Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

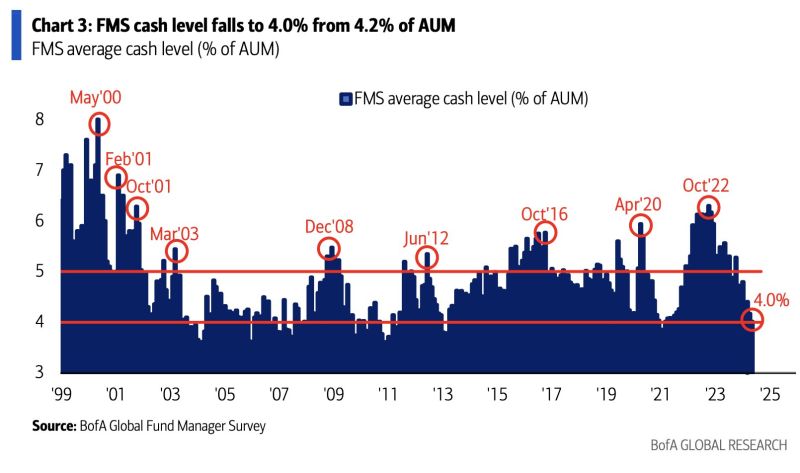

Are investors too complacent?

May Fund Manager Survey (FMS) sentiment is at the most bullish level since Nov’21, BofA says. The average cash level of FMS investors fell to 4.0% of AUM from 4.2%, the lowest level since Jun’21. Source: BofA, HolgerZ

Today’s inflation numbers are seen as a relief by investors… and the FED

Indeed, the just released data shows that US inflation cooled down in April for the first time in 6 months, following several reports of upside surprises. While yoy headline inflation is in-line with expectations (+3.4pct) the positive surprise came from the MoM number (+0.3pct) which is BELOW estimates (+0.4pct). Core inflation number MoM came in as expected (+0.3pct). The core yoy number (+3.6pct as expected) is at the lowest level since April 2021. Bottom-line: this report is bullish equities, bonds, gold and cryptos as it indicated that the disinflation trend might have further to go. Still, we believe that the Fed might wait for some confirmation before turning dovish. We note that the SuperCore (core ex-shelter) rose 0.5pct MoM to 5.05pct YoY. Source: CNBC

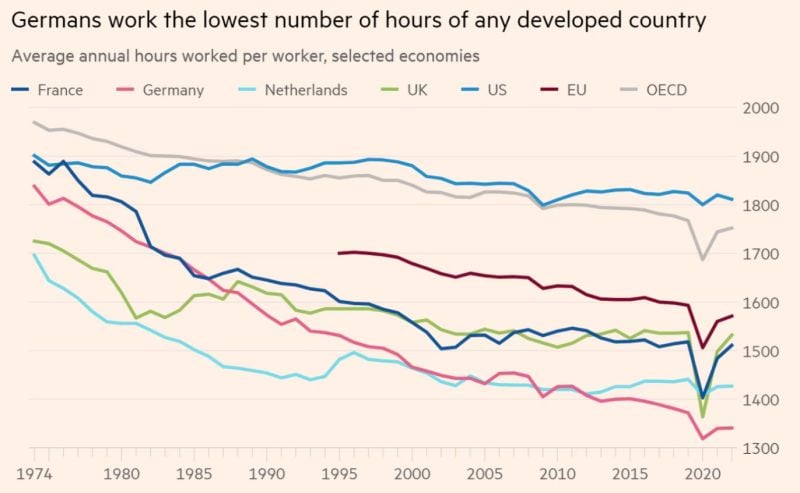

Germans already work much less than others, but German unions and some left politicians are seriously requesting move to four days workweek without pay cut

Source: FT, Michel A.Arouet

JUST IN: Vanguard appoints Salim Ramji as a new CEO, a former Blackrock’s Bitcoin ETF lead. Earlier, Vanguard refused to offer BTC ETF 👀

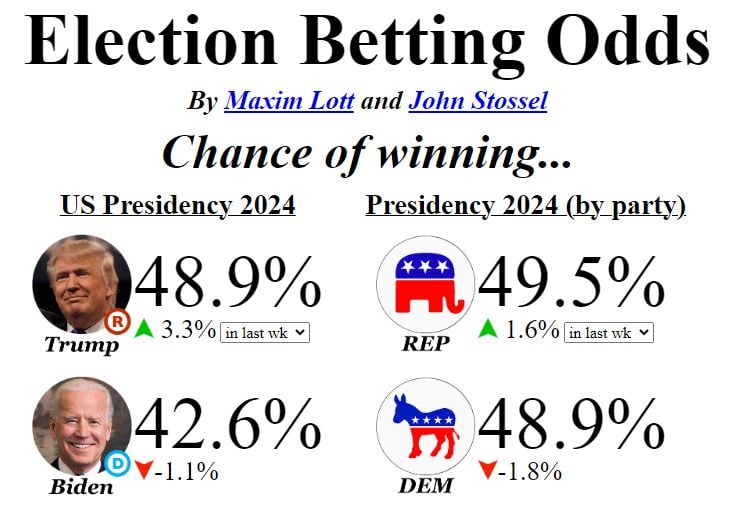

Trump now holds a 6.3 point lead on Biden and Republicans are now on top in the generic head to head. From @maximlott at https://lnkd.in/dT6EHQvp thru bespoke

We've seen a pretty big move in Presidential betting odds over the last week

Trump now holds a 6.3 point lead on Biden and Republicans are now on top in the generic head to head. From @maximlott at https://lnkd.in/dT6EHQvp thru bespoke

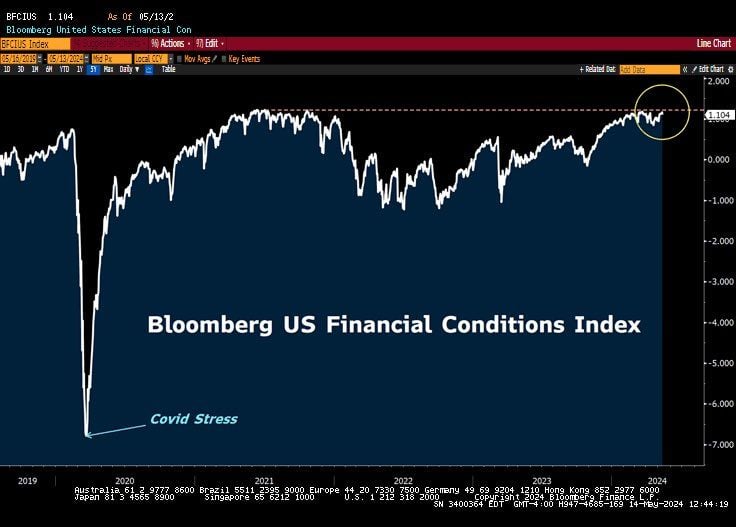

“We have to let restrictive policy do its work on inflation.”

Fed Chair Jay Powell Source: Lawrence McDonald, Bloomberg

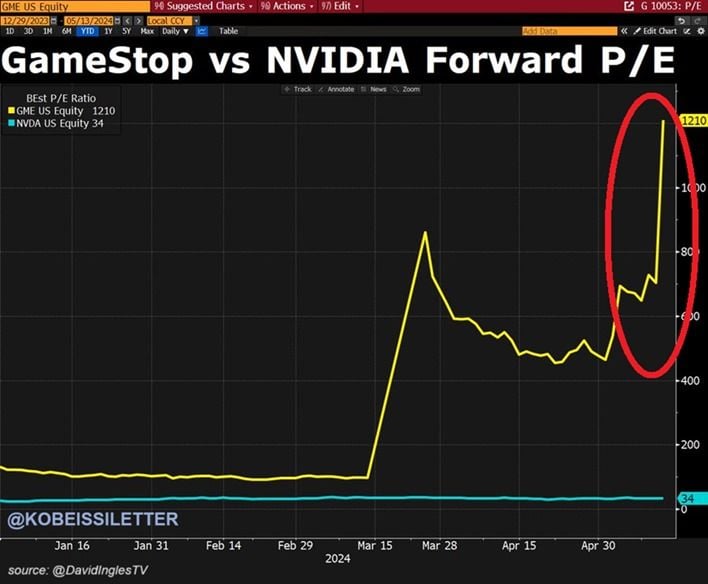

The P/E ratio of Gamestop, $GME, has spiked to a WHOPPING 1,210x

In other words, it costs $1,210 to purchase just $1 of earnings generated by $GME. By comparison, the P/E ratio of Nvidia, $NVDA, is 34x. Meanwhile, $GME is up nearly 400% this month hitting its highest levels in over 2 years. Over 175 million $GME shares were traded on Monday, 30 TIMES the 1-year average, according to Bloomberg. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks