Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

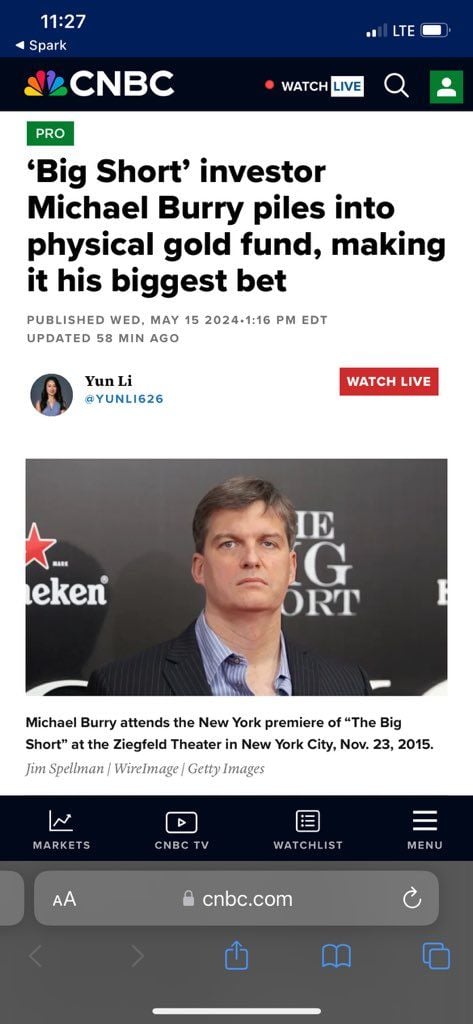

Michael Burry is back! This time he’s loading up on $10 million worth of physical gold $PHYS

Source: Barchart, CNBC

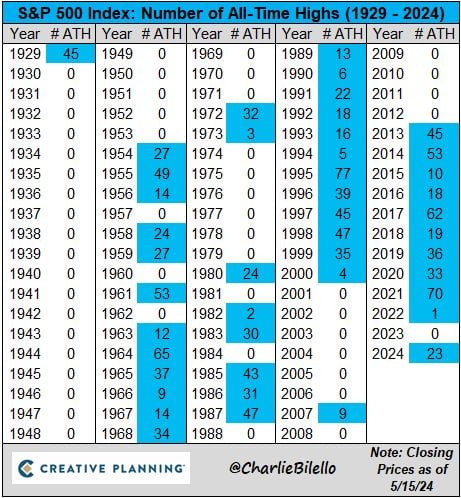

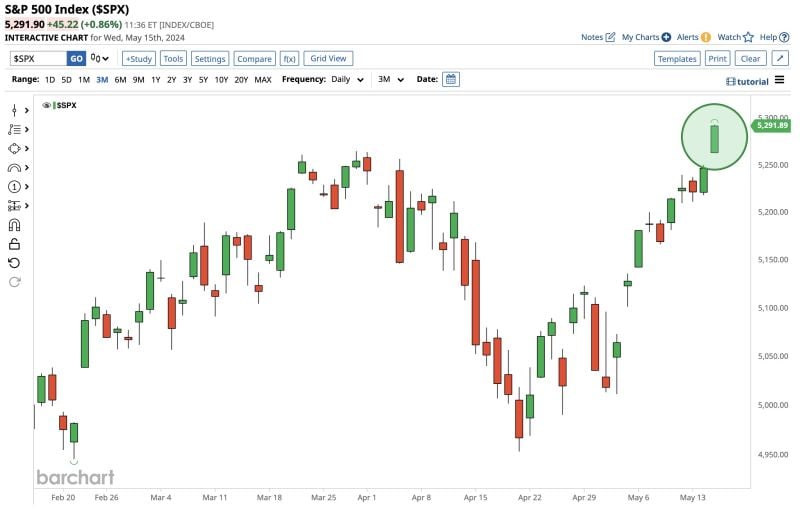

BREAKING: The S&P 500 has just hit its 23rd all time high this year and is now up 29% since October 2023

This means that the S&P 500 has officially added $10 TRILLION in market cap since its October 2023 low. The index is now up 11.5% in 2024 even as a total of four interest rate cuts have been priced-out since January. We are on track to see the most all time highs in a year since 2021. Over the last 12 years, the S&P 500 has hit 370 all-time highs, which is more than any 12-year period in history. $SPX Source: Charlie Bilello, The Kobeissi Letter

A new study by the University of Arkansas pitted 151 humans against ChatGPT-4 in three tests designed to measure divergent thinking, which is considered to be an indicator of creative thought

Not a single human won. Source: Jeremiah Owyang

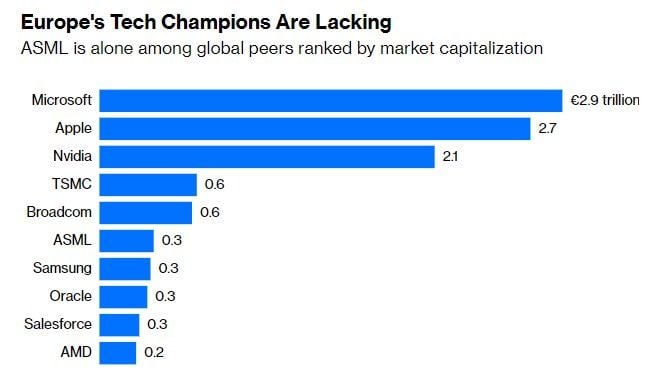

The issue with europe:

1) Over-regulation; 2) Too much bureaucracy: 3) Lack of hashtag#innovation. As shown below, Tech champions are lacking. Source: Bloomberg

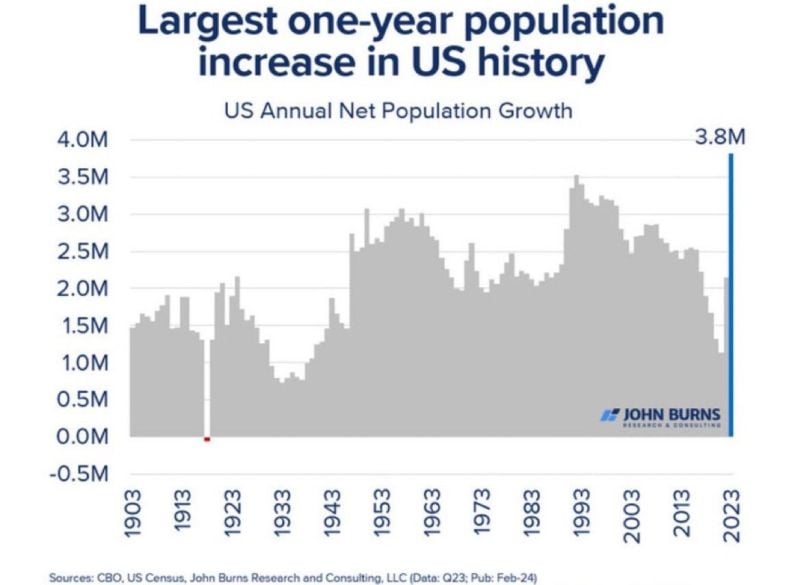

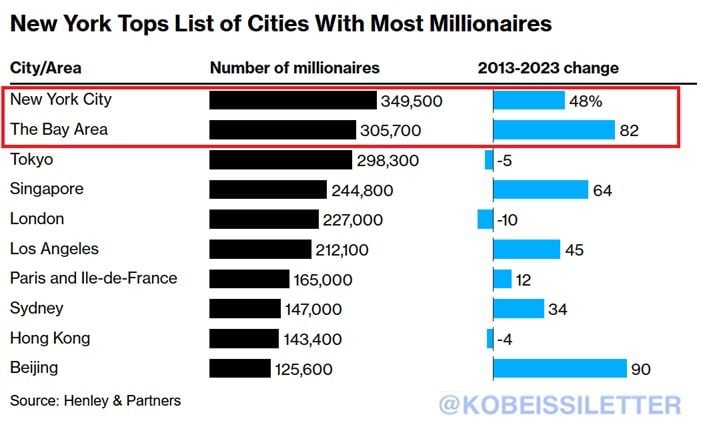

New York City now has 349,500 millionaires, more than any city in the world

Over the last decade, the number of millionaires in NYC has risen by a massive 48%. At the same time, in The Bay Area, the number of people with a seven-figure net worth has risen 82% to 305,700, the second-highest worldwide. This surge has been driven by a massive rally in financial markets and real estate prices. Meanwhile, 78% of Americans live paycheck to paycheck, according to the latest Payroll-org survey. The rich are getting richer at the fastest pace ever. Source: The Kobeissi Letter, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks