Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

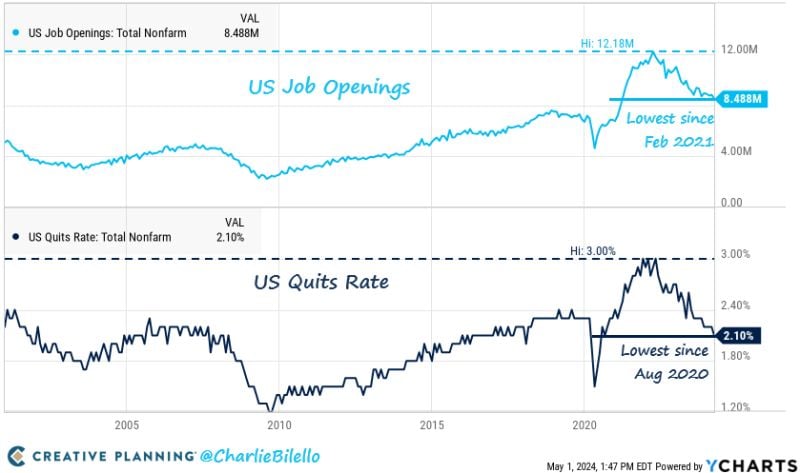

The tightest labor market in US history continues to loosen with Job

Openings moving down to 8.49 million (lowest since Feb 2021) and the Quits Rate moving down to 2.1% (lowest since Aug 2020). Source: Charlie Bilello

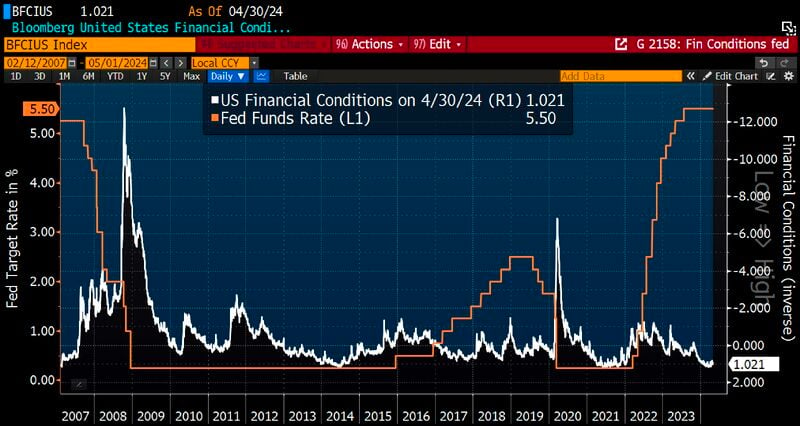

Fed's Powell: Very pleased we haven't seen pain originally projected.

The chart below summarizes it well: despite rates hikes and rates staying higher for longer financial conditions kept easing Source: Bloomberg, HolgerZ

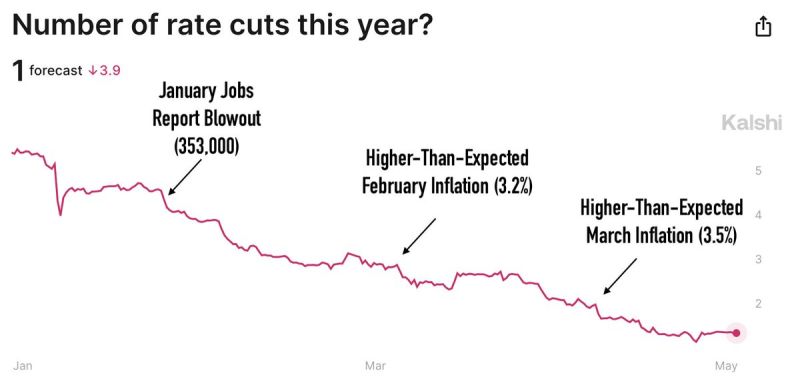

Interest rate futures have been wildly inaccurate over the last 12 months.

In September, just 2 rate cuts were expected by December 2024. In January, 6 rate cuts were expected by December 2024. Now, we will be lucky to get one rate cut over the next year or so. In fact, prediction markets are showing a 40% chance of ZERO rate cuts in 2024. Prediction markets also see an 11% chance of a rate HIKE in 2024 despite Powell saying he thinks it's unlikely. Source: The Kobeissi Letter, Kalshi

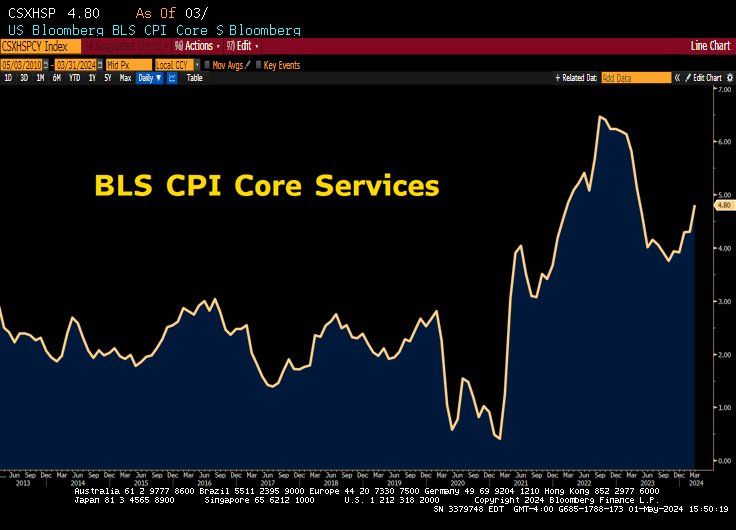

The Fed just eased its policy stance into this...

Source: Lawrence McDonald, Bloomberg

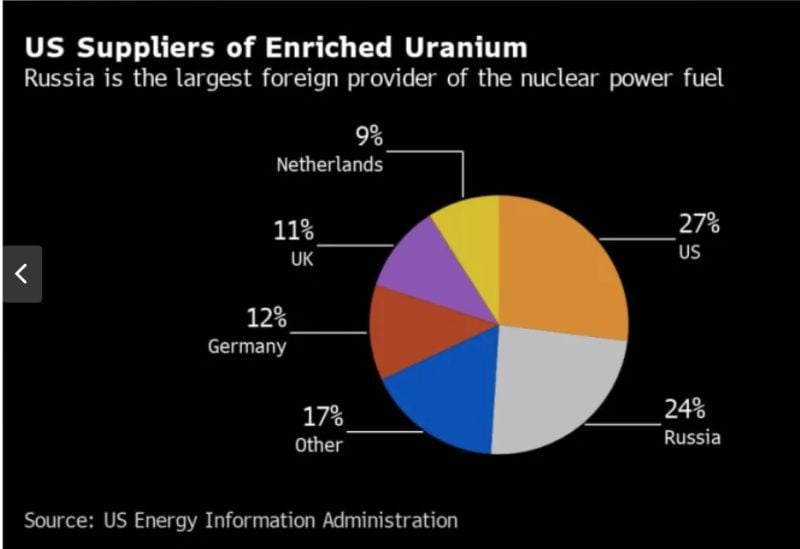

US Senate approves bill to ban Russian uranium imports

The U.S. Senate approved on Tuesday legislation to bar imports of Russian uranium, as the United States continues to seek to disrupt Russia's efforts in its war against Ukraine. The Senate passed the measure by unanimous consent, meaning that no senators objected to it. The House of Representatives passed the bill in December. Uranium is used to power commercial nuclear reactors that produce electricity. The legislation would ban the imports 90 days after enactment. It contains waivers in case there were supply concerns for domestic reactors. The bill also frees up $2.7 billion passed in previous legislation to build out the domestic uranium processing industry. U.S. nuclear power plants imported around 12% of their uranium from Russia in 2022, according to the U.S. Energy Information Administration. Source: Reuters, Bloomberg

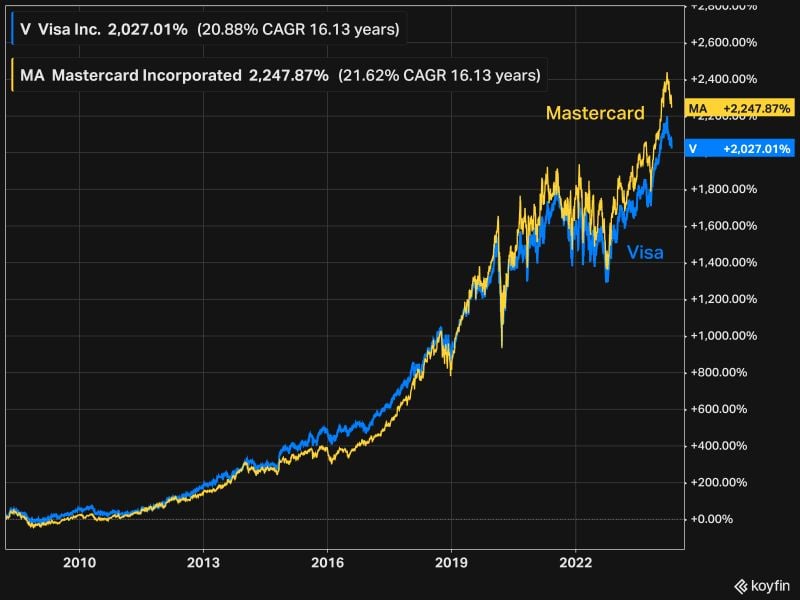

16 years of Mastercard vs Visa.

Both $MA (21.6%) and $V (20.9%) have remarkable CAGRs over that period. They have been pretty correlated throughout the period, taking over the world in unison. Source: Bloomberg, KoyfinCharts

- &summary="Based on the history, with the index up 113 bps at 3:00pm, the SP500 had a 99% chance of closing green. Its failure to do so is a remarkable stumble, to say the least." Source: Bespoke&source=https://blog.syzgroup.com/syz-the-moment/bespoke-about-yesterdays-last-hour-of-trading-' target="_blank">

Bespoke about yesterday's last hour of trading =>

"Based on the history, with the index up 113 bps at 3:00pm, the SP500 had a 99% chance of closing green. Its failure to do so is a remarkable stumble, to say the least." Source: Bespoke

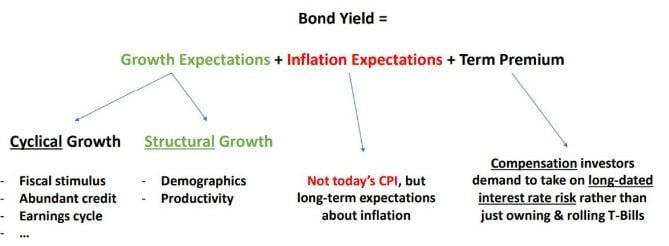

Bond Market 101: a useful way to think about bond yields by Alfonso Peccatiello.

Nominal bond yields can be thought of as the interaction between: 1️⃣ Growth expectations 2️⃣ Inflation expectations 3️⃣ Term premium

Investing with intelligence

Our latest research, commentary and market outlooks