Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Charlie Munger helped Warren Buffett turn Berkshire Hathaway into one of the most successful companies in the world.

Here's one of his famous quotes... Source: Evan

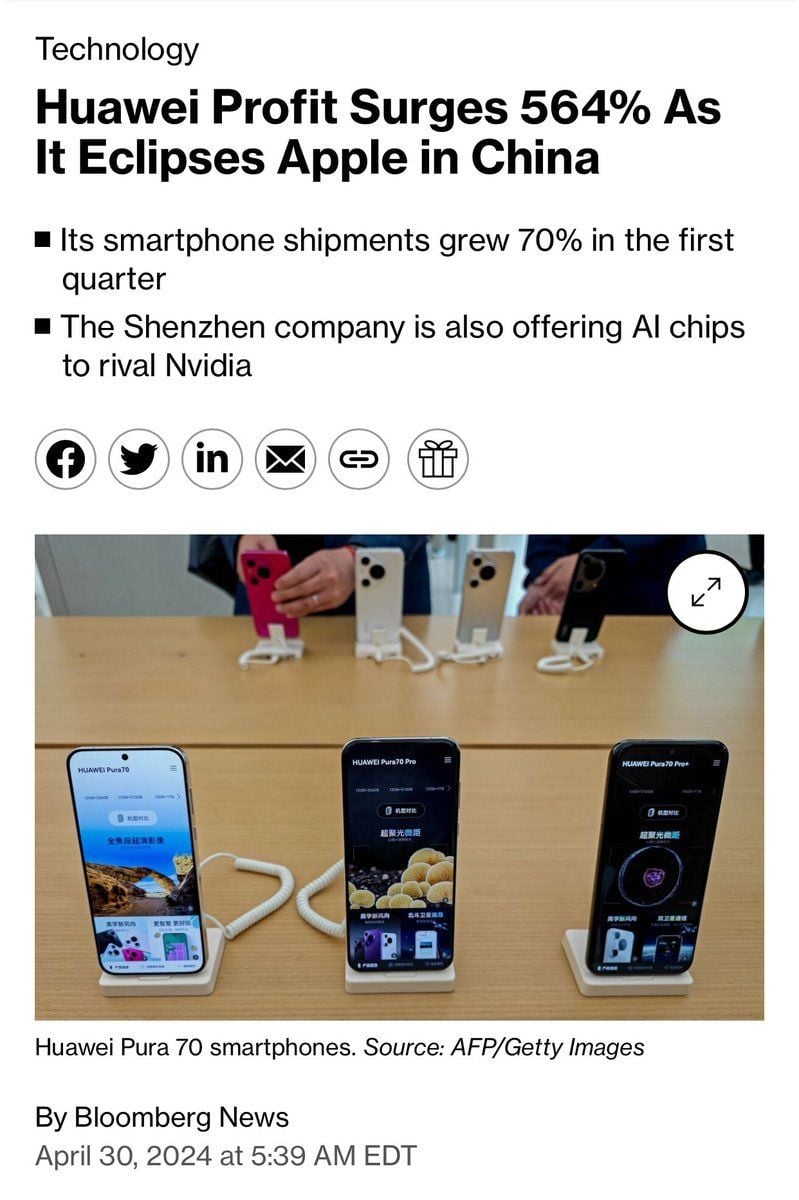

Meanwhile in China...

What if China starts doing to US "tech champions" what China did to US Rust Belt "industrial champions", US unions, & the US working class 2001-10? Source: Bloomberg / Luke Gromen

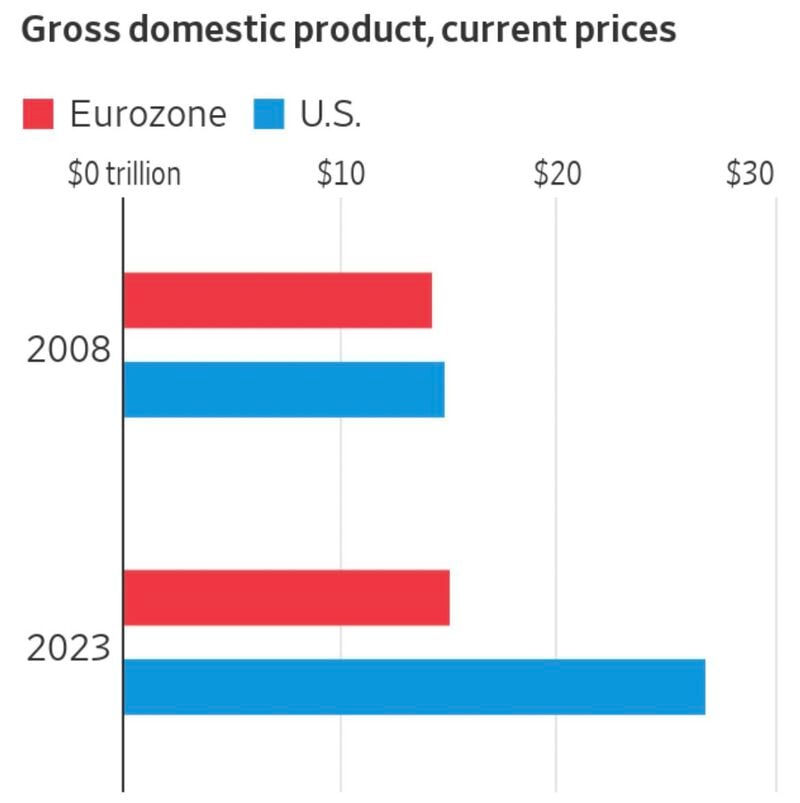

US vs. Europe: equity returns were very much similar before 2009...

Source: FT

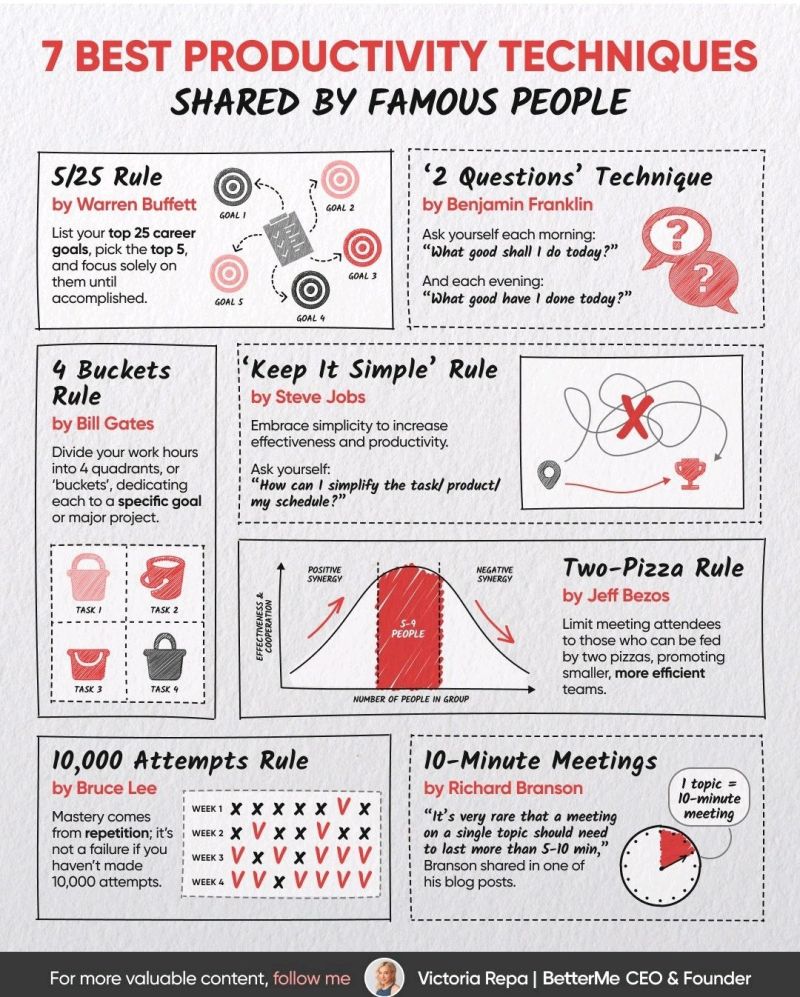

7 best productivity techniques shared by famous people

Victoria Repa thru @investment books (Dhaval)

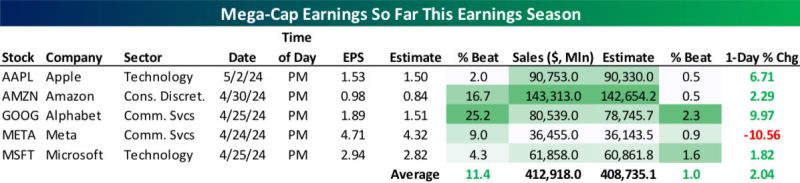

The five $1+ trillion market cap companies that have reported Q1 earnings so far posted sales of more than $412 billion combined during the quarter.

All five beat both EPS and sales estimates. $AAPL $AMZN $GOOGL $META $MSFT Source: Bespoke

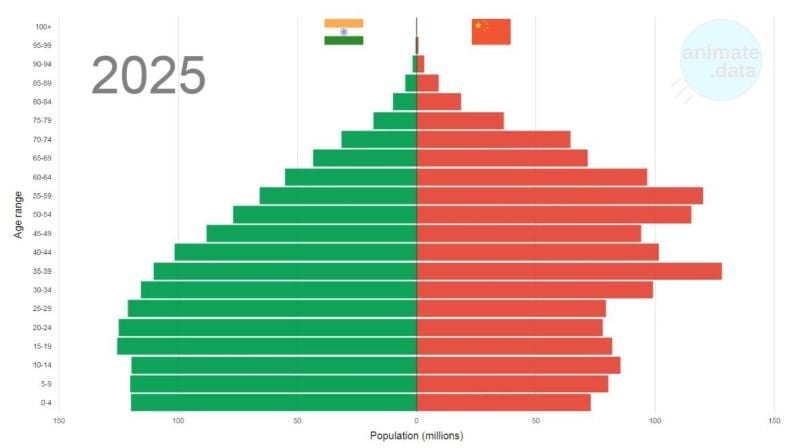

Demographics of two Asian heavyweights. Which country would you like to invest?

Source: Michel A.Arouet

JPMorgan Unveils IndexGPT in Next Wall Street Bid to Tap AI Boom.

The bank is creating thematic investment baskets using GPT-4 model. Trademark for name was filed last year, stirring speculation A year after a wave of speculation broke out over its application to trademark the word “IndexGPT” in connection to an unspecified artificial intelligence-powered tool, JPMorgan Chase & Co. is finally unveiling the product that will bear the name. IndexGPT is a new range of thematic investment baskets created with the help of OpenAI’s GPT-4 model. The tool generates a list of keywords associated with a theme, which are then fed into a separate natural language processing model that scans news articles to identify companies involved in the space. In essence, it’s a largely automated way to create so-called thematic indexes, which identify investments based on emerging trends — think cloud computing, e-sports or cybersecurity — rather than on traditional industry sectors or company fundamentals. Source: Yahoo Finance, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks