Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Earnings for the week of May 13, 2024

https://lnkd.in/eEaHXwcK $BABA $WMT $NU $HD $AMAT $BIDU $NXT $CSCO $JD $STNE $TTWO $SE $DE $OTRK $MNDY $LEGN $OCGN $WULF $DT $LUNR $GRAB $PBR $PSFE $SONY $NICE $HUT $TME $MNSO $OGI $DFLI $CPA $DHT $BITF $BKKT $HUYA $NOTV $QUIK $MAXN $KOPN $LSPD $HBM $ARQT $DDL $CGAU $CRLBF $DOCS $DOLE $ACXP $AGYS $GROY

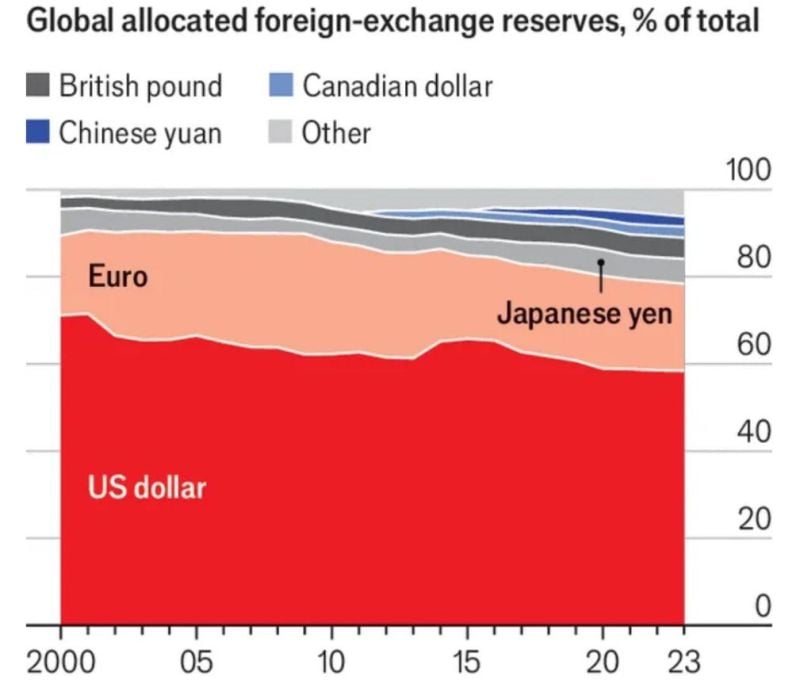

Global foreign exchange reserves.

The US dollar still dominates but share has been eroding sligthly Source: Michel A.Arouet

In case you missed it... In the FT yesterday... "Slowbalization" and East-West divide in the making... 100% tariffs on EVs, wow.

Or is it just about US refusing globalization on industries they can just not compete?

German business model was based on:

1. Cheap energy from Russia; 2 Cheap subcontractors in Eastern Europe; 3. Steadily growing exports to China. All three are gone by now Source: Michel A.Arouet, Bloomberg

JUST IN: Argentina to print its first 10,000-peso note as a result of hyper-inflation.

Source: Radar

In case you missed it...

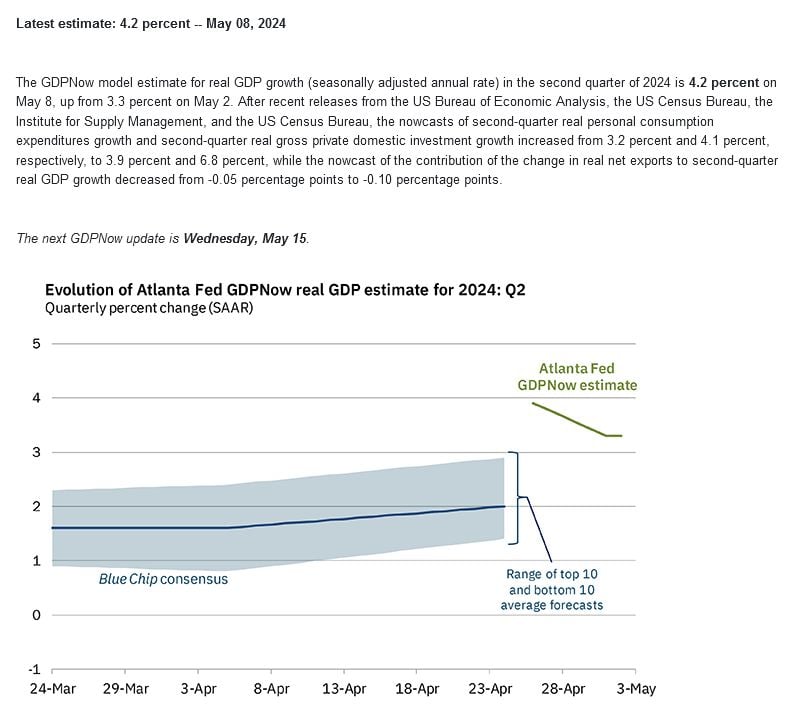

Atlanta Fed US Q2 GDP Now latest 4.18%, vs last 3.31%...

Bank of England declares independence from the US Fed ->

BoE's Bailey pushed back against a slower rate cutting cycle for the UK: “Quite a lot of the market movements of late appear to have been US-originated. Inflation dynamics here are different to inflation dynamics in the US. (It’s a) very different sort of situation in terms of our economies.” Percentage odds of a June cut were similar for the BOE and Fed at the start of the quarter, but now the market sees a wide gap. Source: Jeffrey Kleintop, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks