Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Commodities

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

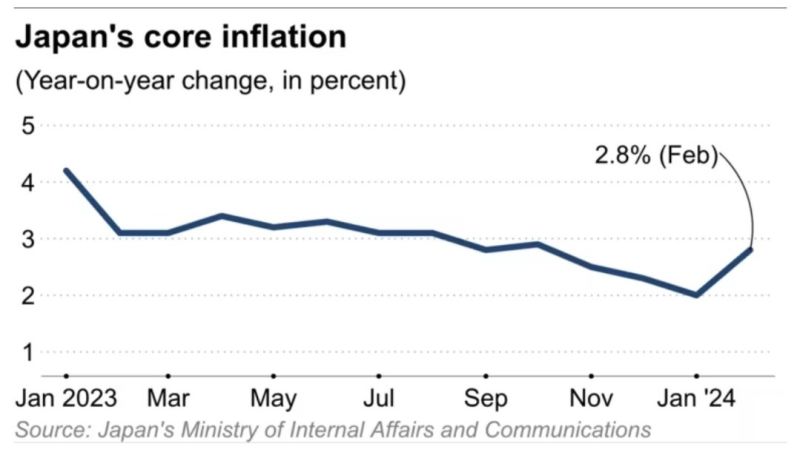

BREAKING: Japan's core inflation accelerates to 2.8%, the first increase in 4 months.

Japan's core inflation has now been above the Bank of Japan's 2% target for 23 consecutive months. Source: Win Smart

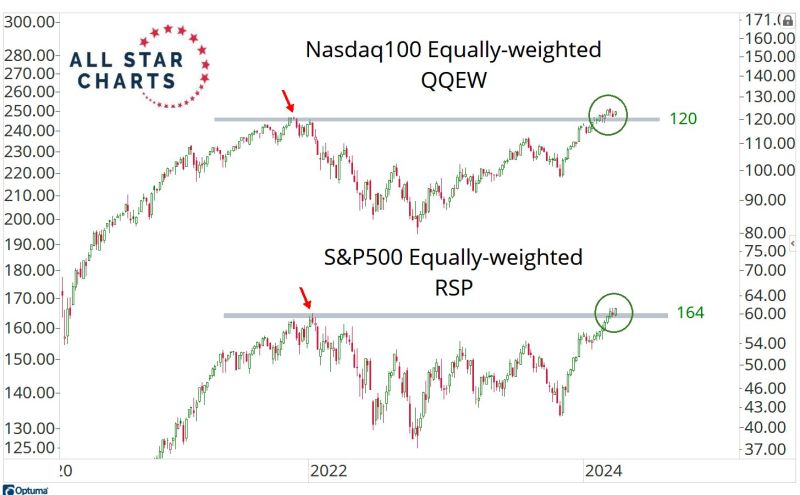

Here are the Equally-weighted Nasdaq100 and S&P500.

If these two are above their former cycle highs, it's hard to be too bearish on this market. Source: J-C Parets

Crude Oil is approaching a Golden Cross formation with an upward sloping 200D moving average.

The last Golden Cross sent Crude Oil soaring to its highest price since August/September 2022. Source: Barchart

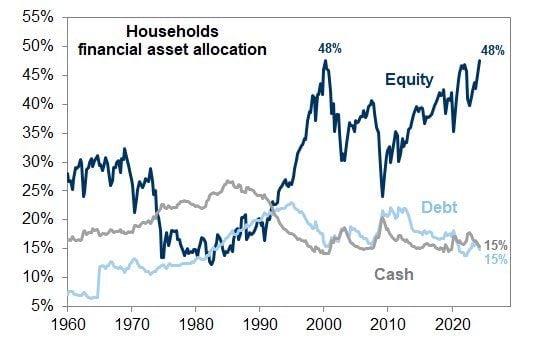

us households equity allocation is at record high

Source: Goldman Sachs

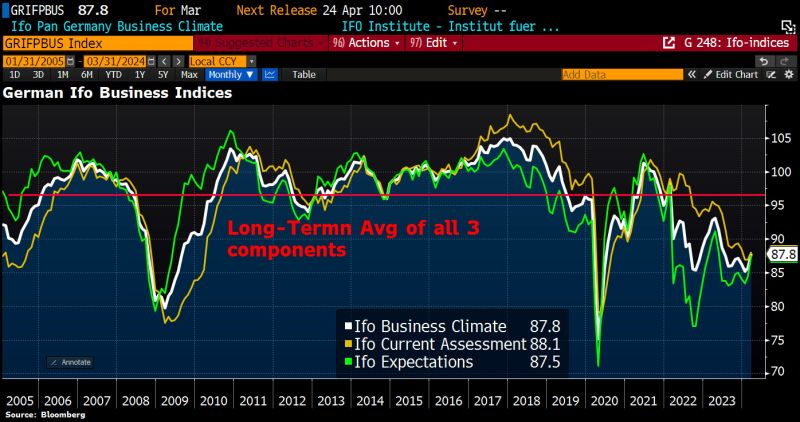

The worst seems behind the economy.

This is indicated by the Ifo Business Climate Index, which has jumped to 87.8 in March, highest level since June 2023 vs 86.0 expected. Current conditions rose to 88.1 in March from 86.9 in Feb, Ifo business confidence to 87.8 from 85.7 in Feb. Suggests that we could see a recovery as households begin to spend their real income gains. Employment is robust and nominal wage growth comfortably exceeds inflation again. There could be some green shoots in the export sector, and even the deep slump in construction may have bottomed out. Source: Bloomberg, HolgerZ

Current state of the stock market:

Wingstop, $WING, a chicken wing company, is now up 84% over the last year and worth $10 billion. It's trading at 144x earnings and tripling the S&P 500's return... Who needs AI when you have chicken wings? Source: The Kobeissi Letter

Swiss National Bank SNB cuts interest rates by 0.25%, chart

@BloombergTV

Investing with intelligence

Our latest research, commentary and market outlooks