Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Commodities

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

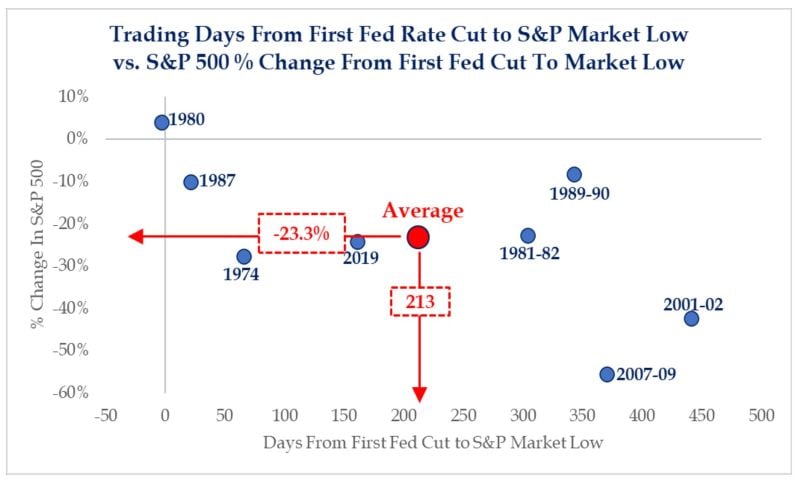

Don't be too excited about Fed rate cuts.

Examining Fed rate cycles since 1970s has revealed that investors have more to fear from 1st cut in a cycle than the pause. On average, sp500 is up +5% over 100 days between last Fed tightening and 1st cut. The trough in broader market is -23% over 200 days after 1st cut in a series, SRP has calculated. Source: HolgerZ

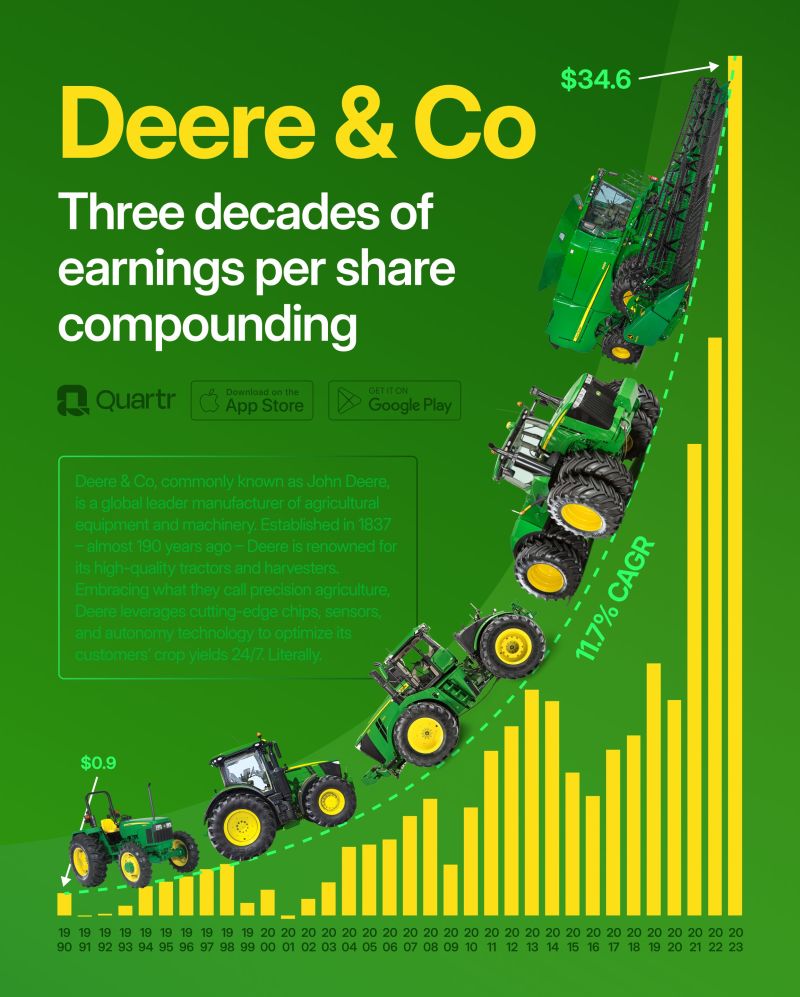

Great visual by Quartr ->

Agriculture equipment giant $DE may appear boring at first glance. Under the hood lies a complex and fascinating entity with a rich 187-year history, leveraging cutting-edge chips, sensors, and autonomy technology. $DE has grown its EPS at a 11.7% CAGR, or 38x, since 1990

Tech Stocks are trading at all-time highs relative to the SP500, even surpassing the peak of the Dot Com bubble...

Source: BofA, Bar chart

In case you missed it:

After bank of japan abolished negative interest rates this week for 1st time since 2016, the volume of bonds with negative interest rates has shrunk to $300mln. At its peak, there was a volume of $18tn worth of bonds with negative rates. But this weird experiment seems to be over – for now. Source: HolgerZ, Bloomberg

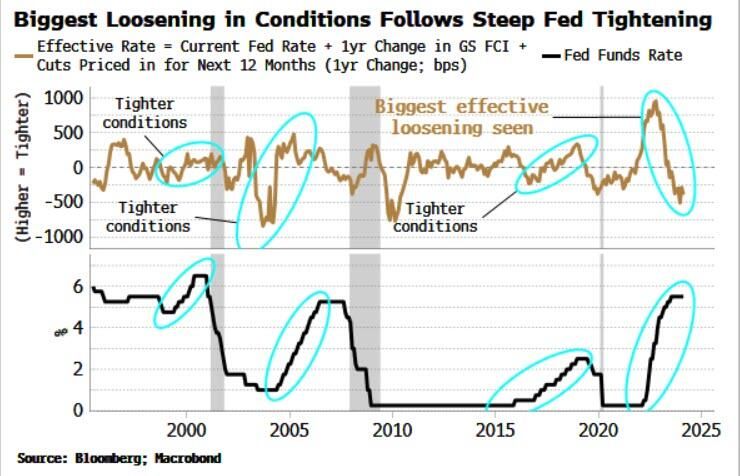

The Fed wants to loosen into what has already been the largest effective easing of financial conditions that we've seen from peak to trough...

equity markets, gold and digitalgold absolutely love it! Source: Markets & Mayhem

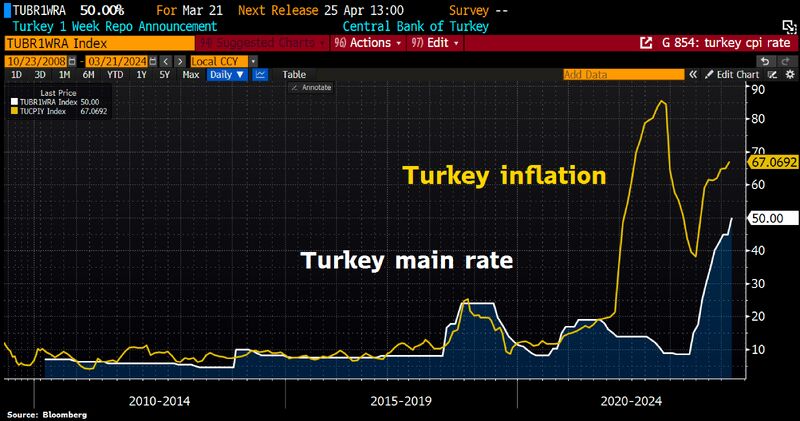

Turkey raises benchmark rate unexpectedly by 500bps to 50%.

But main rate still way below inflation of 67.1%. Source: Bloomberg, HolgerZ

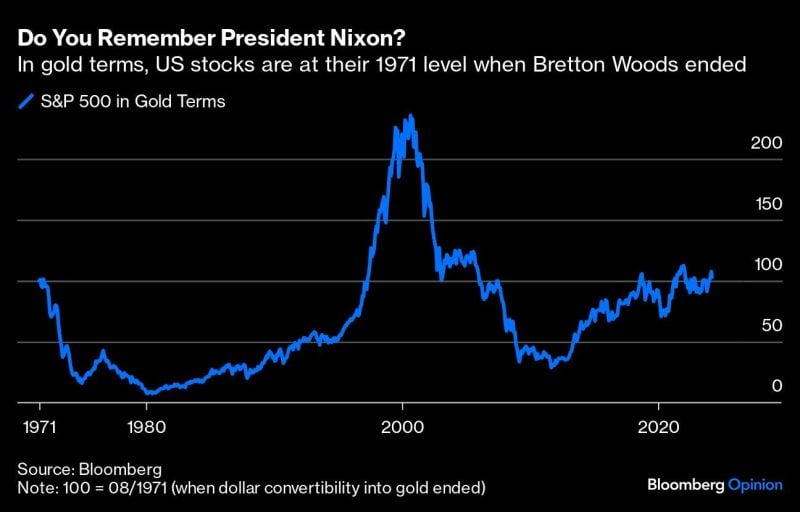

If one ignores dividends gold has been able to keep up with equities since Nixon ended things in 1971.

Source: Michel A.Arouet, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks