Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Penny stock trading is booming.

Seven of the top 10 most traded US equities in May are penny stocks worth less than $1. None are profitable Source: FT, Gunjan Banerji

Warren Buffett's Berkshire Hathaway owns 3% of the entire Treasury Bill market according to JP Morgan

Source: Barchart

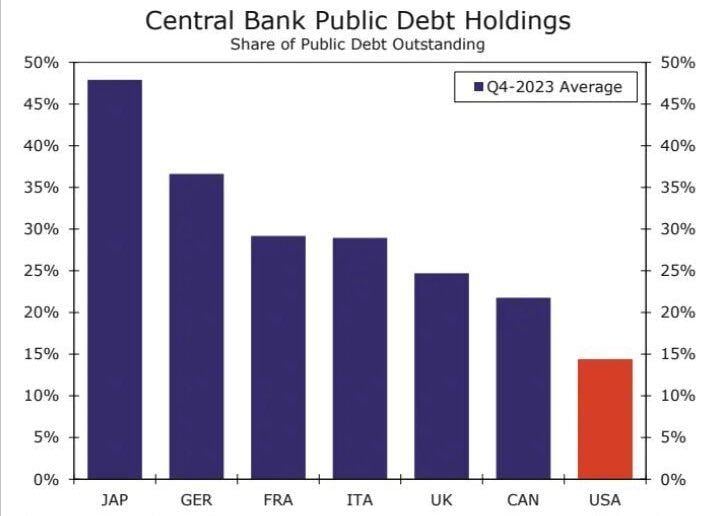

Japan currently owns the highest share of public debt outstanding.

They will most likely move even higher... and everybody else will follow. There is no other option left. This chart also means there is still a lot of firepower for the Fed to keep treasuries interest rates under control if needed. Source: Michel A.Arouet

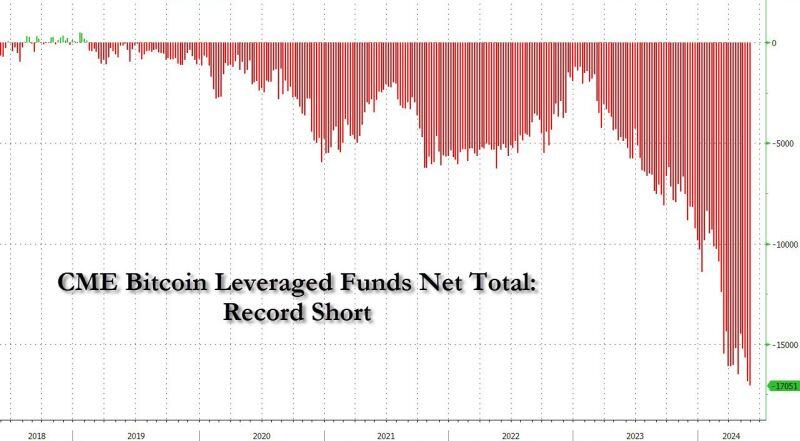

Hedge funds are betting big against Bitcoin in the futures markets, possibly looking to profit from elevated funding rates, as the most valuable cryptocurrency continues to trade sideways.

Funds have built up record short positions in Bitcoin futures, according to data shared by zerohedge.

China likely to impose the largest fine in history against an accounting firm of at least $138 million against PwC due to their failure to catch the largest financial fraud in history at Evergrande.

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks