Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

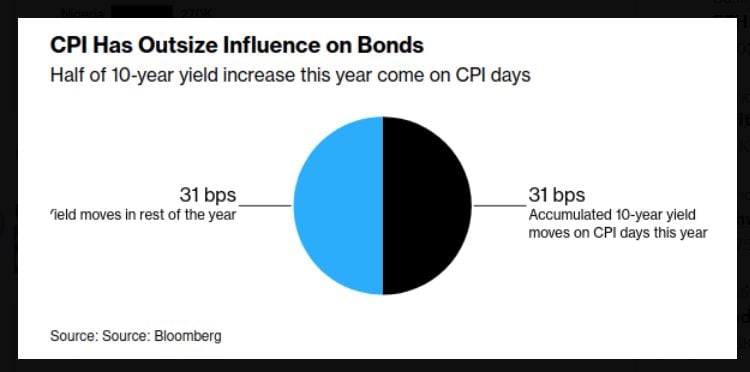

Ahead of US CPI, it's important to note that the data point tends to weigh heavily on bond yields -- up or down.

Source: Bloomberg, Markets & Mayhem

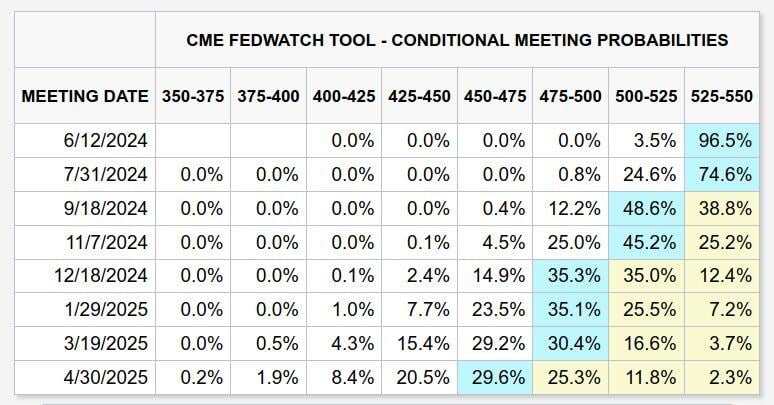

Markets are currently anticipating the first Fed cut in September and a potential second cut in December.

This week's US inflation data could shift these expectations backward or forward depending on how the data comes in. Source: Markets & Mayhem

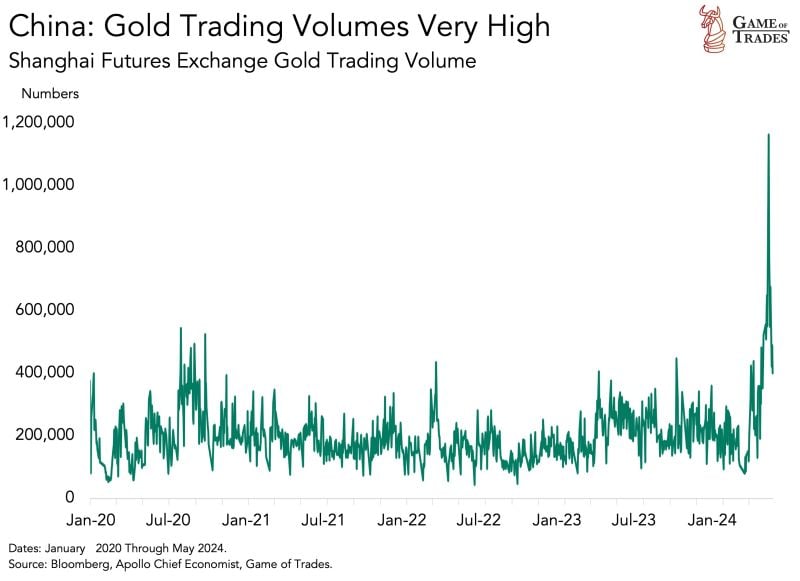

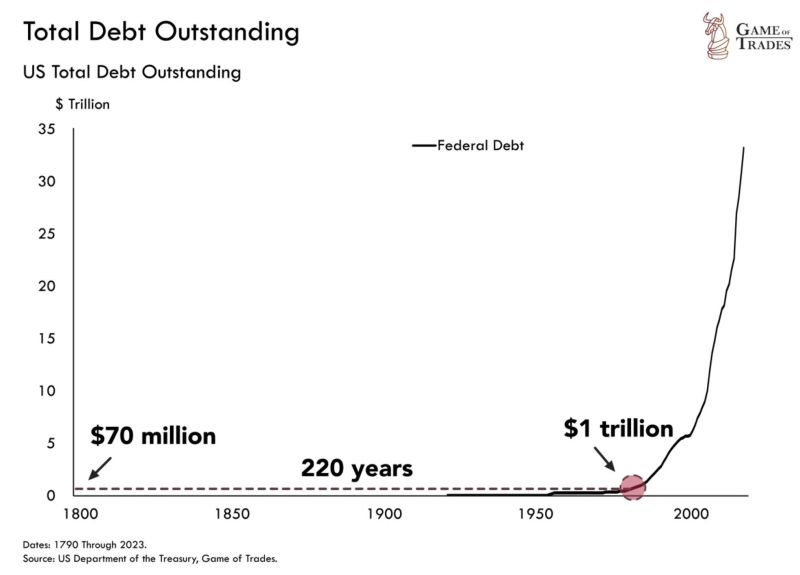

In 1971 the US came off the gold standard

Source: Game of Trades, Michael Burry Stock Tracker ♟

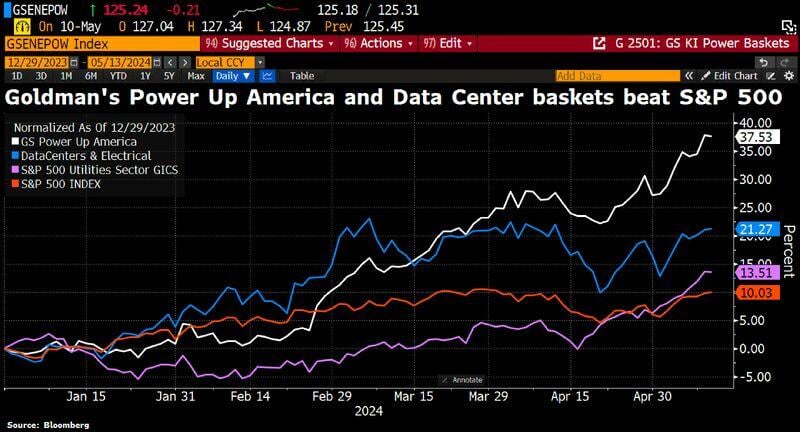

"Power Up America" theme is Goldman's top performing basket year-to-date w/+37.5% driven by global data centers' eye-popping demand for power.

17 of the 22 companies from the basket that have reported earnings have beat estimates by an average of +29%. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks