Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

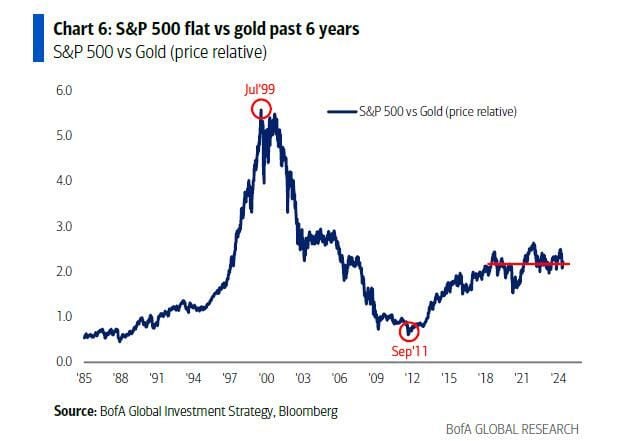

Did you know that the S&P 500 has been basically flat vs gold over the last six years? 🤔

Source: Markets & Mayhem, BofA

A key point on Nvidia story: $NVDA CEO Jensen Huang doesn't lack demand. What he lacks is supply.

In an exclusive interview following last week's earnings Huang said demand for its programs will soon outstrip supply, with the complexity of these chips also challenging the company's efforts to keep pace. Source: Yahoo Finance

BREAKING: RFK JR. SHAKES UP PRESIDENTIAL RACE

Robert F. Kennedy Jr. has accepted the Libertarian Party's presidential nomination, introducing a dynamic twist to the upcoming election that could disrupt the prospects for both Trump and Biden. This move puts RFK on the ballot in enough states to theoretically secure the 270 Electoral College votes necessary for a presidential victory. Kennedy's decision was announced during a contentious moment at the Libertarian Party convention, where he was nominated unexpectedly. Trump and Biden's campaigns are reportedly uneasy about Kennedy's candidacy, fearing it could siphon crucial votes in a tight race. Kennedy has positioned his campaign as a fusion of third-party and independent voters to challenge the traditional two-party system. Source: Daily Mail thru Mario Nawfal

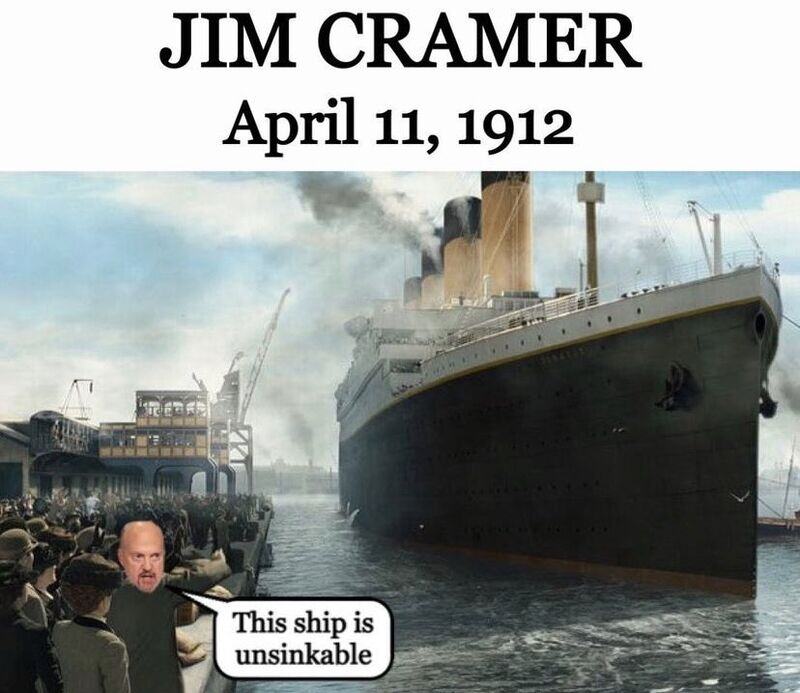

One of the most famous Jim Cramer meme

Source: Not Jerome Powell on X

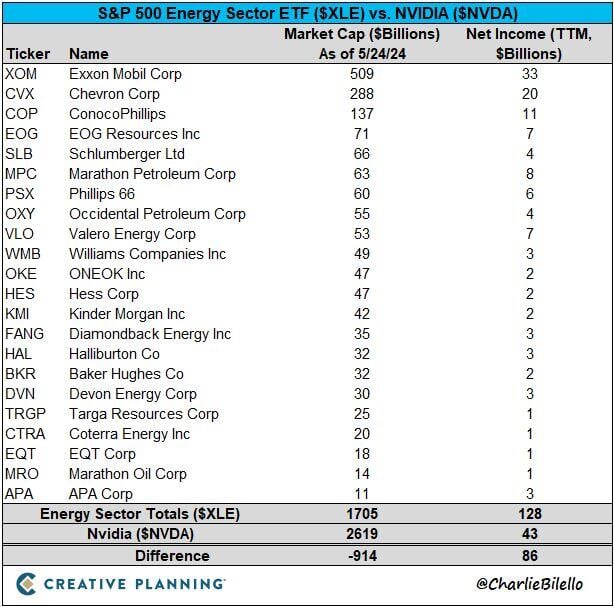

Nvidia vs US energy sector...

At $2.6 trillion, Nvidia's market cap is now over $900 billion higher than all of the companies in the S&P 500 Energy sector ... combined. The net income of the Energy sector is $128 billion vs. $43 billion for Nvidia. $NVDA $XLE Source: Charlie Bilello

Deckers Outdoor acquired the Hoka brand roughly a decade ago.

At the time, Hoka’s annual sales were around $3 million. In the past year, sales topped $1.8 billion. And since the acquisition, Decker’s stock has risen by more than 2,000%... (btw I love these shoes !!!) Source: Jon Erlichman

Investing with intelligence

Our latest research, commentary and market outlooks