Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Tech CEOs are the new modern day rockstars $NVDA

Source: Trendspider

India’s stock markets erase $371 billion after ruling BJP falls short of election expectations

India’s markets saw their largest one-day loss in four years after the electoral performance of Prime Minister Narendra Modi’s ruling Bharatiya Janata Party fell short of expectations. The All India Market Capitalization index, tracked on the Bombay Stock index, dropped over $371 billion on June 4 alone. The losses on Tuesday meant the Sensex index erased all its gains this year in a single day, going from a 5.85% year-to-date gain on Monday to a 0.22% loss position. Source: CNBC https://lnkd.in/df_9zjkZ

JUST IN: BlackRock and Citadel to start a new stock exchange based in Texas that is set to compete against the New York Stock Exchange

Source: Barchart

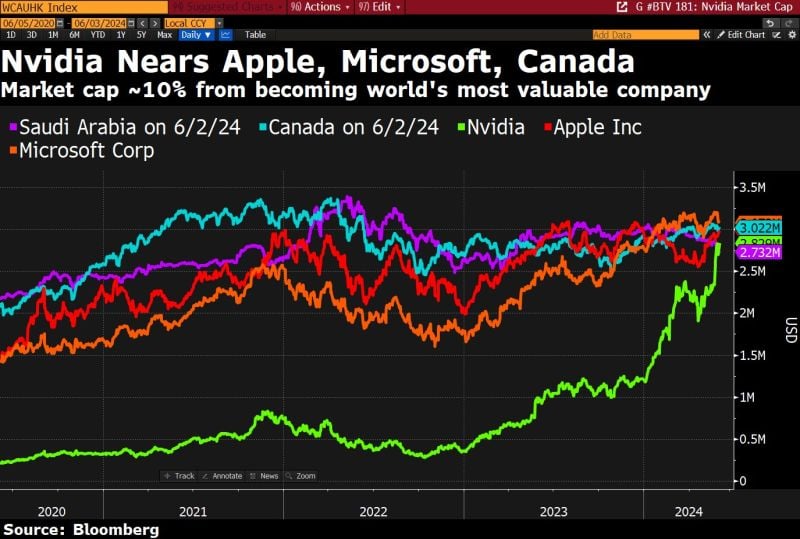

Nvidia is within single digits now of becoming the world's most valuable company $NVDA

•5% away from Apple •6% away from Canada •9% away from Microsoft Source: Bloomberg, HolgerZ

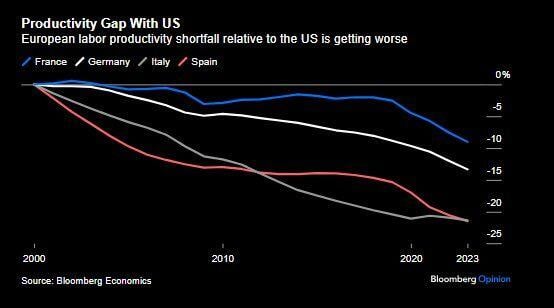

Productivity shortfall against the US is one thing, but Germany falling behind France is remarkable. What happened?

Source: Bloomberg, Michel A.Arouet

Investing with intelligence

Our latest research, commentary and market outlooks