Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

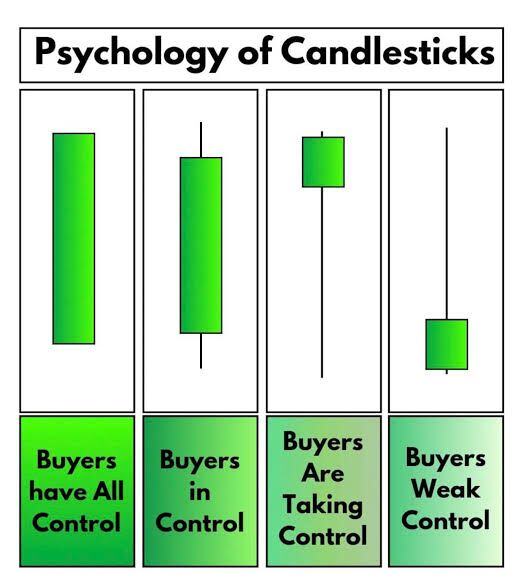

Psychology of candlestick in one image courtesy of Market Insights

Source: Market Insights

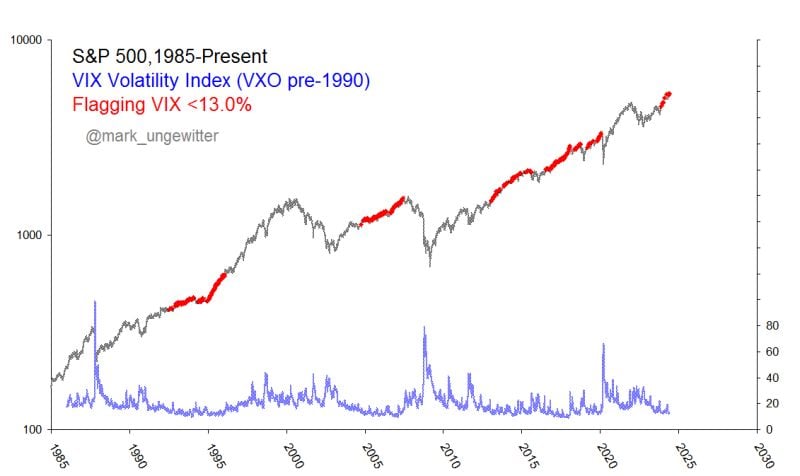

Low-volatility regimes can last longer than you think.

Source: Mark Ungewitter

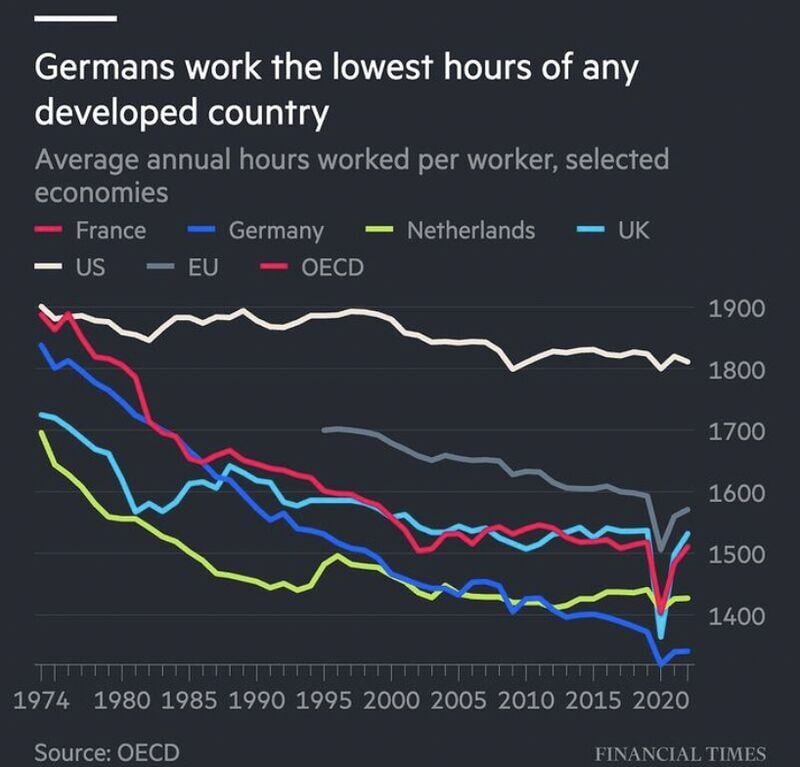

Germany has the shortest average working hours of any advanced economy, with the annual figure falling 30% in the past 50 years and now a quarter below US levels, per FT.

Source: unusual_whales, FT

As expected, OPEC+ agreed to extend its oil supply cuts, delegates said, as the group continues its efforts to avert a global surplus and shore up prices.

The so-called “voluntary” cuts from key members including Saudi Arabia and Russia, which total roughly 2 million barrels a day and were set to expire at the end of June, will continue until the end of 2024, delegates said, asking not to be named because the talks were private. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks