Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

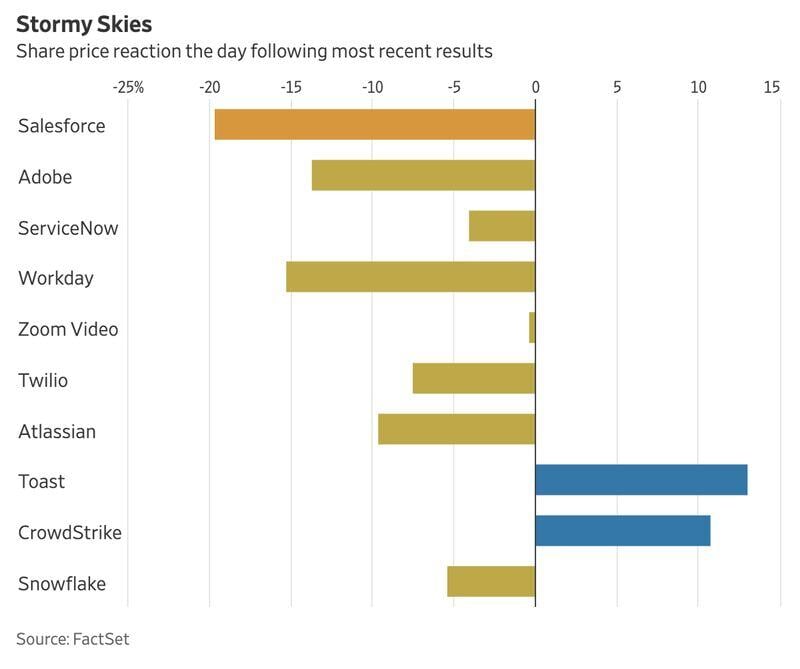

The current earnings season has largely been a rough one for cloud software providers.

Source: Win Smart, Factset

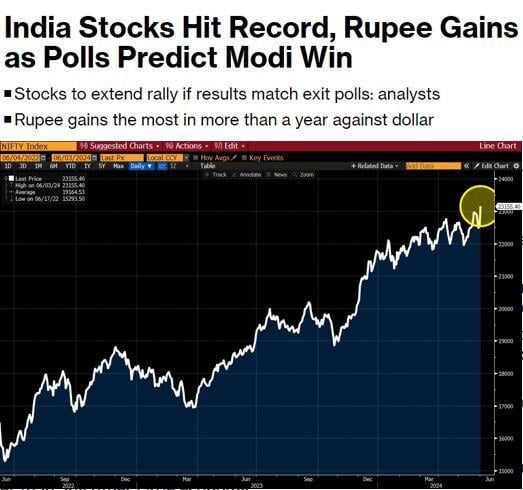

Exit polls show a clear victory for Prime Minister Modi’s party BJP + allies (called NDA = National Democratic Alliance).

The market is likely to view this very favorably, expecting another 5 years of policy stability, reforms and visibility on growth. Source: Bloomberg, David Ingles

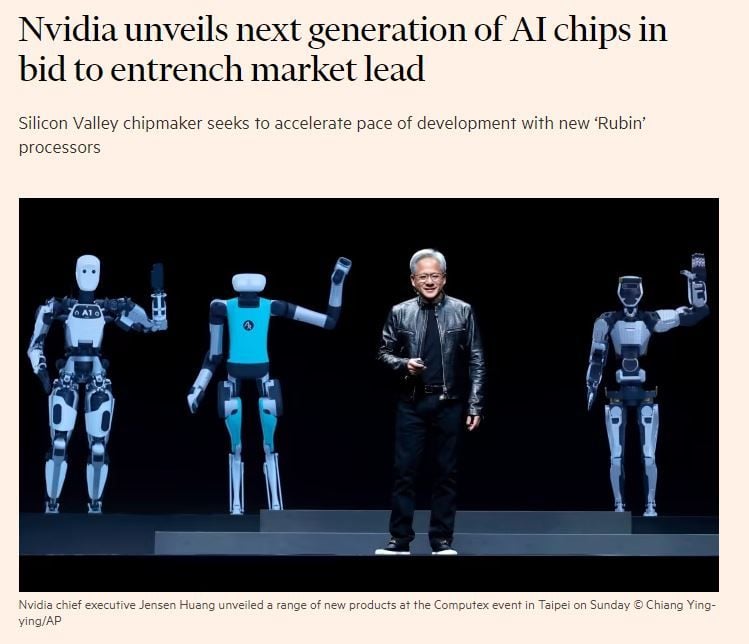

Nvidia $NVDA announced the next generation of its artificial intelligence processors on Sunday in a surprise move less than three months after its most recent launch.

At the Computex conference in Taipei, the chipmaker’s chief executive Jensen Huang unveiled “Rubin”, the successor to its “Blackwell” chips for data centres, which are currently in production after being announced in March. The unexpected move to reveal its next wave of products before Blackwell has even started shipping to customers shows how the world’s most valuable chipmaker is racing to entrench its dominance of AI processors, which has propelled it into the ranks of the world’s most valuable companies. “A new computing age is starting,” Huang said, as Nvidia also unveiled new AI chip deals with PC makers. Source: FT https://lnkd.in/edmWpGEZ

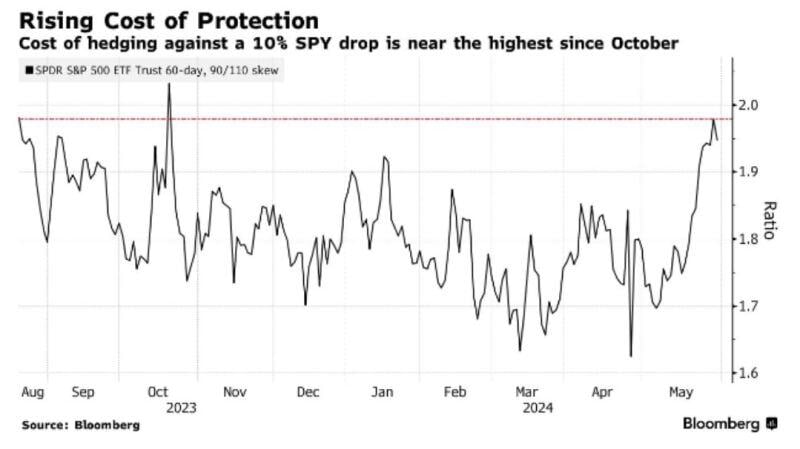

The cost to hedge a 10% drop in the S&P 500 reached its highest level since October

Source: Win Smart, Bloomberg

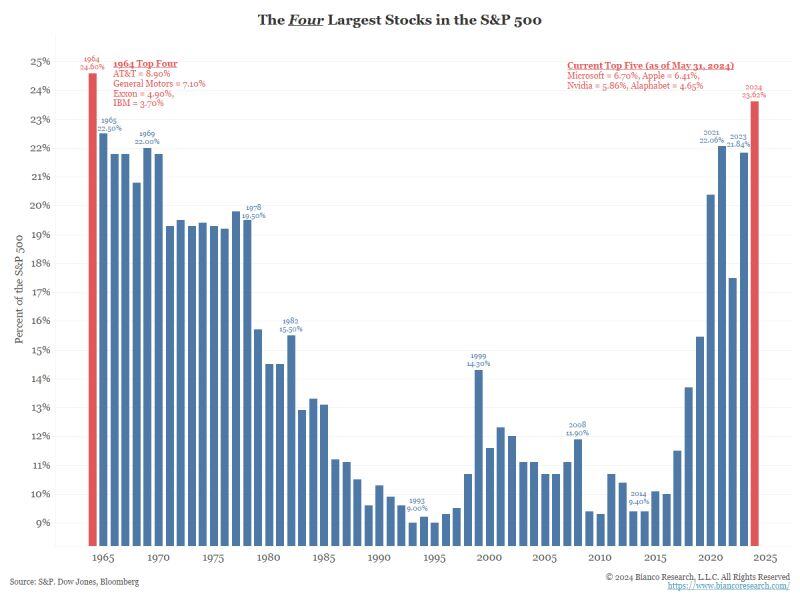

The equal-weighted SP500 relative to the S&P 500 index has dropped to its lowest level since March 2009.

This year, the S&P 500 has gained ~10% while the equal-weighted index rallied just 3%. At the same time, Magnificent 7 stocks have rallied over 50%. Since the ratio peaked in February 2023, the S&P 500 is up ~29% compared to a 7% gain of the equal-weighted index. Meanwhile, the top 10% of US stocks now account for ~75% of the S&P 500, the most since the 1930s’. The market has never been driven by so few names. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks