Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Is US Consumer Discretionary vs Staples giving us a warning sign about the US consumer?

Source: Bloomberg

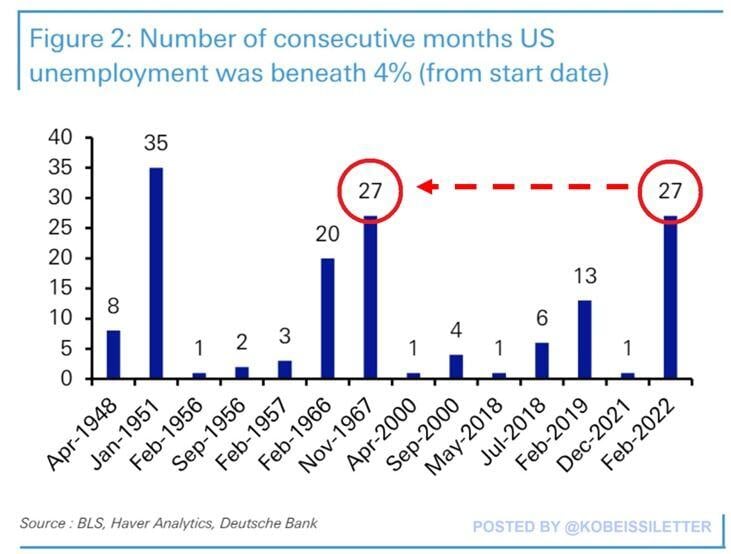

How "strong" is the labor market?

The US economy has seen an unemployment rate below 4% for 27 straight months, longest streak since the 1967. The longest streak of below 4% unemployment occurred in 1951 and lasted for 35 months. On Friday, the BLS will release labor market data for May, and estimates believe unemployment will be 3.9%. If unemployment comes in line or below expectations, it would mark the 2nd longest streak in history. Meanwhile, most Americans argue that the economy is getting worse. All eyes are on labor market data on Friday. Source: The Kobeissi Letter, DB

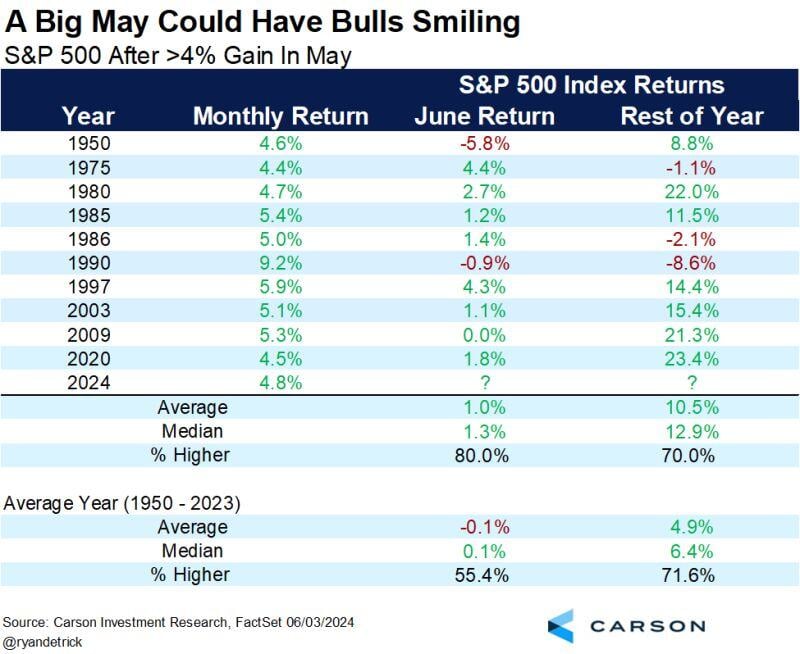

Best May for the S&P 500 in 15 years.

Looking at the 10 best monthly returns ever in May showed the future returns were quite impressive. When May return was above 4%, the rest of year up was double the average year (10.5% vs 4.9%) and June was up 1.0% on average vs negative. Source: Carson, Ryan Detrick

Atlanta Fed US Q2 GDP estimate plunges to 1.8% from 2.7% on May 31, and from 4.1% two weeks ago

Source: zerohedge

BREAKING: Mexico's stock market ETF, $EWW, crashes 11% after as the Mexican stock market posts its worst day since 2008.

The Mexican Peso also lost 4.5% against the US Dollar in its biggest one-day drop in years. This comes after Claudia Sheinbaum was elected as the next president of Mexico. Source: The Kobeissi Letter

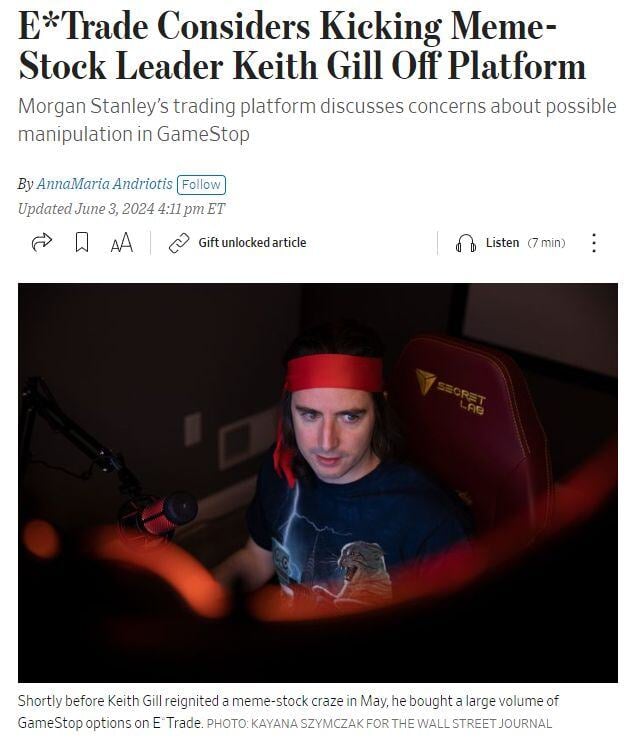

BREAKING 🚨: Roaring Kitty

E*Trade is reportedly discussing whether to remove Roaring Kitty from its platform Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks