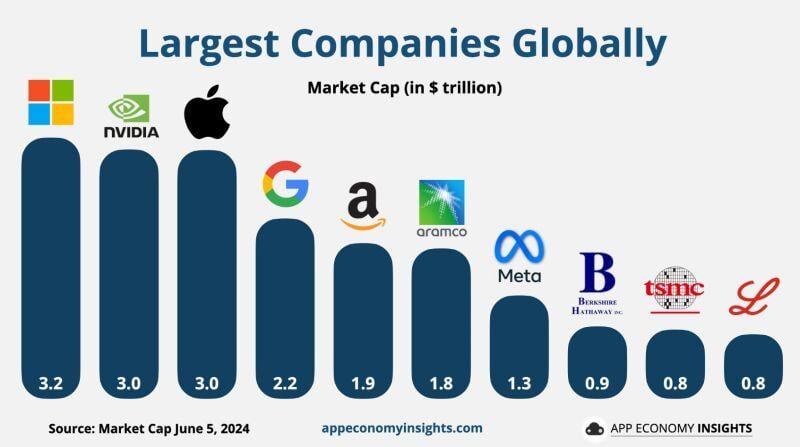

NVIDIA $NVDA reaches a $3T valuation and overtakes Apple $AAPL as the 2nd largest company globally.

Source: App Economy Insights

Investing with intelligence

Our latest research, commentary and market outlooks