Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

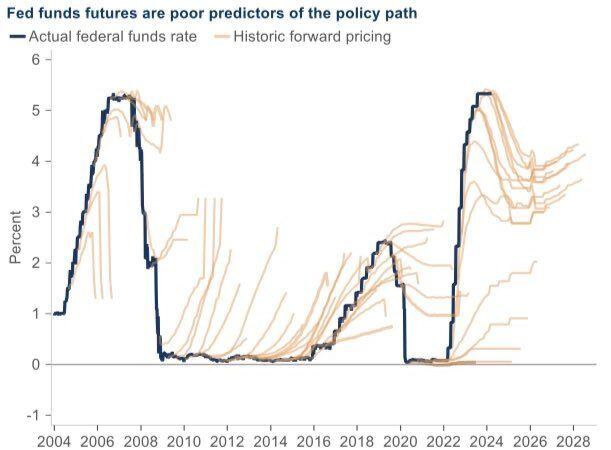

Friendly reminder that markets are always wrong about future Fed funds rate.

Source: Michel A.Arouet

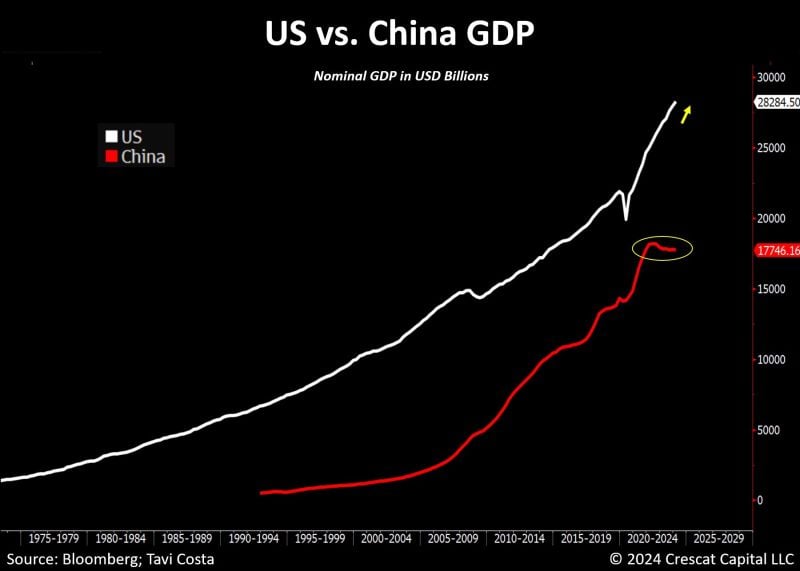

As highlighted by Tavi Costa, this is one of the reasons China is enhancing teh quality of its international reserves and accumulating gold:

China’s macro imbalances are increasing pressure on its monetary system to devalue. Source: Bloomberg, Tavi Costa, Crescat Capital

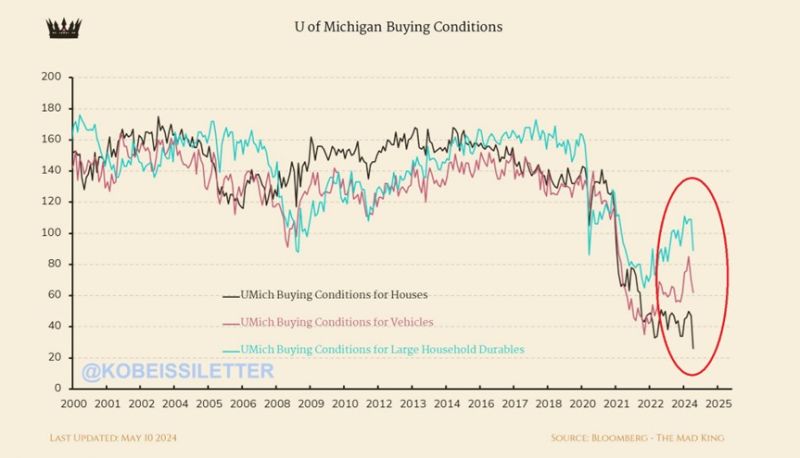

Homebuyer conditions for US consumers plummeted to their lowest level in history this month.

The index of buying conditions for houses fell to ~30 points which is below the previous low of ~40 points in the early 1980s. In just 4 years, conditions for buying a house have dropped by 110 points, a massive 73% decline. Meanwhile, buying conditions for vehicles and large household durables are down for 3 straight months. Source: The Kobeissi Letter

S&P 500 $SPX hasn't declined by 2% or more for 317 consecutive trading days, the longest streak since a 351-day stretch that lasted from Sep 2016 through Feb 2018.

Source: Barchart

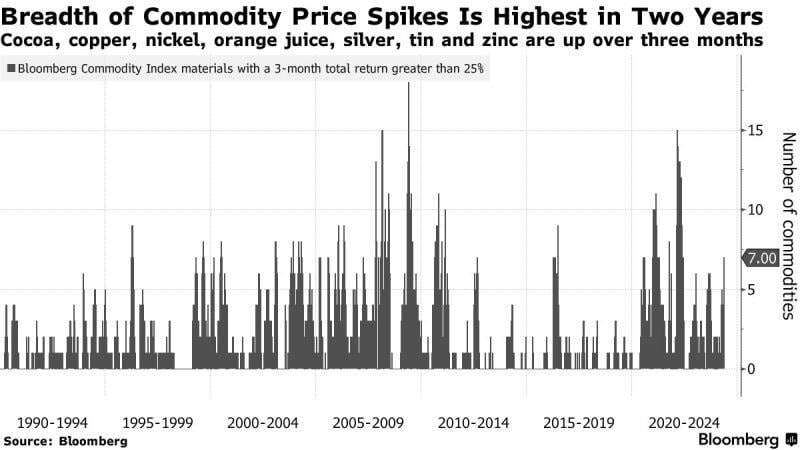

The breadth in commodity price spikes is the highest in two years

Source: Bloomberg

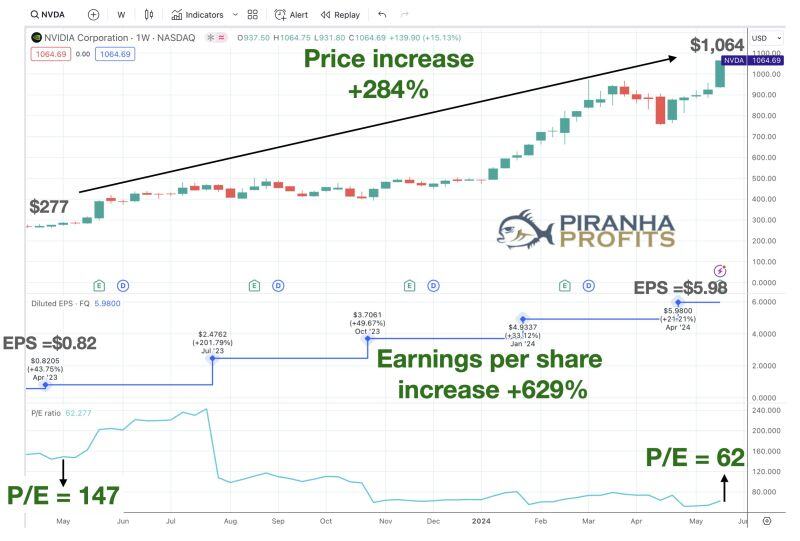

The higher a stock's price goes, the more expensive it gets. Right? Well, not always.

A year ago, when NVDA was selling at $277, its earnings per share was $0.82 and its P/E ratio was 147x Today, NVDA's share price is up +284% to $1,064.... BUT... Its earnings per share is up +629% to $5.98. Its P/E has fallen to 62x... forward P/E is now at 30x So, NVDA is CHEAPER today than it was a year ago. Source: Adam Khoo Trader, Piranha Profits

Investing with intelligence

Our latest research, commentary and market outlooks