Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

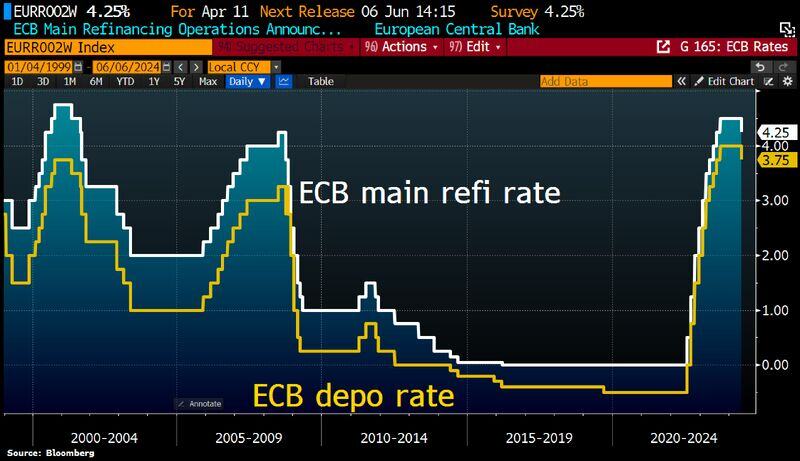

A hawkish cut? As expected, ECB cuts rates by 25bps despite higher inflation projections for 2024 and 2025.

Main rate now at 4.25%, Deposit rate now at 3.75. ECB not pre-committing to any particular rate path. ECB to follow data-dependent, meeting-by-meeting approach. The main surprise of the day is inflation forecasts being revised slightly upwards for 2024 (2.5% vs. 2.3%) and 2025 (2.2% vs. 2%), suggesting that the ECB will maintain a restrictive stance, keeping key rates above the neutral rate for the next 12 to 18 months. Bond yields have slightly increased across maturities without significant weakness in peripheral rates. The market is now pricing in fewer than two rate cuts for the remainder of the year, aligning with expectations of one rate cut per quarter. Source: Bloomberg, HolgerZ

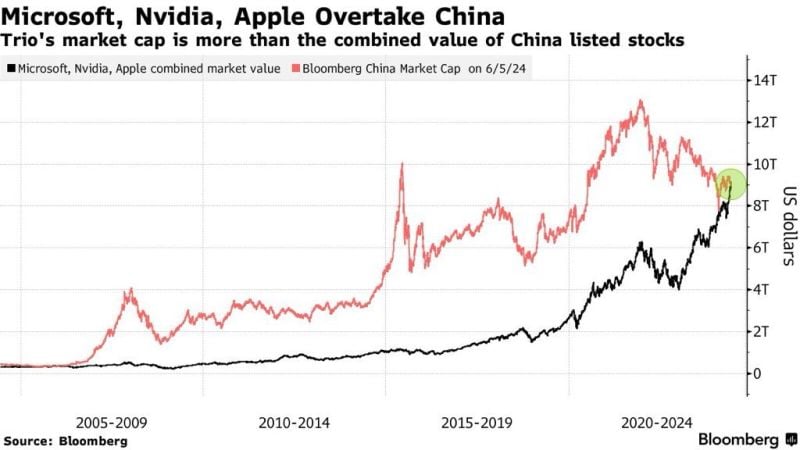

It’s official: Nvidia, Apple, and Microsoft are now bigger than China’s entire stock market.

Source: Bloomberg, www.zerohedge.com

The Bloomberg US Economic Surprise index is about the most negative since 2019.

DB's Jim Reid: Yesterday's ISM manufacturing report "was definitely one that dampened optimism about the state of the US economy right now. And it follows a run of weaker US data over recent days." Source: Bloomberg, Liza Abramowitz

Oil prices crash nearly 10% in 5 days over fears around weakening global demand.

Even as OPEC just extended oil production cuts of 2 million barrels per day, oil prices are nearing their 2024 lows. Recent data suggests that US economic activity in manufacturing and construction is slowing. As a result, oil prices are down 16% from their April peak and up just 3% year-to-date Source: The Kobeissi Letter

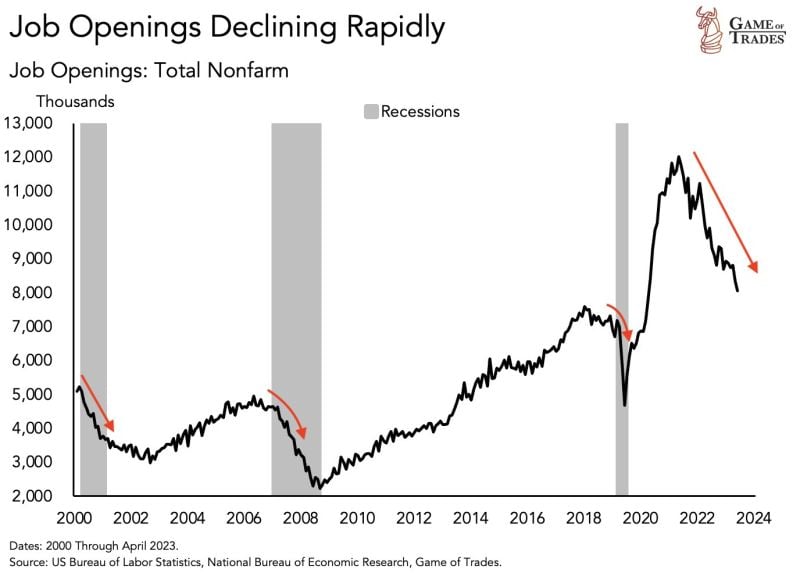

US job openings have just seen a sharp move down today.

JOLTS 8.06 million openings vs 8.4 million expectations. This is rather a large miss. This kind of a steep declining has only been seen 3 times since 2000. The jobs market continues to soften. Source: Game of Trades

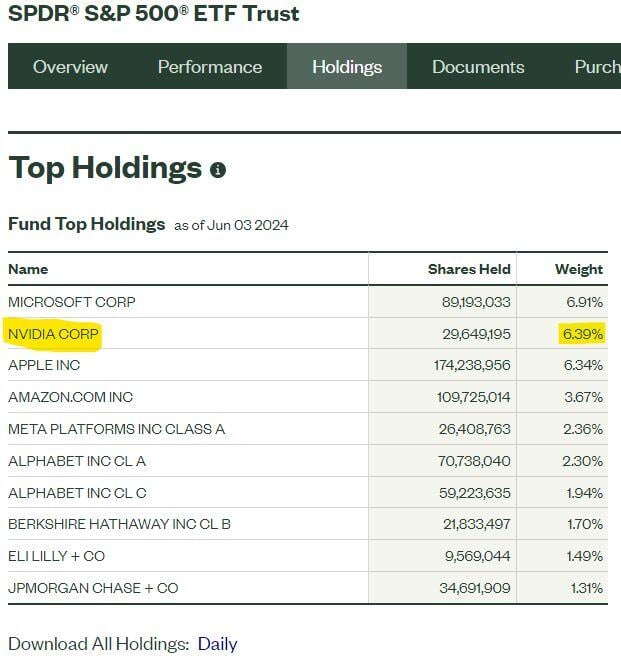

Nvidia $NVDA hit a new all-time high today of $1,166 and has passed Apple to become the 2nd largest holding in the S&P 500.

$SPY $NVDA $AAPL Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks