Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

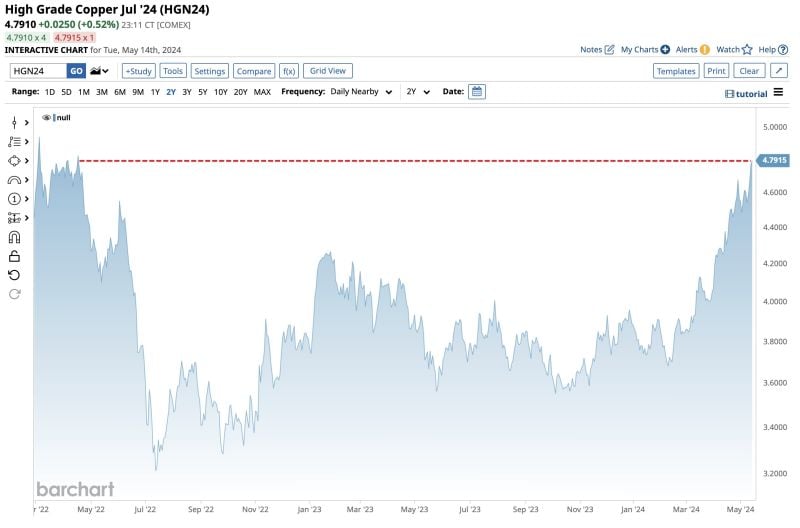

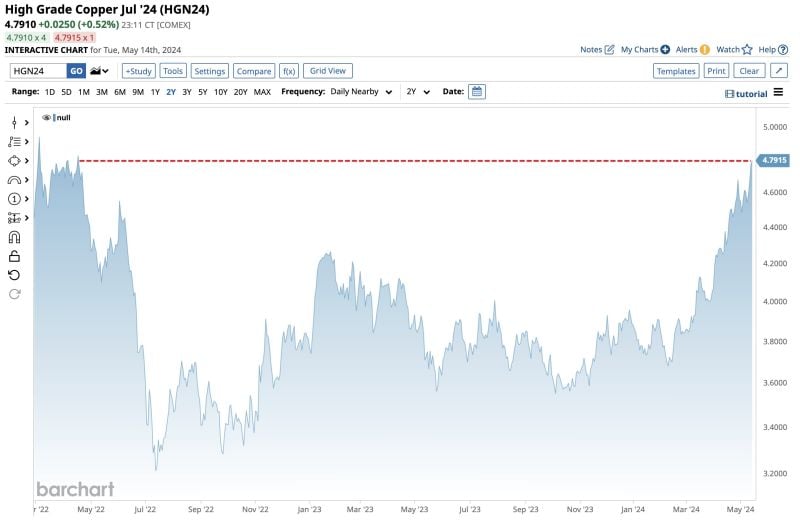

Copper jumps to highest price since April 2022 👀

Source: Barchart

Simply the best...

Emirates Group posted record profits of Dh18.7 billion ($4.7B) for its financial year that ended March 31, boosted by unprecedented travel demand and strong capacity operations across its network. The Dubai aviation giant’s revenues for the period also broke records at Dh137.3 billion. Source: Gulf News

Most-closely watched China stock index just formed the first golden cross in over a year...

Source: David Ingles, Bloomberg

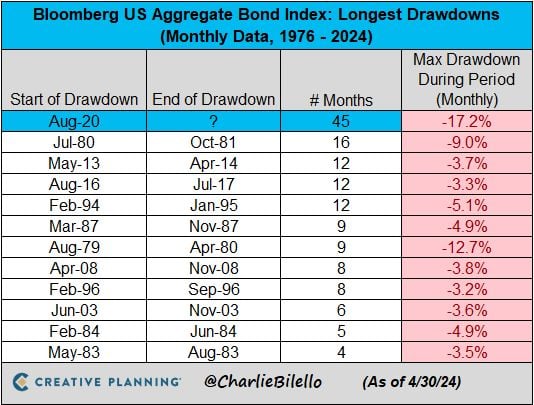

The US Bond Market has now been in a drawdown for 45 months, by far the longest bond bear market in history.

Source: Charlie Bilello

Gamestop $GME is up 110% because Roaring Kitty posted a meme after 3 years of silence. So is this garbage???

Source: Geiger Capital

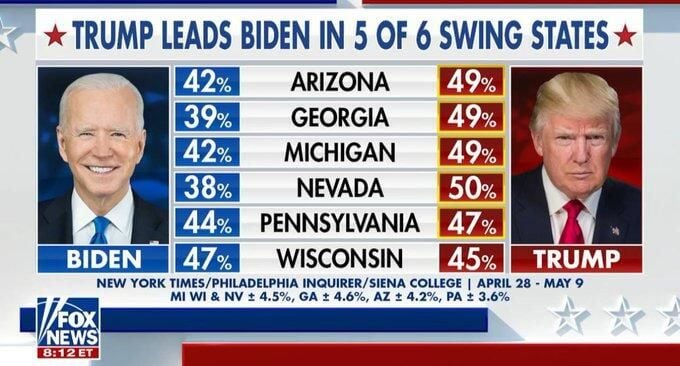

A new set of polls reveals that Donald Trump is leading President Biden in five out of six critical battleground states

as young and non-white voters grow increasingly dissatisfied with the current president. Source: www.zerohedge.com, FoxNews

Positive market breadth ALERT >>>

77% of S&P 500 stocks are now trading above their 200-day moving average, one of the highest levels in the last 2 years Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks