Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

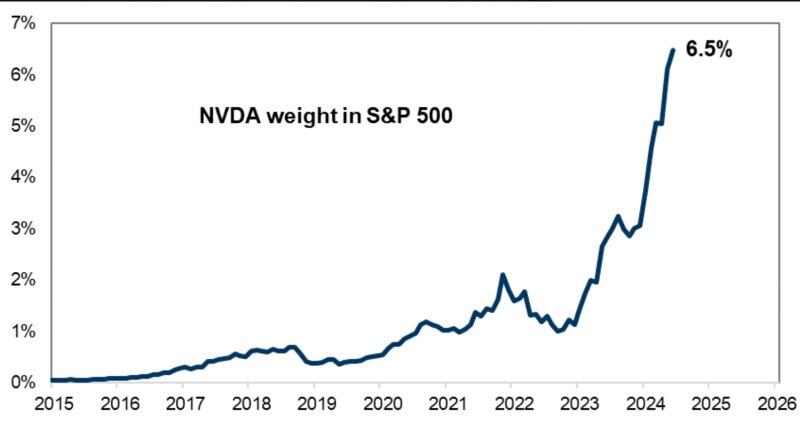

Just 3 stocks - Microsoft $MSFT, Nvidia $NVDA, and Apple $AAPL - now account for 20% of the S&P 500

Source: Barchart

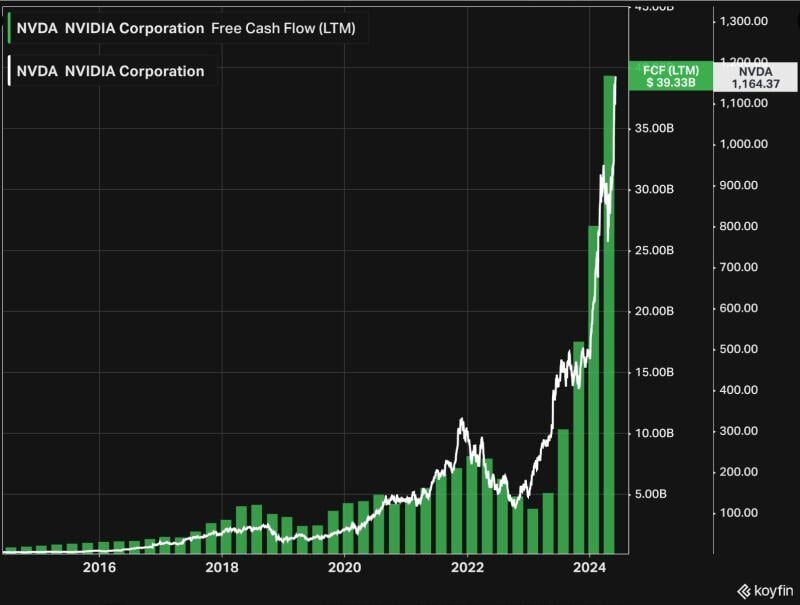

Nvidia, $NVDA, was up another 6% yesterday (including after hours) moving to a record $1,237/share.

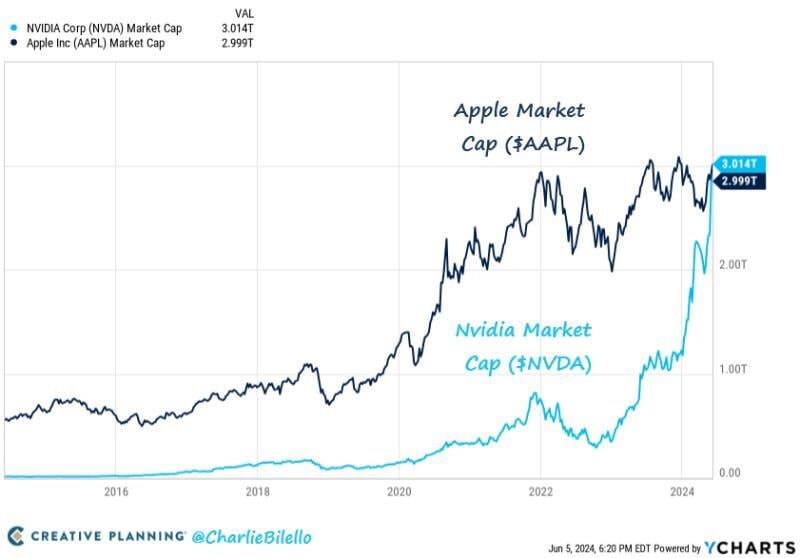

This puts the stock up 155% in 2024 ALONE, adding $1.83 TRILLION of market cap. To put this in perspective, Nvidia has now added as much market cap as the entire value of Amazon, $AMZN, in 6 months. 10 years ago Apple had a market cap 53x higher than hashtag#Nvidia. Today, Nvidia ended the day with a market cap of $3 trillion, surpassing Apple to become the 2nd largest company in the world. Note that Nvidia has also accounted for almost HALF of the S&P 500's YTD market cap gain... Source: Charlie Bilello. The Kobeissi Letter

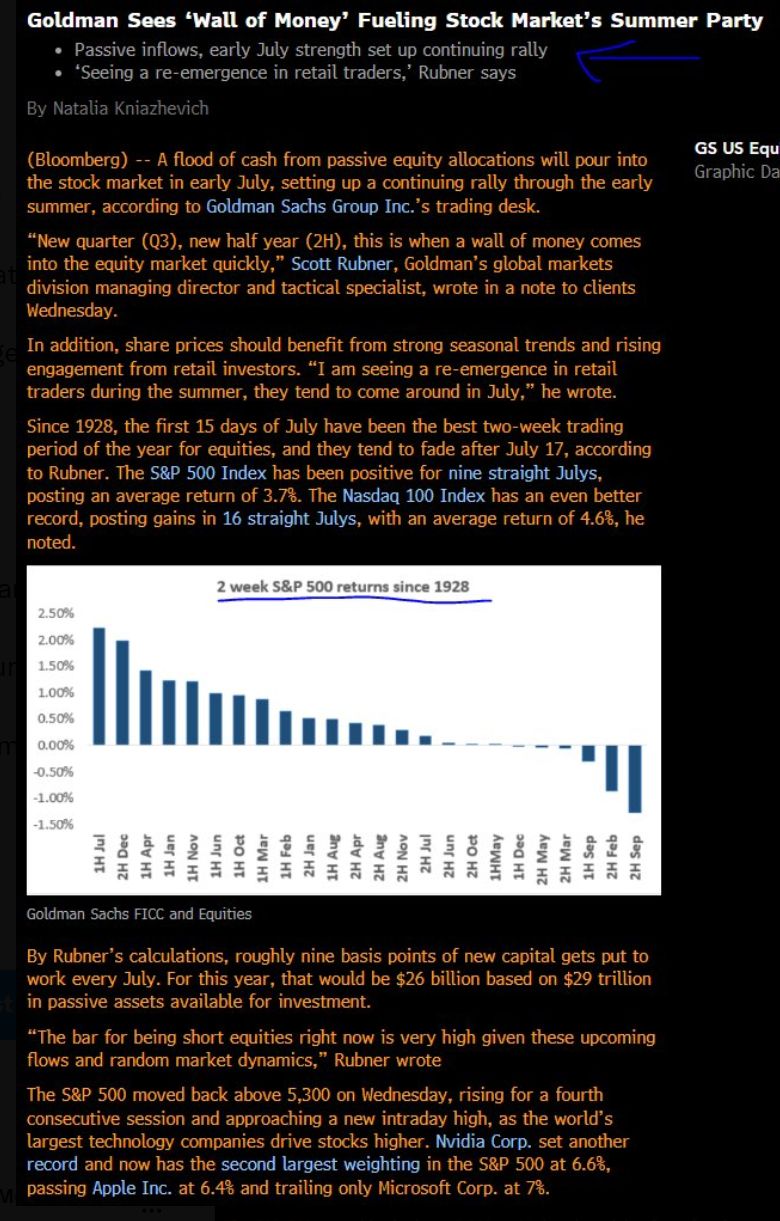

* Goldman Sees ‘Wall of Money’ Fueling Stock Market’s Summer Party

Source: Carl Quintanilla, Bloomberg

Foreign investors have flocked to saudiaramco’s $12 billion share sale, people familiar with the matter said

This marks a turnaround from the oil giant’s 2019 listing that ended up as a largely local affair. The deal attracted significant interest from foreign investors, according to the people, who declined be identified as the information is private. It wasn’t immediately clear exactly how much demand came from overseas, but those investors put in enough bids to more than fully cover the offering, the people said. Source: Bloomberg

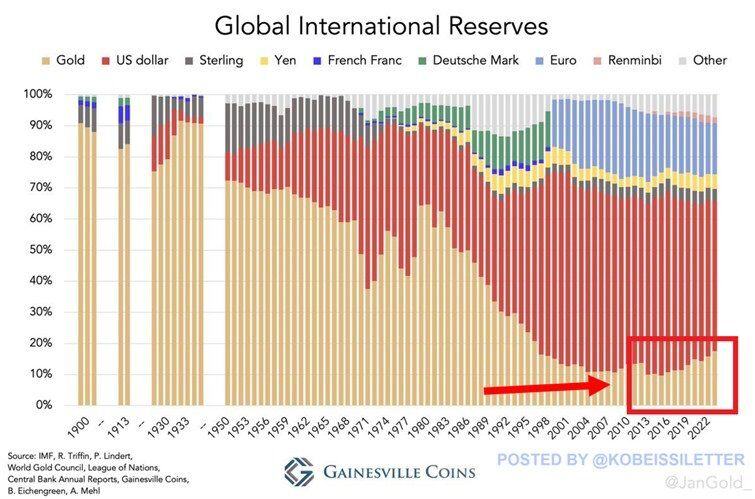

BREAKING: Gold's share of global international reserves jumps to 17.6% in 2023, the most in 27 years.

Source: WinSmart, Gainesville Coins, The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks