Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

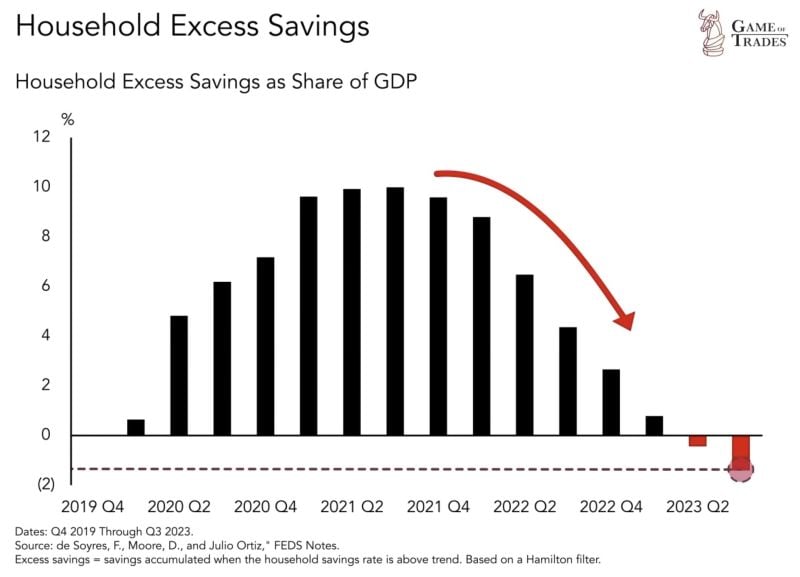

US Households have now run out of excess savings.

Current levels are worse than even 2019. The hard part is that this is happening just as the labor market has started to weaken. Source: Game of Trades

“I don’t mind at all under current conditions building the cash position."

"When I look at what’s available in equity markets and the composition of what’s going on in the world, we find it quite attractive." - Warren Buffett

JUST IN: Bitcoin has officially processed over 1 billion transactions.

In a fully decentralized way and without a single glitch... Source: Bitcoin Magazine

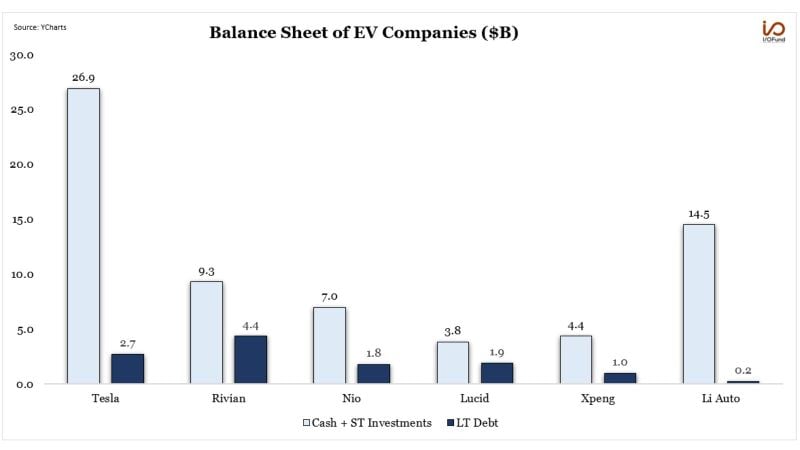

Electric vehicles companies are cash-rich...

Here’s a look at the cash vs. long-term debt for EV companies: $TSLA $RIVN $NIO $XPEV $LI Source: YCharts, Beth Kindig

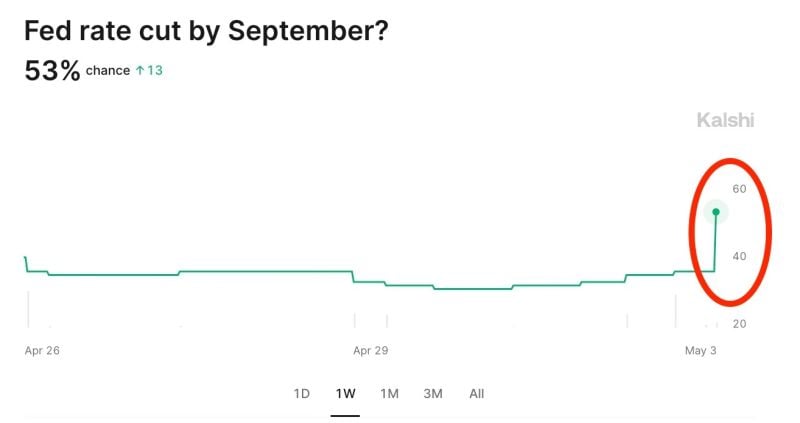

Odds of a September 2024 rate cut jump to 53% after the weaker than expected jobs report, according to Kalshi.

The base case now shows TWO interest rate cuts in 2024, up from ONE prior to the report. On Wednesday, Fed Chair Powell specifically said weakening of the labor market could spur rate cuts. Market implied odds of zero interest rate cuts this year have dropped from 35% to 27%. The Fed rollercoaster ride continues. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks