Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

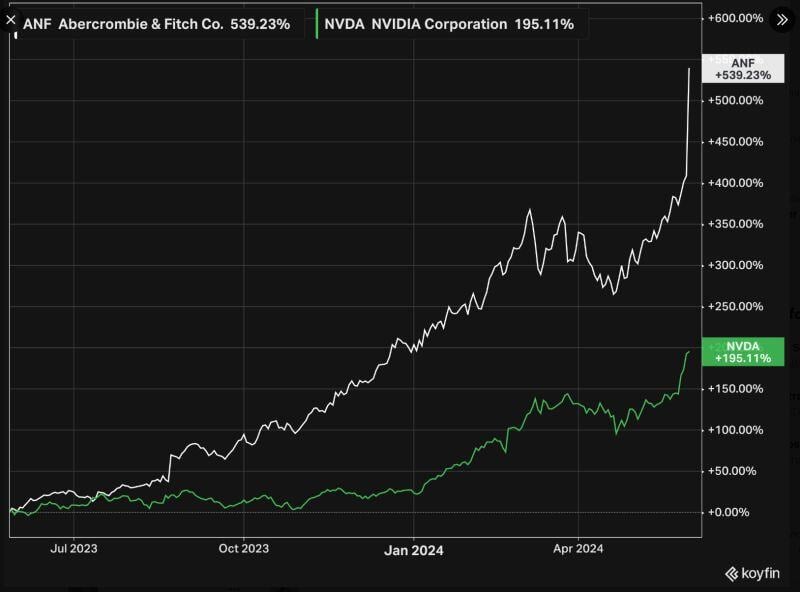

Abercrombie & Fitch $ANF making Nvidia $NVDA shareholders look poor...

Abercrombie & Fitch reported its financial results for the first quarter today. Here's what its CEO Fran Horowitz said in a press release on Wednesday. Abercrombie & Fitch stock is now up close to 70% versus the start of 2024. Source: Conor Mac, InvestmentTalkk

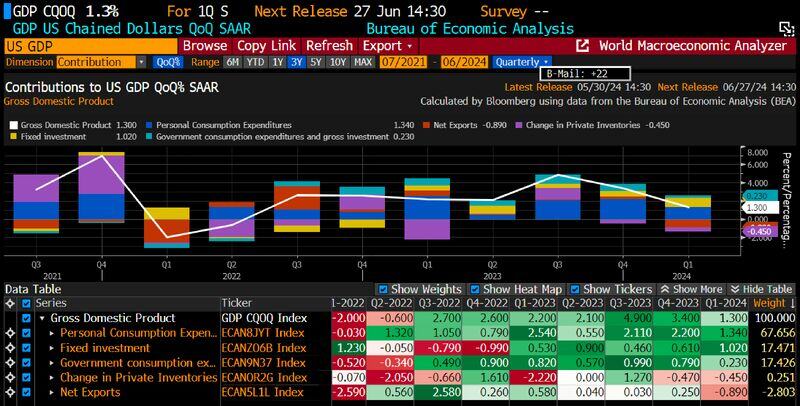

US Q1 GDP growth was slower on soft consumer spending.

The US economy expanded at 1.3% pace versus initial estimate of 1.6%. Consumer spending was lower on outlays for goods like autos. Source: Bloomberg, HolgerZ

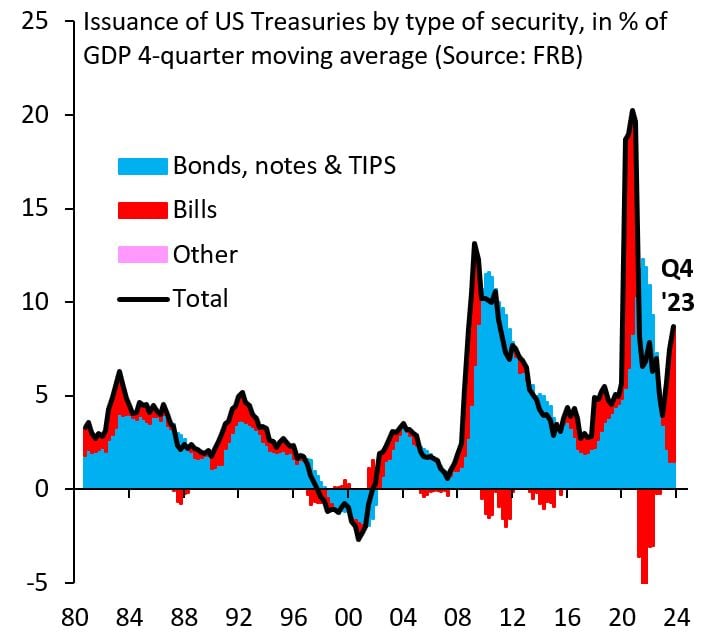

It's hard to understate just how unprecedented the scale of US fiscal stimulus is at the moment.

Not only is the deficit massive for a non-crisis period, but its financing is almost entirely via very short-term issuance, which has never been the case before in a non-crisis time. Source: Robin Brooks

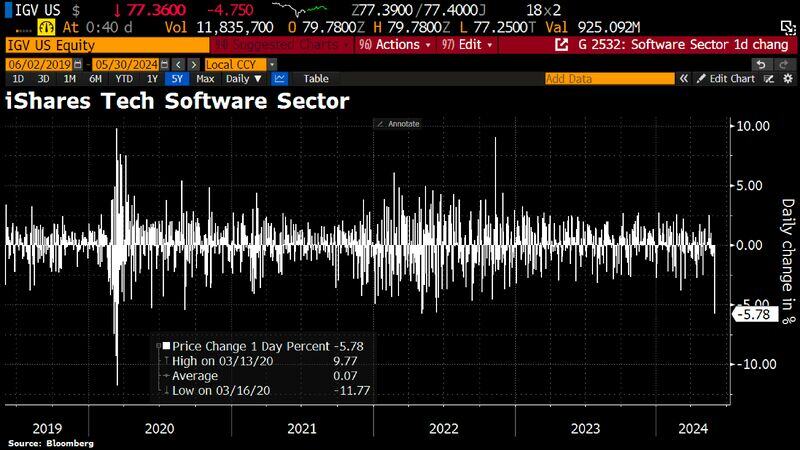

Software stocks got hammered yesterday.

iShares Tech Software Sector ETF finished -5.8% (biggest daily drop since the pandemic w/Salesforce DOWN 20% (worst session in ~20 years), UiPath -35%, Okta -6%, Mongo DB -24%. Source: Bloomberg, HolgerZ

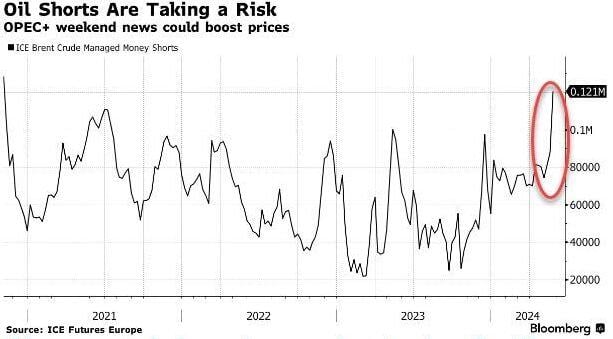

Speculators have built the largest Brent Oil short position since 2020

Source: Barchart, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks